http://www.newsdissector.com/blog/2008/07/13/special-report-are-we-facing-a-9-11-for-our-economy/

The

United States current record-breaking rates of mortgage

foreclosure will directly affect 2 million children this year and next,

according to a recent report from First Focus, a bipartisan child

advocacy organization.

Our homeless education liaisons are noticing increase in the number

of students who are homeless, not just in high-poverty families but

also those who have typically been middle class and facing this for the

first time, says Patricia Popp, state coordinator for homeless

education in Virginia. As it turns out, one of McCain closest advisors, Former Senator and

subprime lobbyist Phil Gramm who criticized Anericans for whining and

showing signs of mental depression played a direct role in planting

the seeds of the subprime situation that started the ball

free-falling downhill and gathering more than mere moss.

Appearing on Democracy Now with Amy Goodman, journalist David Corn

explained that it involved a sly backroom legislative maneuver

mounted by Phil Gramm, who was Republican chairman of the Senate

Banking Committee in the 90s.

It was the week that the Supreme Court was giving the election to

George W. Bush. As often happens in Washington, Congress had yet to

pass most of the appropriation measures that are needed to before that

Congress coming to a close, and so they were lumping together, you

know, six, seven different appropriation bills into one mega bill,

working all hours of the day

And in the midst of all that chaos, Senator Phil Gramm slipped into

this must-pass spending bill a 268-page bill, the Commodity Futures

Modernization Acta portion of the bill deregulated these financial

instruments called swapsThe problem is that these swaps, thanks to

Phil Gramms bill, are totally, totally unregulated, and the swap

market is something like now about four times the size of Wall Street,

in terms of securities that are regulated. And it really turned a lot

of the economy into a secret casino, all this action going back and

forth, people betting on bets.

And how this related to the subprime crisis is, about this same

time, you know, securities firms started bundling all these bad or

risky mortgages and securitizing them, and then they would sell these

securities or buy them and then buy swaps or sell swaps to cover the

possible loss. So it really enabled a lot of firms to go hog wild on

the subprime stuff .

The subprime stuff has now led to a massive rise in foreclosures

and a fall in profits as investment banks are forced to write off

billions in bad investments.

That in turn destroyed credit markets and

confidence in Wall Street. Even after interest rates were cut seven

times by the Fed, little improvement was registered except the rise in

joblessness and inflation.

And that, in turn is what is behind, at least in part, the current

fall of mortgage giants Fannie Mae and Freddie Mac. Add in the Bush

policies of lowering the value of the dollar, and you got higher oil

prices. Add in speculators and short sellers and a total lack of

effective regulation, and you get the possibility of a system collapse!"

JULY 12, 2008 GOODBYE FANNIE! SO LONG!

GOOD BYE US DOLLAR, TOO!

Fannie and Freddie shares have both dropped more than 80 percent in New York trading over the past year on concern they don't have enough capital to weather the worst housing slump since the Great Depression. William Poole, the former St. Louis Federal Reserve president, said this week that Freddie is ``insolvent,'' meaning it owes more than its assets are worth.

Fannie, Freddie

Fannie shares opened the day down as much as 49 percent and Freddie dropped as much as 51 percent. A government takeover of one or both companies is among options that could be considered by White House officials, said Joshua Rosner, an analyst with Graham Fisher & Co. Inc., who met with the administration yesterday.

Officials may push for the firms, which own or guarantee about half of the over $12 trillion of U.S. mortgages, to be placed in a conservatorship if their problems get worse, he said.

Israel Infinity Venture

Infinity is a leading Israeli-Chinese equity fund managing many BILLIONS since 1993. The Fund leverages its strong network and experience in both Israel and China to bring added value to Israeli and Chinese companies. The Fund's core strategy is to invest in late-stage Israeli technology related companies with parallel investments in Hakka Chinese operational businesses that license Israeli technologies, adjust them to the needs of the Chinese market and market them in China. The Fund's partners include leading financial institutions in Israel, China, Europe and the US.

In partnership with the IDB Group and CSVC/SIP, Infinity received the first license ever awarded by the Chinese government to foreign investors to operate an on-shore fund (00001 registration number). The Fund has since been able to assist Israeli technology companies expand operations in the Chinese market by utilizing strategic relationships in China with governmental agencies, large corporations and private firms.

Historically, the Fund's performance has ranked in the top-tier of all global firms with successful exits in companies such as Galileo, ESC Medical, Saifun, Shopping.com, Scitex Vision, Sightline, Identify Software, AGT International, Beidahuang Group, Beijing Capital Group Co., Ltd, BOE Technology Group Co., Ltd., China Aerospace Science and Industry Corporation, CASIC, COFCO, Ichilov hospital (Tel Aviv Sourasky Medical Center- TASMC), Zhejiang University’s Insigma Technology Company Ltd, is a leader in the China-based IT services and outsourcing industry, LR Group - Agriculture Partner, Miya - Water Partners, Sanpower Group, Sheba Medical Center - Medical Partner, Sichuan Development Holding, Wahaha, WEGO, ZONGSHEN Industrial Group.

From its creation in 1938 to 1968, Fannie Mae was part of the government. It bought loans from banks and held them on its balance sheet. Homeownership expanded by about 20 percentage points and we had no national housing crashes that wiped out homeowners and the country’s banking system. Fannie and Freddie’s problems developed much later, after they became publicly traded companies. These “neither fish nor fowl” hybrids had both government charters with implicit government guarantees and had shareholders to please. In their drive for shareholder value, the companies took more risk. And then they LOBBIED to lower their capital requirements to take even MORE RISK.

April 21, 2008 THE ADRIAN REPORT on Fannie Mae and the Countdown to the Financial U.S. Meltdown

late 2007 quote: "Raines's ouster may remove an obstacle to efforts in Congress to create a stronger regulator for FANNIE MAE and Freddie Mac. The two companies together have more than $1.7 trillion of debt, exceeding either France or the U.K."

REVIEW

& OUTLOOK | |

|

|

WALL STREET

JOURNAL

Too Political to Fail

April 21,

2008; Page A16

Standard & Poor's issued a report last week concluding that

Fannie Mae and Freddie Mac are the biggest financial threat to the U.S.

government's AAA credit rating. And on Friday, we found out once again why this

is so: The two "government-sponsored" mortgage giants

aren't held to the same standards of accountability as everyone else in

American business.

A group of former Fannie executives settled with federal

regulators Friday, ending a two-year legal battle over the inflated pay and

bonuses they received as a result of fraudulent accounting at the firm. The

upshot is that former CEO Franklin Raines will forfeit some underwater

stock options, make a donation to charity and pay $2 million to the

government, although that last sum will be covered by Fannie's

officers-and-directors insurance. The lawyer for former CFO Timothy Howard

called it a "capitulation" by the government, and it's hard to

disagree.

To be clear, Mr. Raines and the rest have never been charged

with any crime, and we aren't suggesting they should be. Our point is that we

rather doubt the government would show similar restraint if Fannie were not a

Washington favorite, and in fact it has thrown the book at executives at other

scandal-tarred companies. We fear this settlement � which Ofheo, the regulator, generously values at $31 million

for the three executives involved is one more sign that Fannie Mae exists in a separate, politically

protected universe.

When Fannie went two years without filing financial reports,

the New York Stock Exchange passed the "Fannie rule" to avoid having to delist

the stock. And now the three top executives during the height of Fannie's

accounting fraud have walked away with only a token acknowledgement of

"managerial" responsibility for a scandal. Recall that their huge bonuses depended on reported

profits that were later determined to be fanciful. Recall, too, that Mr. Raines,

other Fannie executives and their Wall Street retinue derided those of us who wrote critically about their derivatives

accounting before it all blew up.

Friday's paltry settlement shows once again that Fannie and

Freddie are dangerous because, as creatures of Congress, they

can never be seen to have failed. So their accounting fraud is explained as

merely a mistake, and their former executives keep the bulk of their riches.

"Government-sponsored" capitalism means never having to say you're sorry.

See all of today's WALL STREET JOURNAL editorials and

op-eds, plus video commentary, on Opinion Journal.

New HUD director, Steven C. Preston, former $6 billion post-Katrina [with FEMA aid money] Small Business Loan director -- to take the Helm!

Steven C. Preston left Lehman Brothers in 2006 to become SBA

administrator, taking over an agency struggling through criticism of its own,

particularly regarding its seemingly laggard efforts to help

small businesses damaged by Hurricane Katrina.

The administration official said Preston was credited with turning that

program around, resolving tens of thousands of small-business requests in a

matter of months and disbursing about $6 billion to business owners.

Bush to Name SBA's Preston as HUD Chief

Washington Post Staff

Writers

Friday, April 18, 2008; 10:11 AM

President Bush

intends today to nominate Steven C. Preston, the head of the Small Business

Administration, to take over the Department of Housing and Urban Development [HUD],

according to a senior administration official.

href="http://www.washingtonpost.com/wp-dyn/content/story/2008/04/18/ST2008041801158.html

Bush to Name SBA's Preston as HUD Chief

Preston would take over from Alphonso

Jackson, a longtime Bush ally who resigned following allegations of favoritism

in his dealings with a Philadelphia developer and criticism of his response to

the crisis in the housing industry.

HUD has taken on an increasing profile

amid rising mortgage default rates and collapsing home values.

Bush chose Preston, a former investment

banker with Lehman Brothers, because of his background in finance, the official

said, referring to him as "a problem solver who knows how to tackle complex

challenges."

The U.S. housing industry is in the

midst of a sharp downturn, with prices dropping throughout the country and a

record number of homeowners falling behind on their mortgage payments.

The problem stemmed in part from years

of loose lending practices in which mortgage brokers and finance companies

freely provided loans to less creditworthy borrowers -- often on terms that

began with a low interest rate, only to escalate beyond the borrowers' ability

to pay.

Defaults on those loans have

contributed to broad problems in global financial markets, and prompted efforts

in the United States to overhaul the way the mortgage industry is regulated.

Preston left Lehman in 2006 to become

SBA administrator, taking over an agency struggling through criticism of its

own, particularly regarding its seemingly laggard efforts to help small

businesses damaged by Hurricane Katrina.

The

administration official said Preston was credited with turning that program

around, resolving tens of thousands of small-business requests in a matter of

months and disbursing about $6 billion to business

owners.

Drake lost much of its money last year [2007] from bad bets on U.S. Treasuries, as well as Japanese bonds and stocks in developed markets, according to a year-end report sent to investors. It had borrowed about $12 for every $1 of net assets as of Dec. 31. CLICK HERE FOR NIGHTMARE RECESSION/MELTDOWN NEWS.....

The Adrian Report on BLACK MONDAY, January 21, 2008, Martin Luther King Jr. Day ... Wall Street sleeps....

Executive Director of the Pacific Society, predicts that, given time, "Chinese interests and American interests will clash."

Foreign central banks are major buyers of US Treasuries, with the Peoples Bank of China (PBoC) the second largest purchaser, just after the Bank of Japan.

China's central bank has also led the swelling demand for US mortgage-backed securities. Chinese purchases of Freddie Mac, Fannie Mae, and other pre-packaged debt securities have contributed to bullish momentum in housing prices and helped maintain low mortgage rates. In short, China has played a key role in keeping interest rates low by financing huge US budget deficits, while its participation in the mortgage market has enhanced the pool of capital available for American homebuyers.

THE LONG FALL FROM GOLDMAN SACHS in LOWER MANHATTAN tooooooo-----> TIANANMEN SQUARE, CHINA, the true and mighty COLOSSUS! click here....

culled from the notes of Andrew Meyer, CUNY professor,

NYC

ARM mortgage loans -- Analysts fear that a wave of defaults could

create a vicious cycle of foreclosures and fire-sale liquidations that would

bleed U.S. real estate markets of massive equity. While

this situation is well reported, little has been said about its link to Chinese

fiscal policy and U.S.-China trade relations. A

disasterous Chinese-U.S. trade imbalance is married to the

growing crisis of sub-prime mortgages meltdowns. China's foreign

currency reserves have grown to 1.2 trillion dollars

U.S. The reasons for this mounting pile of cash are well-understood:

China has kept the value of the Renminbi (RMB) relative to the dollar

artificially low so as to keep prices in China low and spur employment and

economic growth. What relation may be drawn between Chinese fiscal

policy and the sub-prime mortgage market? $350 billion of China's

foreign currency reserve is held in U.S. T-bills. A further $230 billion of this cash,

however, is held in bonds issued by U.S.-backed agencies such as Freddie

Mac and Fannie

Mae. These latter instruments are bonds that consolidate the

debt of homeowners toward the purchase of their houses, much of which was

generated by the issuance of risky sub-prime mortgages. When one parses

out the motives for Chinese fiscal policy, the link between it and the sub-prime

mortgage crisis becomes clear. The PRC can only keep the value of the RMB

against the US dollar artificially low by parking the profits from its massive

trade surplus in U.S.-denominated assets. This has created a constant fund of

cheap cash available to lenders in US housing markets. Bankers do not need to

stringently calculate the risks associated with sub-prime loans because they

know that they can always sell off that debt to an eager Chinese

treasury in the form of a US-backed T-bill bond. The chronic need of

the Chinese fisc to hypercirculate RMB has thus created a number of economic

aberrations, including a Shanghai Stock-market

bubble at home and a US real-estate market bubble abroad. What

the long term effects of this situation will be is anyone's guess, but most

economists would agree that when there is a bubble it is bound to burst. The

effects will not be good, the only open question is their ultimate severity. One

lesson from the situation is clear: US complacency about the domestic political

situation in China is self-defeating. US leaders express frequent frustration

over Chinese fiscal policy and the distorting effect it has on CHINA-US trade,

but this ignores the deeper structural motives that perpetuate the

anomaly.

Chinese leaders continue to prime the economic pump that is causing

securities and real estate bubbles for fear of the political consequences of any

degree of economic slowdown. They hope that they will not be held to account for

failing to deliver fundamental political reform as long as the Chinese economy

continues to enjoy robust growth. How long this inherently unstable situation

can be sustained is an open question. The political consequences of

acute economic collapse are likely to be far more grave than

the instability that might be engendered by proactive and preemptive reform, but

this contingency does not seem to have registered upon China's nor America's

Wall Street nor Goldman Sachs leadership. An acute collapse is

certain to occur.

Angry and combative U.S. PROGRAMMERS GUILD blogsite, all of the many thousands of jobless American PhDs and MS educated in programming blame the H1-B visa for the death of U.S. jobs at home! Read it here.....

2007/2008 GW Administration history of Fannie Mae shareholder suit adds Goldman Sachs

NEW YORK, Sept 1 2006 (Reuters) - A lawsuit against former Fannie Mae (FNM.N: Quote, Profile, Research) executives claiming fraud has been amended to include Wall Street banks Goldman Sachs Group Inc. (GS.N: Quote, Profile, Research) and Lehman Brothers Holdings Inc. (LEH.N: Quote, Profile, Research), according to a complaint prepared by shareholder attorneys.

The complaint claimed the banks, as well as mortgage insurer Radian Group Inc. (RDN.N: Quote, Profile, Research), abetted Fannie Mae officers in mismanagement and manipulation of earnings that will result in an estimated $11 billion restatement.

Randall Baron, a partner with lead counsel Lerach Coughlin Stoia Geller Rudman & Robbins LLP, provided a copy of the amended suit that he said was filed with the United States District Court for the District of Columbia.

Spokeswomen from Fannie Mae and Lehman Brothers declined to comment. Telephone calls to Goldman Sachs and Radian were not immediately returned.

click here for ....Close to TRILLION DOLLAR accounting and US Treasury tied GROSS MISMANAGEMENT of tax dollars by FANNIE MAE "forgiven," by our toothless fed regulatory agency OFHEO, for misdeeds as boldly evident as the Super Stellar Big Bang BOOM going on without abatement in CHINA, with our T-bills too, to the stinging and burning eyes and ears of unemployed and part time and uninsured Homelanders, unraveling here in the States and abroad in U.S. vassal nations, quietly and desperately seeking money and jobs and poorly competing with never before seen mulitudes of illegal immigrants who will never protest.

Things are getting very SMALL at both the Smithsonian and Fannie Mae....despite this, the OFHEO report on Fannie Mae abuses has been "billed" to be a 'certain' BLISTERING ATTACK against the improprieties of that great and wealthy global reaching lady named FANNIE!

Things are getting very SMALL at both the Smithsonian and Fannie Mae....despite this, the OFHEO report on Fannie Mae abuses has been "billed" to be a 'certain' BLISTERING ATTACK against the improprieties of that great and wealthy global reaching lady named FANNIE!

THE ADRIAN REPORT ON

FANNIE MAE THE ADRIAN REPORT ON

FANNIE MAE

SMITHSONIAN's Lawrence M. Small pulled deep into doo-doo voodoo Fannie Mae

AND outrageous Showtime scandal! ... click here

U.S.

middle class in bloody tatters....Borrowing over $40 BILLION a year just for

basic survival from Goldman Sachs & Friends loan sharks ... click here

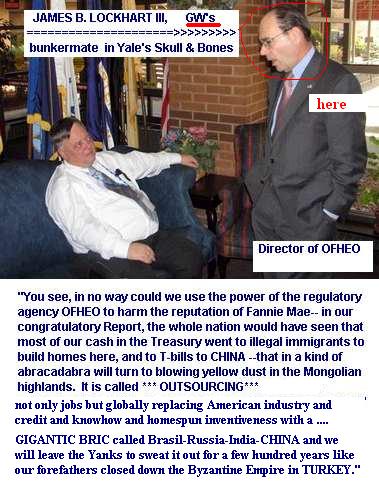

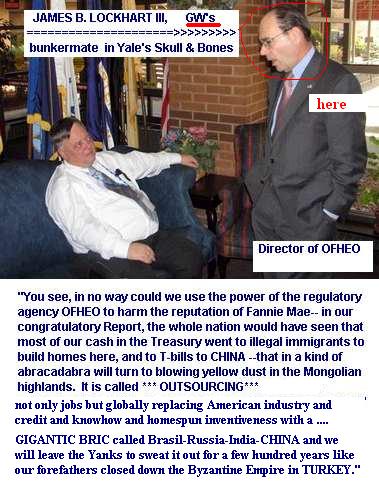

James B. Lockhart, Skull & Bones roommate of GW at Yale, former #1 man

at Pension Benefits Guarantee Corp [PBGC], currently still #2 man at Social

Security Administration, appointed by GW as new head of OFHEO, to "investigate"

for the final audit/probe his [ho ho ho] so-called "BLISTERING REPORT" by the OFHEO, of the

unknown BILLIONS OF DOLLARS swindle by Fannie Mae! ... click here ... even

OFHEO's spokesperson said earlier this quarter, "we will not see much change in

Fannie Mae even after this report, it will take years to begin implementing the

reforms".... click...DOES ANYONE SMELL A NetRisk?!

"Fannie Mae, Your Name is MUDD!"

click to read GOD OF WAR & MERCHANTS OF DEATH.....here

KABBALA

see the Mashiach video here!....

Don't be shy, CLIQUE me now!

Don't be shy, CLIQUE me now!

The vast majority of Fannie Mae's mortgages are loans to borrowers with good credit, but over the past five years the government sponsored enterprise became exposed to mortgages that were made to people with poor credit - subprime mortgages - and to mortgages that were made with incomplete documentation of borrowers' income, called Alt-A mortgages in industry parlance.

One way that Fannie increased its exposure to subprime and Alt-A mortgages was to buy bonds backed with these types of loans. While these subprime and Alt-A mortgage-backed bonds are only a small proportion of Fannie's overall mortgage holdings, their combined value of $76 billion is almost double Fannie's $40 billion of capital, which is the net worth of a company and the last cushion against losses.

please click here for a partial guest list of the secretive BILDERBERG society meeting held in Turkey at an unspecified location in May of 2004....

HOW TO PUT THE WRECKING BALL TO YOUR HOME AND LIFE....

As kla...@clark.net I reported some years ago at the beginning of the

housing bubble that the _Post_ was doing coverage of a couple of scam

operators who were in the extremely profitable business of helping illegal

aliens misrepresent their incomes on fraudulent applications to Fannie Mae

and thus securing mortgages which the scammers helped the applicants apply

to overpriced homes. I predicted at the time that the inflated prices of

these fraudulently acquired homes would force upwards the asking prices of

nearby homes, and that's exactly what happened. I also predicted at the time

that if this wasn't addressed, a housing bubble would result. What I did not

predict was that human nature and greed would go right past the ability of

the regulators, and that the entire industry would pile on, all of them

screaming "if it makes a buck, it's _good_" and I further didn't predict

that suddenly the average bottom-feeding Realtor would find themselves

launched into not just mere respectability, but to actual wealth sufficient

as to influence the political fortunes of candidates and parties.

What Mr Minnery doesn't quite seem to grasp is that the ascendancy of the

Realtor, feeding on and fed by fraudulent applications for sketchy mortgages

buying overpriced properties, is over.

It doesn't matter how he spins it. It's done. There's no more money.

Immigration, Housing Ills Seen as Linked

By Nick Miroff

Washington Post Staff Writer

Friday, October 5, 2007; Page A01

Prince William County's home prices and its Hispanic population rose in

tandem during the first half of this decade, a result of a home-building

frenzy that became a powerful magnet for immigrant laborers. They arrived by

the thousands, sending housing values even higher.

Many did not come legally. But in the blur of swinging hammers and flying

dollar signs, that detail was often overlooked. Illegal immigrants had

little trouble finding jobs and not much trouble getting fraudulently Fannie Mae backed mortgages.

[ It should be noted that this exact problem with utterly unqualified people

getting mortgages has brought this nation, and many others, to the brink of

economic disaster of a magnitude not seen in nearly 80 years. --thardman]

In a nutshell: [excerpts]

Fuel to the Fire: Investor Behavior

Just as the homeowners are to blame for their purchases gone wrong, much of

the blame also must be placed on those who invested in CDOs.

Investors were the ones willing to purchase these CDOs

at ridiculously low premiums over Treasury bonds.

These enticingly low rates are what ultimately led to such huge demand for

subprime loans.

Much of the blame here lies with investors because it is up to individuals to

perform due diligence on their investments and make appropriate expectations.

Investors failed in this by taking the 'AAA' CDO ratings at face value.

GINNIE MAE, FANNIE MAE

March 20, 2006---In a Monday

conference call with analysts, Fannie Mae Chief Executive Officer Daniel Mudd

reviewed the company's finances, and stressed the "substantial progress" the

company has made in cleaning up its scandal ridden books. Although it has not

finished reviewing its accounting policies and practices, the Fannie Mae company

has completed identifying the accounting issues it intends to examine, Mudd

said.

"The Mudd mantra here is: change, progress and more to do," said

Mr. Mudd, a former Chief Executive Officer of GE Capital, Japan, and one time

officer in the U.S. Marines, in addition to having completed a tour for the

Department of Defense, before going to Germany and participating in

conversations leading up to the installation in Germany of Angela Merkel as new

Chancellor, the favorite "girl" for the Council on Foreign relations [CFR], a

former anti-communist East German who is quickly implementing OUTSOURCING as her

mantra imposed upon all of Germany. Mudd is a proud and privileged member of the

Council on Foreign Relations, himself.

Have you ever wanted a SMS chip implanted into your brain?

The new fraud

and accounting errors of Fannie Mae were disclosed in more detail in a

Securities and Exchange Commission document filed Monday. The company grossly

failed to take into account hefty fees and obligations related to its

mortgage-backed securities, the document said. It miserably and incorrectly

classified many loans and did not properly estimate the value of foreclosed

properties. It also inappropriately recorded debt related to loans the company

had reason to believe would not be repaid.

Fannie Mae did not provide

estimates of how much each error would affect the size of the restatement, and

Congress has done next to nothing, neither has the U.S. Justice Dept.

Fannie Mae remains, however, under investigation by the powerless Office

of Federal Housing Enterprise Oversight, and is fighting several shareholder

lawsuits.

Just last week, the Senate, on a 52-48 vote, sent to President

Bush a bill raising the ceiling on the national debt to nearly $9 trillion and

preventing the FIRST EVER DEFAULT ON U.S. TREASURY NOTES IN THE HISTORY OF OUR

NATION! This translates to a debt for the faulty T-bills and the Fannie Mae

miscalculations and the war in Iraq to a debt that represents $30,000 for every

man, woman and child [legally here] in the United States.

SALLIE MAE STUDENT UPRISINGS PREDICTED FOR 2016

Who really controls PBS and NPR?

TEDx makes lots and lots of dough! You thought it was a cute humanitarian NGO? Think twice!

Did HAARP shoot down COLUMBIA?

The largest mortgage originator in the United States is

Countrywide Financial, which is an almost exclusive Fannie Mae partner, although

they have sold small amounts to GSE competitors. Their "loan production" during

2003 was $434.9 billion, of which most was sold to Fannie Mae.

Read it in the London ELECTRONIC WHIP online!

Who Will Put a Stake through the heart of the God of War?

U.S. HOMELANDERS Beware! When we are beholden to so few -- we have very

little SECURITY! There IS NO Homeland Security, only in GW's ramblings....

Please scroll down for the dope on CHEVRON MITIGATION BANK taking over

the area all around New Orleans! ... ahem, "to save our wetlands"

Merger Mania of the late 1980s, read about it in ELECTRONIC WHIP, LONDON

Merger Mania of the late 1980s, read about it in ELECTRONIC WHIP, LONDON, part 2

The CENTURY FOUNDATION declares: "Any bond represents a promise by the borrower to pay the lender. In the past, some private borrowers and even nations have defaulted on their debts. Enron, Pan Am, Polaroid, and Bethlehem Steel went bankrupt. Debt issued by Argentina and Ecuador can be purchased for far less than its face value because many investors doubt that it will be repaid. And bonds issued by the Confederate States of America are suitable for framing, but for little else; they will never be repaid. The United States, too, could default on its debt. The country could lose a war or a plague could decimate the population. Or our government could simply announce "We will no longer honor our promises to the Central Bank of China or the Federal Reserve Bank or the Social Security trust funds or anybody unlucky enough to have trusted us at our word."

please click on photo for

history of the lost tribe ... The HAAKA Jews since time immemorial have been a stronghold for ancient Aramaic and Hebrew tribes from 900

BC till Christ and up to today! ... the Silk Road is maybe 4000+ years old! please click on photo for

history of the lost tribe ... The HAAKA Jews since time immemorial have been a stronghold for ancient Aramaic and Hebrew tribes from 900

BC till Christ and up to today! ... the Silk Road is maybe 4000+ years old!

HOW OUR T-BONDS "IMMIGRATED" TO

CHINAhttp://www.atimes.com/atimes/Global_Economy/FA23Dj01.html

Veteran

New York money manager Arnold Schmeidler warns, "We are in a period unlike

anything since the 1930s when the world is confronting deflationary forces."

"American auto companies are selling their production at zero interest rates,

because there is excess capacity." But China is building auto plants to make

hundreds of thousands of vehicles....their trend is towards 40 cents an hour

wages to make clunker cars for the US in which neither consumer nor manufacturer

has much pride.

In fact, as dangerous as it sounds, China currently is

lending the US all the money to buy Chinese production.

Viva la

France!

HOORAY FOR BLACK TUESDAY!! Long live

the STRIKING FRENCH NATION!! Screw cheap and outsourced labor!! HOORAY FOR BLACK TUESDAY!! Long live

the STRIKING FRENCH NATION!! Screw cheap and outsourced labor!!

For example, as the "boom" of President George W Bush takes

off, puzzled American commentators are asking where are all the extra JOBS that

the apparently positive indicators should be creating. In fact, they are being

created abroad - MOSTLY IN CHINA.

Peter D. Schiff, chief global

strategist of Euro Pacific Capital, isn't so sanguine. Indeed, Schiff can fairly

be called an alarmist on America's borrowing and spending ways. In a note to

clients Thursday, he wrote that China's revaluation rang "the mother of all

bells."

With the change in its currency regime, "the pressure on China

to prop up the dollar will be greatly diminished," he said.

True, a

weaker dollar would hurt Chinese exports to the United States, but over the long

haul, a rising yuan would give ordinary Chinese the purchasing power to "enjoy

the fruits of their own productivity," he said.

The flip side is a

lowered American standard of living, Schiff predicted. A weaker dollar would

mean higher prices for import-loving U.S. consumers, higher interest rates and a

COLLAPSE OF HOUSING PRICES, he said.

newsflash: AUG. 2005--Rushing to beat an October deadline when the biggest overhaul of the bankruptcy law in a quarter century goes into effect, rising numbers of Americans have filed for protection in the four months since the law was changed, seeking to have their debts erased.

Recent GW induced CREDIT CARD PANIC and Dismantling of the Family Bankruptcy

laws [only against the lone citizen and his/her family, not against

mega-business bankrupticies] could affect U.S. cities like in France!

click here to read

about Dubya's monstrously cold disenfranchisement of the struggling middle and

lower classes of USA through his bill stripping away rights to claim bankruptcy

against old credit card debts ... this has kept our unemployment rate down from

25% to 11%! GW is the loser with his signing of the "Bankruptcy Abuse Prevention

and Consumer Protection Act"....another special treatment for the very rich, the

pretty rich, and the BANKS BANKS BANKS and BANKSTERS!

KENNETH TOMLINSON, bedmate of GW & Newt Gingrich, defending his email records from investigators digging up his purchase of expensive Arabic race horses on the PBS and VOA dollar!

.... you must scroll down a bit to find out how CHINA consumed

our Treasury with T-bond giveaways!.....

Jan 5, 2006

-- CHINA-USA --- USA BEING DEVOURED BY CHINA -- America's trade deficit in goods

and services reached another record, hitting $68.9 billion in October. The news,

much worse than expected, was blamed partly on a surge of Chinese electronic and

toy imports (the deficit in goods with the country was a record $20.5 billion)

and capped a year of growing political rancour with Beijing over trade.

http://www.atimes.com/atimes/Global_Economy/FA23Dj01.html

China recycles trade surplus into US Treasury bonds

American

companies may have forgotten what Henry Ford propounded when he first built his

Model T: If you do not pay high enough wages to your workers, they can't afford

to buy your product. One simple basis for that Bush boom is that China is

recycling its US$100 billion-plus trade surplus with the US back into dollars,

and especially into US Treasury bonds. Almost half of the US Treasury bonds are

now owned in Asia. So China is financing Bush's bold economic experiment:

running two or more wars simultaneously with a huge budget and trade deficit,

and equally huge tax handouts for the richest Americans.

One has to

question the long-term economic rationale for China of putting its long-term

assets into very low-interest bonds in a currency that has already dropped

recently by a third - and is going to drop even more. It certainly makes

strategic sense: if push came to shove over, for example, the Taiwan Strait, all

Beijing has to do is to mention the possibility of a sell order going down the

wires. It would devastate the US economy more than any nuclear strike the

Chinese could manage at the moment.

But far from wanting to devastate

the dollar, China is more concerned to maintain its currency's parity with the

dollar, even as it devalues massively against the Euro or the Yen. Indeed,

without those Sino-dollars flowing back, the dollar would have tanked even more.

There is a big multiplier effect here. China only accounts for 3 percent

of the world's GDP, but for from three to five times as much of the world's

growth. And its economy is disproportionately trade-oriented. So its double act

with the US - both the seller of consumer goods on a huge scale and the financer

for US' purchase makes it even more important.

Dangerously, the global

economy is faced by an addictive combination of China - a developing country

with many problems of social instability - and the US - which the recent IMF

report hints is a rapidly undeveloping country - whose fiscal irresponsibility

is compounded by a political immaturity that tends to ignore geopolitical and

economic reality.

If the US economy sinks and Americans stop buying

Chinese goods, then it will compound the US slump as China first stops buying US

bonds that have inflated the American bubble and then moves on to selling them.

On the other hand, if the Chinese economy falters and it stops recycling dollars

into the US economy, then the boom stops anyway. Indeed, it seems that China

increasingly will need more of that cash to pay for energy imports anyway.

Even though economics is a dismal science, the best economists realize,

that it is still better science than politicians drumming up votes, and

investment bankers drumming up fun money, seem to understand. The West is in the

red, and if it crashes, the East may join it.

===================================================================

Fannie Mae is a "government sponsored enterprise", aka a 'GSE'.

Are Mitigation Banks for Wetlands a GSE also??? [they are carpet bagging

through the Katrina afflicted Gulf Coast states--wherever the Army Corp of

Engineers turns up so do the mitigation banks].

Considering the WHOPPER

federal funding handouts [Mitigation Bank and Fannie Mae welfare for Big

Business] to both sneaky anti-eco 'pro-wetland' Mitigation Banks, and the sly

& shifty Fannie, they sure seem to be among the most emblematic of the

'Guaranteed Shit Entities' [GSEs]!!

About HMDA [Home

Mortgage Disclosure Act], Regulation C, The Federal Reserve, and Fannie Mae!

click pls...

"CARRYING

TRADE," which means foreigners can borrow at cheap rates in the United

States and pump the proceeds into China.

Here is how it works! FANNIE

MAE, did you know that only one US 'bank' is fatter and richer than Fannie Mae,

our collosally powerful dispenser of money [home mortgage loans]. Only Citibank

is its superior? Fannie Mae doles out trillions in home loans which are tied

into U.S. tax dollars & the US Treasury. This includes muy MUCHO bad home

loans to illegal immigrants -- just check out Bank of America records or hang

out in a Latino neighborhood bank branch and listen in if you can speak Spanish.

When this TRILLIONS goes SPLIFF!, where is the cash to back it up? It has all

disappeared without a trace same as our pension funds!

Our US Treasury

will be under much pressure to owe up somehow at the time of the meltdown which

will come at the same time that the Chinese Dragon starts to fly to Mars and

soars the skies above our heads -- making a laughing stock of our National

Reconnaissance Organization [NRO] spy satellites -- and leaving us behind

financially, culturally, astronautically, and materialistically, like an

overextended 7-11 store chock full of shrunken heads!

CHINA -- The

Chinese have been long buying up the vast bulk of our T-bonds. Our CEOs and our

Federal Reserve and our Congress have BEEN ALL FOR IT! The Japanese yen and the

British pound are not pegged to our dollar like the Chinese yuan, so don't get

your panties in a twist fretting over the Japanese and British small island

nations holding some of our T-bonds.

The Chinese have been raking in

money from this CARRYING

TRADE deal and are making a killing off of the interest we must pay them. In

a parallel universe, the Communist Chinese [suddenly in the last decade at

least] are brilliant venture capitalists and have their own mirror image T-bond

structure in their bloated Treasury, looking a lot unlike our thin Lizzy! They

got all of Europe and most of the world buying up their own T-bonds like hot

dogs on Coney Island. Funny thing is, almost not even one Chinese elite will

touch their own Chinese T-bonds. They don't buy them! They know why! It's time

for you readers to get hip too! [Why has the Chinese

domestic T-bond become the target for harsh analysis? The national Chinese debt

is known as the "bond laced with the gold," in China's financial markets.

However, the "bond laced with the gold" has long since passed its prime. On

Sept. 13,2005, China's one-year state bonds were sold at 98.87 yuan, with a

yield of only 1.1585]

Thus, funny money in our Treasury is backing

up the growth of illegal immigrant housing in the US and also the most powerful

boom in China not seen since the building of the Great Pyramids in ancient

Egypt! We are the sad losers, wasting away our very short and desperately needed

time to defeat an illusory monster in the sand dunes and Gulfs of ancient

Babylon, and doing next to nothing for our Gulf Coast wounded here at home!

Why are we helping undocumented aliens in the USA to buy homes and cars

and SUVs and giving away our assets to the booming Chinese economy, who today as

a middle class live better than our middle class in the USA, especially better

than the dissed and neglected displaced denizens of New Orleans. We have

produced a surplus of native born PhDs in science and engineering right here at

home, for over a decade or two, and yet our lawyers and Senators have been

doling out H1-B visas to alien scientists and engineers!

Our exports are

laughable compared to Germany ... thus, do we have any real money left in our

Treasury that has not been spent on contractors such as Halliburton and

Wackenhut and KBG and Caryle Group and USIS, just to mention a few of the

insiders, with no bid contracts awash over in Afghanistan and Iraq for these

parasites. I don't think so. Prove me wrong, make my day. When even our own

unions do NOTHING to help African Americans nor blue collar workers nor our

rapidly shrinking and vanishing middle class to stay afloat and to train to keep

abreast of new technologies, when these impotent and supplicating and feather

lined union managers can only reach out like beggars to help ONLY illegal

immigrants to organize and strike against Big Business abuses, and not organize

and assist us legals, we are in need of some new founding fathers and a new and

bolder drum and fife corps! Lace up your boots and pump up the volume! Make some

music and make yourself heard!

GW FEMA-VILLES MORE PREVALENT THAN

HOOVERVILLES>=========================

What

is a MITIGATION BANK and what does it have to do with military engineers and

wetland swap deals and New Orleans Reconstruction? What

is a MITIGATION BANK and what does it have to do with military engineers and

wetland swap deals and New Orleans Reconstruction?

CHEVRON SAVING OUR

WETLANDS? THINK TWICE .... CHEVRON SAVING OUR

WETLANDS? THINK TWICE ....

PALACIO WETLANDS BANK

.... click here for helpful details....

Sept. 1, 2005 -- Paul Krugman, NY Times, on ARM home mortgage loans and the

imminent explosion of the toy bubble economy, owned by the Chinese holding our

T-bonds:

"These days Mr. Greenspan expresses concern about the

financial risks created by "the prevalence of interest-only loans and the

introduction of more-exotic forms of adjustable-rate mortgages [ARMs]." But last

year he encouraged families to take on those very risks, touting the advantages

of adjustable-rate mortgages [ARMs] and declaring that "American consumers might

benefit if lenders provided greater mortgage product alternatives to the

traditional fixed-rate mortgage."

If Mr. Greenspan had said two years

ago what he's saying now, people might have borrowed less and bought more

wisely. But he didn't, and now it's too late. There are signs that the housing

market either has peaked already or soon will. And it will be up to Mr.

Greenspan's successor to manage the bubble's aftermath.

How bad will

that aftermath be? The U.S. economy is currently suffering from twin imbalances.

On one side, domestic spending is swollen by the housing bubble, which has led

both to a huge surge in construction and to high consumer spending, as people

extract equity from their homes. On the other side, we have a huge trade

deficit, which we cover by selling bonds to foreigners. As I like to say, these

days Americans make a living by selling each other houses, paid for with money

borrowed from China.

One way or another, the economy will eventually

eliminate both imbalances. But if the process doesn't go smoothly - if, in

particular, the housing bubble bursts before the trade deficit shrinks - we're

going to have an economic slowdown, and possibly a recession. In fact, a growing

number of economists are using the "R" word for 2006.

And here's where

Mr. Greenspan is still saying foolish things. In his closing remarks he

suggested that "an end to the housing boom could induce a significant rise in

the personal saving rate, a decline in imports and a corresponding improvement

in the current account deficit." Translation, I think: the end of the housing

bubble will automatically cure the trade deficit, too.

Sorry, but no. A

housing slowdown will lead to the loss of many jobs in construction and service

industries but won't have much direct effect on the trade deficit. So those jobs

won't be replaced by new jobs elsewhere until and unless something else, like a

plunge in the value of the dollar, makes U.S. goods more competitive on world

markets, leading to higher exports and lower imports.

So there's a rough

ride ahead for the U.S. economy. And it's partly Mr. Greenspan's fault."

Is

Walmart really at the cutting edge of illegal immigrant labor or are they falling behind many of the other "union" shops?! ... click

here Is

Walmart really at the cutting edge of illegal immigrant labor or are they falling behind many of the other "union" shops?! ... click

here

...click here for legal citizens aka African Americans reaction to the new GW

inspired NO BANKRUPTCY law for the impoverished --that just swept through both

sides of the House, with Democrat & Republican Neo-Cons cheering as they hold hands with

their blushing fatcat lobbyists!

...click here for legal citizens aka African Americans reaction to the new GW

inspired NO BANKRUPTCY law for the impoverished --that just swept through both

sides of the House, with Democrat & Republican Neo-Cons cheering as they hold hands with

their blushing fatcat lobbyists!

Israel slapped on the back for using illegal cluster bombs purchased from USA and used on civilians in Lebanon!....click here

click here for Dirt Bag Contractors in Iraq

New York Democrat Bans Contractors from hiring Illegal Immigrants .... companies that hire illegals will do six months in jail and pay hefty fines .... Steve Levy cares about our jobs and welfare and making our unions strong with LEGAL RESIDENTS, not illegals, like the SEIU and AFL-CIO prefer....click here for riveting details!

CHEVRON is SAVING our Wetlands for us and getting paid well to do it! ... click here to believe! CHEVRON is SAVING our Wetlands for us and getting paid well to do it! ... click here to believe!

Please ... if you are interested or share concern in saving our wetlands, please consult the classic textbook on it, "WETLANDS: Third Edition", by William J. Mitsch & James G. Gosselin, 2000, John Wiley & Son.

What comes across clear to me after having looked the book over, is that MITIGATION BANKING should be called REPLACEMENT BANKING, in that the wetlands are being replaced much faster than the damages to them are being mitigated.....

Rachel's Precaution Reporter---click here -- [PP] "Precautionary Principle," far better than the PETER PRINCIPLE! Stand behind a clean and integrated MOTHER EARTH! Read over Rachel's List and see who is violating the PP litmus test concerning our vulnerable environment.....click here! Rachel's Precaution Reporter---click here -- [PP] "Precautionary Principle," far better than the PETER PRINCIPLE! Stand behind a clean and integrated MOTHER EARTH! Read over Rachel's List and see who is violating the PP litmus test concerning our vulnerable environment.....click here!

Speaking of Rachels, the plucky Jewish anarchist, MURRAY BOOKCHIN, passed away recently... he had DEEP THROAT FBI deputy director W. MARK FELT convicted for violating his civil and U.S. Constitutional rights in his hayday, in addition to writing OUR SYNTHETIC ENVIRONMENT [1962], against pesticides and the dangers of industrial and commercial chemical proliferation, at the same time as RACHEL CARSON's "Silent Spring" came onto the scene...click here for more... Speaking of Rachels, the plucky Jewish anarchist, MURRAY BOOKCHIN, passed away recently... he had DEEP THROAT FBI deputy director W. MARK FELT convicted for violating his civil and U.S. Constitutional rights in his hayday, in addition to writing OUR SYNTHETIC ENVIRONMENT [1962], against pesticides and the dangers of industrial and commercial chemical proliferation, at the same time as RACHEL CARSON's "Silent Spring" came onto the scene...click here for more...

Both ducks and civil rights are LIMITED, far from "unlimited", as THE TERRENE INSTITUTE would have you believe.

"The Office of Homeland Security has been accused of wasting billions on no-bid contracts leading to enormous fraud and abuse", by Gary D. Bass and Dana Chasin: Bass & Chasin Shed sunlight on no-bid federal contracts, in The DC Examiner, Aug 4, 2006 -- Gary D. Bass and Dana Chasin are executive director and senior adviser on budget and tax issues, respectively, at OMB Watch

ICF Kaiser International Consulting won hands down in an easy government bid [for them] to a cushy nearly $5 billion dollar bonanza through HUD today, to "rebuild" the homes for the lower and poorer middle classes in the Katrina strike zone---those Homelanders are gonna be proud of ICF when they are back in their homeland homes [wink wink wink]! Read about it here......click! And don't cofuse ICF with ICC, it easy to do and that is a future story!!

Some very very happy homelander Gulf Coast dolphins today at the ICF-HUD press conference on hearing that all will soon be well thanks to the homebuilding skills of ICF military software consultants!

"ANONYMOUS" recommended websites:

DUCKS UNLIMITED

https://www.angelfire.com/electronic2/haarpmicrowaves/Ducks_Unlimited_2006.pdf

Reimportation

of Drugs, PhRMA & Tea Party

http://beaties_of_bulgaria.tripod.com/sandy.html

http://beaties_of_bulgaria.tripod.com/NGO-OBSERVER/The_NGO_OBSERVER.html

https://www.angelfire.com/electronic2/haarpmicrowaves/Varoufakis-NEVER-AGAIN.html

http://rebbe_rocky.tripod.com/Jon_Stewart_NED.htm

http://ikeya_zhang.tripod.com/NED-license-to-kill.html

https://www.angelfire.com/planet/blacklisting_central/Temp_Slaves.htm

How Illegal Immigration &

Fannie Mae Set Us Up for the CRASH of 2008

https://www.angelfire.com/planet/blacklisting_central/Adrian-2005-Report-Immigration.html

Trump’s Chabad/Hasidic

Stetson Hat Backers

http://rebbe_rocky.tripod.com/CHABAD_gangsta_ties_TRUMP.html

Rachel Maddow Rockets

for Israel family

http://rebbe_rocky.tripod.com/Rachel-Maddow-background.html

Synthetic Telepathy

& Elon Musk

http://carpathian_bronze.tripod.com/synthetic-telepathy.html

GROUND ZERO BOGUS

https://www.angelfire.com/zine/cetaceandragon/Ground-Zero-Conspiracy.html

SCAN of AISLING

http://boudiccaarran.tripod.com/aisling_bryan_adrian.html

click here for the "real dope" on who funds NPR

|

... this website is just one rather old man's small effort to make a layman's composite and historical "string" of many of the news events of the decade, which forced the Western World democracies to collapse and fold themselves like rolly pollies into the mere semblance of their former selves, whimpering in the corner, trembling at each new ...

... this website is just one rather old man's small effort to make a layman's composite and historical "string" of many of the news events of the decade, which forced the Western World democracies to collapse and fold themselves like rolly pollies into the mere semblance of their former selves, whimpering in the corner, trembling at each new ...  ... are all of us headed to the same fate as the Palestinians and Gazans??....this website endeavors to instill a 'remembrance of things past', in the links and excerpts below, which may give some of us yet, a prayer of a chance to survive what has befallen many of us already, before there is only One World Order, and not a good one.

... are all of us headed to the same fate as the Palestinians and Gazans??....this website endeavors to instill a 'remembrance of things past', in the links and excerpts below, which may give some of us yet, a prayer of a chance to survive what has befallen many of us already, before there is only One World Order, and not a good one.

... please click here for William Black on Bill Moyer's PBS interview re: Little Timmy and his cronies in Goldman Sachs and LIARS LOANS.....

... please click here for William Black on Bill Moyer's PBS interview re: Little Timmy and his cronies in Goldman Sachs and LIARS LOANS.....

Things are getting very SMALL at both the Smithsonian and Fannie Mae....despite this, the OFHEO report on Fannie Mae abuses has been "billed" to be a 'certain' BLISTERING ATTACK against the improprieties of that great and wealthy global reaching lady named FANNIE!

Things are getting very SMALL at both the Smithsonian and Fannie Mae....despite this, the OFHEO report on Fannie Mae abuses has been "billed" to be a 'certain' BLISTERING ATTACK against the improprieties of that great and wealthy global reaching lady named FANNIE!

THE ADRIAN REPORT ON

FANNIE MAE

THE ADRIAN REPORT ON

FANNIE MAE

Don't be shy, CLIQUE me now!

Don't be shy, CLIQUE me now!

please click on photo for

history of the lost tribe ... The HAAKA Jews since time immemorial have been a stronghold for ancient Aramaic and Hebrew tribes from 900

BC till Christ and up to today! ... the Silk Road is maybe 4000+ years old!

please click on photo for

history of the lost tribe ... The HAAKA Jews since time immemorial have been a stronghold for ancient Aramaic and Hebrew tribes from 900

BC till Christ and up to today! ... the Silk Road is maybe 4000+ years old!

HOORAY FOR BLACK TUESDAY!! Long live

the STRIKING FRENCH NATION!! Screw cheap and outsourced labor!!

HOORAY FOR BLACK TUESDAY!! Long live

the STRIKING FRENCH NATION!! Screw cheap and outsourced labor!!

What

is a MITIGATION BANK and what does it have to do with military engineers and

wetland swap deals and New Orleans Reconstruction?

What

is a MITIGATION BANK and what does it have to do with military engineers and

wetland swap deals and New Orleans Reconstruction?

CHEVRON SAVING OUR

WETLANDS? THINK TWICE ....

CHEVRON SAVING OUR

WETLANDS? THINK TWICE ....  Is

Walmart really at the cutting edge of illegal immigrant labor or are they falling behind many of the other "union" shops?! ... click

here

Is

Walmart really at the cutting edge of illegal immigrant labor or are they falling behind many of the other "union" shops?! ... click

here

...click here for legal citizens aka African Americans reaction to the new GW

inspired NO BANKRUPTCY law for the impoverished --that just swept through both

sides of the House, with Democrat & Republican Neo-Cons cheering as they hold hands with

their blushing fatcat lobbyists!

...click here for legal citizens aka African Americans reaction to the new GW

inspired NO BANKRUPTCY law for the impoverished --that just swept through both

sides of the House, with Democrat & Republican Neo-Cons cheering as they hold hands with

their blushing fatcat lobbyists! CHEVRON is SAVING our Wetlands for us and getting paid well to do it! ... click here to believe!

CHEVRON is SAVING our Wetlands for us and getting paid well to do it! ... click here to believe!

Rachel's Precaution Reporter---click here -- [PP] "Precautionary Principle," far better than the PETER PRINCIPLE! Stand behind a clean and integrated MOTHER EARTH! Read over Rachel's List and see who is violating the PP litmus test concerning our vulnerable environment.....click here!

Rachel's Precaution Reporter---click here -- [PP] "Precautionary Principle," far better than the PETER PRINCIPLE! Stand behind a clean and integrated MOTHER EARTH! Read over Rachel's List and see who is violating the PP litmus test concerning our vulnerable environment.....click here!

Speaking of Rachels, the plucky Jewish anarchist, MURRAY BOOKCHIN, passed away recently... he had DEEP THROAT FBI deputy director W. MARK FELT convicted for violating his civil and U.S. Constitutional rights in his hayday, in addition to writing OUR SYNTHETIC ENVIRONMENT [1962], against pesticides and the dangers of industrial and commercial chemical proliferation, at the same time as RACHEL CARSON's "Silent Spring" came onto the scene...click here for more...

Speaking of Rachels, the plucky Jewish anarchist, MURRAY BOOKCHIN, passed away recently... he had DEEP THROAT FBI deputy director W. MARK FELT convicted for violating his civil and U.S. Constitutional rights in his hayday, in addition to writing OUR SYNTHETIC ENVIRONMENT [1962], against pesticides and the dangers of industrial and commercial chemical proliferation, at the same time as RACHEL CARSON's "Silent Spring" came onto the scene...click here for more...

UPDATE

UPDATE

UPDATE

UPDATE  CHEVRON is SAVING our Wetlands for us and getting paid well to do it! ... read here to believe!

CHEVRON is SAVING our Wetlands for us and getting paid well to do it! ... read here to believe!

WASHINGTON POST reports on neo-reactionary GW stacked Supreme Court trashing a nearly 35 year old Water Act that formerly protected WETLANDS from parking lot developers and condo building maniacs... click here or DUCK!

WASHINGTON POST reports on neo-reactionary GW stacked Supreme Court trashing a nearly 35 year old Water Act that formerly protected WETLANDS from parking lot developers and condo building maniacs... click here or DUCK!