2 March 2015

Recent Crude Oil Prices

Crude oil or petroleum is an important energy source for present civilization, particularly for transportation.

The consumption of this fossil fuel with both good and bad effects is enmeshed in a modern economy and affects its growth.

The movement of oil prices can impact on the health of oil-producing economies, for example Venezuela, Russia, Canada, etc. and

is of paramount concerns to commodity traders and energy investors.

There were lots of talks about the sharp decline of oil price since last July.

The OPEC countries had kept a production ceiling of 30 million barrel per day for three and a half years.

For decades, they had been cutting production to compensate the drop of their revenue by hiking their oil price.

Nevertheless, the oil market has changed in recent years. New extraction methods make the United States the biggest

oil producer and also make Canada potentially a large producer, meanwhile the global economy is still struggling to return to the

growth level after the 2008 financial crash. Last November, the OPEC cartel switched to a different

price and production strategy by not cutting production level despite of the price drop at the 166th conference

in Vienna. Some believed this price strategy was to safeguard the market share of the OPEC cartel,

but the OPEC spokesman said they sought for stability in the market and for the long-term global economic growth wanted by both producers and consumers.

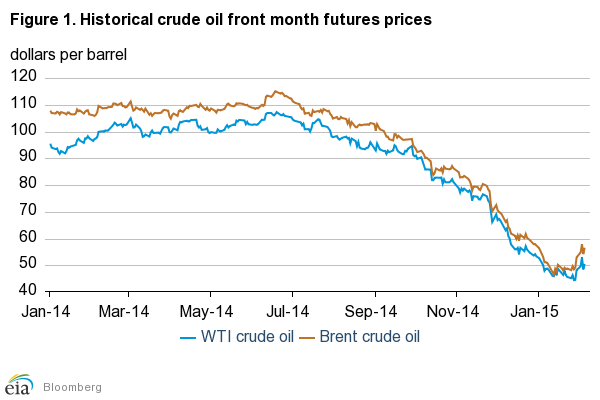

The price decline accelerated last October from about US$90 to the low prices of below US$50 in January of 2015 —

a $40 or 44% drop in a short span of three and a half months. Figure 1 shows the historical monthly future contract prices

for both NYmex WTI and Brent crude oils Between January 2014 and last January.

Balance of Supply and Demand

The global economy is still in a fragile recovery phase, although the rate of growth has been decelerating in 2014 and the first month of 2015. Some countries in Euro zone and Japan are in contraction. Growth in China and many emerging countries have been forecast downward. The United States has achieved an outstanding come back , even though the growth is not as fast as expected and some areas are still weak, for example in wage hike and employment. Volatile geopolitical conditions and unprecedented climate changes of the Earth also complicate the economic situation. According to the demand and supply data in the OPEC Monthly Oil Market Report - February 2015, the global oil demand growth was about 0.96 mb/d in 2014 and is forecast to be 1.17 mb/d in 2015; for non-OPEC oil supply growth was about 1.99 mb/d in 2014 and is to be 0.85 mb/d in 2015. The OPEC crude supply was 30.03 mb/d - a decrease of 0.17 mb/d from 2013. The following is a table to summarize the supply/demand balance from 2013 to 2015:

| 2013 | 2014 | 2015Q1 | 2015Q2 | 2015Q3 | 2015Q4 | 2015 | |

| (a) World oil demand | 90.20 | 91.15 | 91.36 | 91.18 | 92.96 | 93.76 | 92.32 |

| Non-OPEC supply | 54.24 | 56.23 | 57.55 | 57.08 | 56.79 | 56.94 | 57.09 |

| OPEC NGLs and non-conventionals | 5.65 | 5.83 | 5.89 | 5.98 | 6.08 | 6.18 | 6.03 |

| (b) Total supply excluding OPEC crude | 59.89 | 62.06 | 63.44 | 63.05 | 62.87 | 63.12 | 63.12 |

| Difference (a-b) | 30.31 | 29.09 | 27.93 | 28.13 | 30.10 | 30.64 | 29.21 |

| OPEC crude oil production | 30.20 | 30.03 | |||||

| Balance | -0.11 | 0.94 |

The following figure is a quarterly balance of OPEC production:

(Source: OPEC Monthly Oil Market Report - February 2015

Comment:

Assessing the fundamentals of the oil market, the present glut in the oil market seems to a short-term trend of excessive supply over current demand. For these data, the demand and supply of OPEC oil is likely to bottom out between the first and the second quarters of 2015, and may rise steadily in the second half of 2015.

[ Top | Bottom ] of Page

Forecasts

For February 2015, the weekly prices were: Feb 6 at 51.69, Feb 13 at 52.78, Feb 20 at 50.34 and Feb 27 at 49.76. A commodity strategist of a Canadian bank said recently the price might continue to fall and to touch $35, but the chief economist of another Canadian bank said the price would average $50 in the first half and about $52 in the second half of 2015. Some commentators from the Internet aslo believed the price might fall back to the average US$20 levels in 1990s (Fig. 3).

(Source: Bank of Montreal - BMo Investorline, 1 March 2015

(Source: Bank of Montreal - BMo Investorline, 1 March 2015

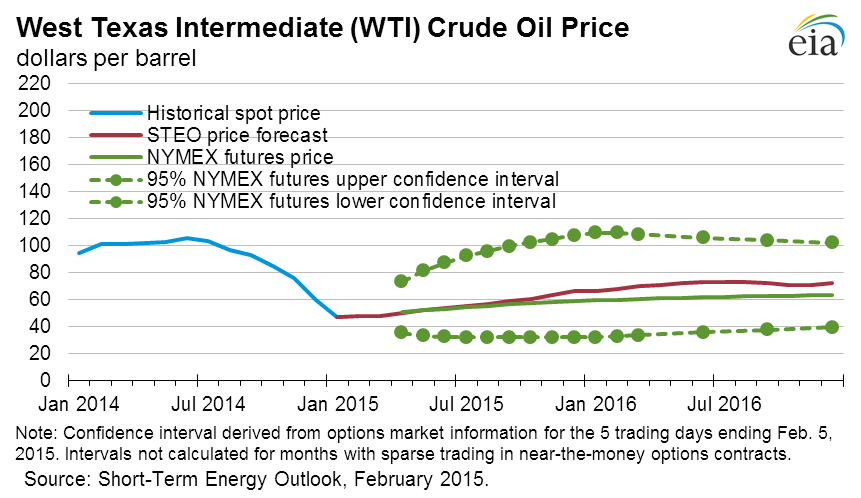

According to an article "Short-Term Energy Outlook February 2015" by the U.S. Energy Information Administration, the WTI future contracts for May 2015 delivery averaged $52/bbl in early February. The prices in December 2015 is projected to fall between $32/bbl and $108/bbl with the 95% confidence interval for the market's expectations. Furthermore, Brent prices will average US$58/bbl in 2015 and US$75/bbl in 2016, and WTI prices US$55/bbl in 2015 and US$71/bbl in 2016 (Fig 4. & Table 2).

| 2013 | 2014 | 2015 | 2016 | |

| WTI | 97.91 | 93.26 | 55.02 | 71.00 |

| Brent | 108.64 | 99.02 | 57.56 | 75.00 |

Comment:

The global economy and strong US dollar presents an uncertain environment for the oil market. There are also several other factors affecting the price

movements. First, the reactions of oil producers to lower prices: Saudi Arabia decided to produce at the same rate, the other key producers reduced output,

and the North American producers curtailed their exploration and development. Also, OPEC might call an urgent meeting if Brent price drops below US$60

and might change their production target; the growth of oil supply might deviate from the current forecast. The speculative activity of commodity traders and

the fund managers also affect the future prices. Then, the increasingly violent climate changes now force all world leaders to confront this real environmental problem.

They might finally agree to curtail the consumption of crude oil, one foremost culprit of carbon emission.

In the long-term, technologies have been making car more fuel efficient; vehicle manufacturers might also produce better and cheaper electric cars and natural gas buses.

Then, the high speed trains and internet might change the ways people travel, cutting the demand of oil and on the other hand prolonging the world oil reserves.

Thus, the oil price might not reach the historical level of US$140 (Brent & WTI) in 2008.

No accuracy of figures or information are guaranteed. The writer and The Site hereby disclaim all liability for the use of this page.