SALLIE MAE-NAVIENT aka SLM Corp--

TRILLIONS DOLLARS SWINDLE BUBBLE

Just Waiting to Burst same as the Home Loan Mortgage Fannie Mae Swindles that

created CRASH OF 2008!

U.S.

universities have morphed into ONE BIG ATM CASH MACHINE mega-business SEEKING

foreign students, to the detriment of US students and future engineers and

computer programmers and IT specialists and software designers and nurses and

Physician Assistants, emerging from the giant womb of US legal resident

citizens and not recruited nor imported in from external factors OUTSIDE of the

domestic reality.

* U.S. Student loans that originate from Sallie Mae or

Navient are not federal loans. They are private loans. Sallie Mae and Navient offer few to no

options for repayment and do not offer any kind of income-based repayment

plans.

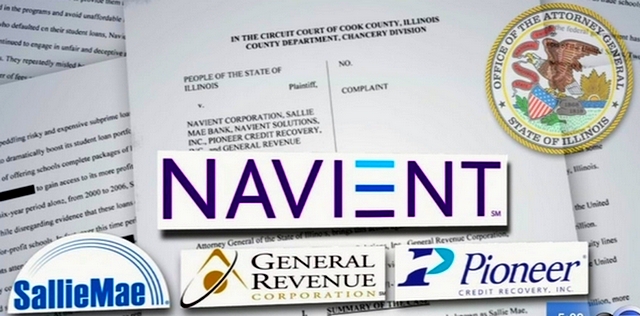

* Navient is Sallie Mae "rebranded":

don't be fooled by this PR stunt.

* No student loan is protected by bankruptcy—not

private loans, not federal loans, none of them. If you attempt to discharge

your loans in bankruptcy, there is a very high chance that your efforts will be

unsuccessful.

About 25% of higher

education students in USA now are foreigners who pay more university tuition,

making Education in the U.S. a vast and colossal Money Making Machine. On the

other hand, national domestic student loan debt has climbed to $1.4 trillion as

of 2017. About 6 million students had subsidized loans in the 2016-2017

academic year, averaging $100,000, which comes to over $20 billion annually.

SALLIE MAE, aka, "Navient" under its new name since a scandal a few

years ago, is the next trillion dollar bubble to burst like Fannie Mae and

the home loan mortgage disaster of 2007/2008 which caused a global financial

CRASH. NAVIENT, new name for Sallie Mae spinoff, is expected to service more

than $300 billion in student loans. In June 2016, stockholders filed a class

action lawsuit against Navient. The plaintiffs included Chicago police officers

and retired city employees in Providence, Rhode Island. Up to 2017, already

"tens of thousands" of complaints were filed against Navient. In

2017, 6,708 federal complaints were filed about the company, in addition to

4,185 private complaints – more than any other student loan lender in the

history of the world.

CNBC--March 2018--The Student Loan

Crisis will be a factor when the economy crashes, even though Wall Street and

the wealthy are the only ones who have benefited from this "Booming"

Economy. U.S. resident native born higher education students whose loans fall into delinquency would be subject to more stringent enforcement as the proposal also calls to "streamline the Department of Education's ability to verify applicants' income data held by the Internal Revenue Service." Some 30 programs would also lose funding, including the Supporting Effective Instruction State Grants, 21st Century Community Learning Centers and Federal Supplemental Educational Opportunity Grant programs. The president's proposal is subject to approval by Congress and is likely to be modified by legislators.

CNBC.COM

Trump's budget ends student loan forgiveness program, slashes repayment

options

Trump's budget

emboldens the government to go after students who don't pay their loans, limits

repayment choices and more.

On September

17, 2010, it was announced that Sallie Mae will acquire federally insured loans

from Citigroup-owned Student Loan Corporation worth $28 billion. On Feb 25, 2014, Sallie Mae (aka SLM

Corp) announced the new name for the student loan side which will be called "Navient". Navient

now manages nearly $300 billion in student loans for more than 12 million customers, the company was formed in 2014 by the split of

Sallie Mae into two distinct entities, Sallie Mae Bank and Navient. It seems

around this time Sallie Mae sold off all her student loan assets and then

bought them back again under their new business name change to Navient, and

thereby avoided many lawsuits and prosecutions and it is the same ole same ole

Sallie Mae swindle and rake off that it was, but now with a face lift and name

change to NAVIENT. Already by In August 2015, the Consumer Financial Protection

Bureau sent Navient a letter telling its executives that the agency's

enforcement staff had found enough evidence to indicate the company violated

consumer protection laws. On May 28, 2015, the United States Department of

Justice announced that nearly 78,000 military service members would begin

receiving $60 million in compensation for being charged excess interest on

their student loans by Navient.

National

student loan debt has climbed to $1.4 trillion as of 2017

In June 2016, stockholders filed a class action lawsuit against Navient. The plaintiffs included Chicago police officers and retired city employees in Providence, Rhode Island. Up to 2017, already "tens of thousands" of complaints were filed against Navient. In 2017, 6,708 federal complaints were filed about the company, in addition to 4,185 private complaints – more than any other student loan lender in the history of the world.

The

Crony Capitalism of Sallie Mae, July 2013

https://reason.org/wp-content/uploads/files/sallie_mae_cronyism.pdf

How

SALLIE MAE (aka SLM Corp) College

Loans Got So Evil, a video

https://www.youtube.com/watch?v=pVKEsiNMPNc

July

2018 -- Navient, the Delaware-based student loan management corporation

formerly known as Sallie Mae, is being sued by California’s Attorney General

Xavier Becerra. In a suit filed Thursday, Becerra accused Navient,

the nation’s largest student loan servicer, of cheating thousands of borrowers

and forcing them to repay more than they owed. Becerra’s suit alleges that

borrowers were steered toward repayment plans that exceeded their income

levels, and that in some cases, Navient misrepresented how much borrowers

owed. When forced to pay more than they owed, many borrowers then defaulted on

their student loans. “By taking Navient to court, we’re sending a very strong

message that these practices will not be tolerated,” he said before the filing,

according to the San Francisco Chronicle.

National

student loan debt has climbed to $1.4 trillion as of 2017

In

February 2007, New York Attorney General’s office launched an investigation

into deceptive lending practices by student loan providers, including The College Board, EduCap, Nelnet, Citibank, and Sallie Mae.. On October 10, 2007, documents surfaced showing that

Sallie Mae was attempting to use the Freedom of Information Act to force

colleges to turn over students' personal information to unfriendly predatory

hands. The university involved was SUNY, State University of New York, which

declined the request and was forced to defend its position in court. In December 2007, a class action lawsuit was

brought against Sallie Mae in a Connecticut federal court alleging that SALLIE MAE discriminated against African American student loan

applicants by charging them much higher interest rates and fees. The

lawsuit also alleged that Sallie Mae failed to properly disclose profit gouging

terms in student loans to unsuspecting students. Finally, under the terms of a

settlement, Sallie Mae agreed to make a $500,000 donation to the United Negro

College Fund and the attorneys for the plaintiffs received a whopping and

handsome $1.8 million in attorneys' fees for being the erudite middlemen. (Wikipedia)

"ANONYMOUS" recommended websites:

DUCKS UNLIMITED

https://www.angelfire.com/electronic2/haarpmicrowaves/Ducks_Unlimited_2006.pdf

Reimportation

of Drugs, PhRMA & Tea Party

http://beaties_of_bulgaria.tripod.com/sandy.html

http://beaties_of_bulgaria.tripod.com/NGO-OBSERVER/The_NGO_OBSERVER.html

https://www.angelfire.com/electronic2/haarpmicrowaves/Varoufakis-NEVER-AGAIN.html

http://rebbe_rocky.tripod.com/Jon_Stewart_NED.htm

http://ikeya_zhang.tripod.com/NED-license-to-kill.html

https://www.angelfire.com/planet/blacklisting_central/Temp_Slaves.htm

How Illegal Immigration &

Fannie Mae Set Us Up for the CRASH of 2008

https://www.angelfire.com/planet/blacklisting_central/Adrian-2005-Report-Immigration.html

Trump’s Chabad/Hasidic

Stetson Hat Backers

http://rebbe_rocky.tripod.com/CHABAD_gangsta_ties_TRUMP.html

Rachel Maddow Rockets

for Israel family

http://rebbe_rocky.tripod.com/Rachel-Maddow-background.html

Synthetic Telepathy

& Elon Musk

http://carpathian_bronze.tripod.com/synthetic-telepathy.html

GROUND ZERO BOGUS

https://www.angelfire.com/zine/cetaceandragon/Ground-Zero-Conspiracy.html

SCAN of AISLING

http://boudiccaarran.tripod.com/aisling_bryan_adrian.html