A Doji is formed when the open and the close are the same or very close. The length of the shadows are not important. The Japanese interpretation is that the bulls and the bears are conflicting. The appearance of a Doji should alert the investor of major indecision.

Recognition: The open and close are the same or very close to the same.

Pattern Psychology: The Bulls and the Bears are conflicting. This is an alert to investors to take heed for possible trend reversal.

========================================================

The Gravestone Doji is formed when the open and the close occur at the low of the day. It is found occasionally at market bottoms, but it's forte is calling market tops. The name, Gravestone Doji, is derived by the formation of the signal looking like a gravestone.

The Long-legged Doji has one or two very long shadows. Long-legged Doji's are often signs of market tops. If the open and the close are in the center of the session's trading range, the signal is referred to as a Rickshaw Man. . The Japanese believe these signals to mean that the trend has "lost it's sense of direction."

The Bullish Engulfing Pattern is formed at the end of a downtrend. A white body is formed that opens lower and closes higher than the black candle open and close from the previous day. This complete engulfing of the previous day's body represents overwhelming buying pressure dissipating the selling pressure.

Recognition: The body of the second day completely engulfs the body of the first day. Shadows are not a consideration.

Pattern Psychology: This pattern suggests the Bulls are stepping in with force, suggesting prices will move up.

==========================================================

The Bearish Engulfing Pattern

is directly opposite to the bullish pattern. It is created at the end of an up-trending market. The black real body completely engulfs the previous day's white body. This shows that the bears are now overwhelming the bulls.

Recognition: The body of the second day completely engulfs the body of the first day. Shadows are not a consideration.

Pattern Psychology: This shows the Bears are overwhelming the Bulls, suggesting prices will move down.

===========================================================

BULLISH HARAMI

Recognition: A two candle pattern forming in a down trending price pattern. The body of the first candle is the same color as the current trend and should be a long black candle. The body of the second candle is white and opens and closes within the body of previous day's candle.

Pattern Psychology: After a strong downtrend the Bulls step in and open the price higher than the previous day's close. This concerns the Bears and the shorts start covering their postions. A strong day after that would convince everybody that the trend may be in a reversal.

===========================================================

BEARISH HARAMI

Recognition: A two candle pattern forming in an uptrending price pattern. The body of the first candle is the same color as the current trend and should be a long white candle. The body of the second candle is black and opens and closes within the body of the previous day's candle.

Pattern Psychology: After a strong uptrend the Bears step in and open the price lower than the previous day's close. The price finishes lower for the day and the Bulls are concerned and begin taking their profits.

===========================================================

The Dark Cloud Cover is a two-day bearish pattern found at the end of an upturn or at the top of a congested trading area. The first day of the pattern is a strong white real body. The second day's price opens higher than any of the previous day's trading range.

Recognition: A two candle pattern, the body of the first candle is white and the body of the second candle is black. The black day opens higher, above the trading range of the previous day. The price closes below the 50% level of the white body. Pattern Psychology: After a strong uptrend, the atmosphere is Bullish but before the end of the day the Bears step in and price closes near the low of the day.

===========================================================

The Piercing Pattern is a bottom reversal. It is a two candle pattern at the end of a declining market. The first day real body is black. The second day is a long white body. The white day opens sharply lower, under the trading range of the previous day. The price comes up to where it closes above the 50% level of the black body.

Recognition: A two candle pattern, the body of the first candle is black and the body of the second candle is white. The white day opens lower, under the trading range of the previous day. The price closes above the 50% level of the black body. Pattern Psychology: After a strong downtrend, the atmosphere is Bearish but before the end of the day the Bulls step in and price closes near the high of the

============================================================

Hammer and Hanging-man are candlesticks with long lower shadows and small real bodies. The bodies are at the top of the trading session. This pattern at the bottom of the down-trend is called a Hammer. It is hammering out a base. The Japanese word is takuri, meaning "trying to gauge the depth".

Recognition: The lower shadow (or tail) should be at least two times the length of the body. The color of the body is not important although a black body has slightly more Bearish indications and a white body has slightly more Bullish indications. Pattern Psychology: This pattern at the bottom of a down trend is called a Hammer. This pattern at the top of an uptrend is called a Hanging-Man

============================================================

The Morning Star is a bottom reversal signal. Like the morning star, the planet Mercury, it foretells the sunrise, or the rising prices. The pattern consists of a three day signal.

Recognition: A three candle pattern at the bottom of a downtrend.The body of the first candle is black, confirming the current downtrend. The second candle is an indecisive formation. The third candle is white and should close at least halfway up the black candle.

Pattern Psychology: After an apparant downtrend the Bulls step in and open the price higher than the previous day's close. The price finishes higher for the day and the Bears are concerned and begin covering their short positions.

==========================================================

The Evening Star is the exact opposite of the morning star. The evening star, the planet Venus, occurs just before the darkness sets in. The evening star is found at the end of the uptrend.

The Evening Star is the exact opposite of the morning star. The evening star, the planet Venus, occurs just before the darkness sets in. The evening star is found at the end of the uptrend.

Recognition: A three candle pattern at the top of an uptrend. The body of the first candle is white, confirming the current uptrend. The second candle is an indecisive formation. The third candle is black and should close at least halfway down the white candle.

Pattern Psychology: After an apparant uptrend the Bears step in and open the price lower than the previous day's open. The price finishes lower for the day and the Bulls are concerned and begin selling to take their profits.

==========================================================

A Shooting Star sends a warning that the top is near. It got its name by looking like a shooting star.

The Shooting Star Formation, at the bottom of a trend, is a bullish signal. It is known as an inverted hammer. It is important to wait for the bullish verification. Now that we have seen some of the basic signals, let's take a look at the added power of some of the other formations.

Recognition: One candle pattern appearing in an uptrend. The shadow (or tail) should be at least two times the length of the body. The color of the body is not important, although a black body has slightly more Bearish indications.

Pattern Psychology: After a strong uptrend the Bulls appear to still be in control with price opening higher, but by the end of the day the Bears step in and take the price back down to the lower end of the trading range. Lower trading the next day reinforces the probability of a pullback.

==========================================================

Recognition: The upper shadow should be at least two times the length of the body. The real body is at the lower end of the trading range. There should be no lower shadow or a very small lower shadow.

Pattern Psychology: After a downtrend has been in effect, the atmosphere is Bearish. The price opens and trades lower but before the end of the day, The Bulls step in and take the price back up. A higher open or a white candle the next day reinforces buying.

==========================================================

BELT HOLD

The Belt Hold lines are formed by single candlesticks. The Bullish Belt Hold is a long white candle that has gapped down in a downtrend. From itís opening point, it moved higher for the rest of the day. This is called a White Opening Shaven Bottom or White Opening Maruboza. The bearish Belt Hold is just the opposite. It is formed with a severe gap away from the existing uptrend. It opens at itís high and immediately backs off for the rest of the day. It is known as a Black Opening Shaven head or Black Opening Maruboza. Yorikiri, a sumo wrestling term, means pushing your opponent out of the ring while holding onto his belt. The longer the body of the Belt Hold, the more significant the reversal.

The Belt Hold lines are formed by single candlesticks. The Bullish Belt Hold is a long white candle that has gapped down in a downtrend. From itís opening point, it moved higher for the rest of the day. This is called a White Opening Shaven Bottom or White Opening Maruboza. The bearish Belt Hold is just the opposite. It is formed with a severe gap away from the existing uptrend. It opens at itís high and immediately backs off for the rest of the day. It is known as a Black Opening Shaven head or Black Opening Maruboza. Yorikiri, a sumo wrestling term, means pushing your opponent out of the ring while holding onto his belt. The longer the body of the Belt Hold, the more significant the reversal.

Criteria

The candlestick body should be the opposite color of the prevailing trend. It significantly gaps open, continuing the trend. The real body of the candlestick has no shadow at the open end. The open is the high or low of that trend. The length of the body should be a long body. The greater the length, the more significant the reversal signal.

Signal Enhancements

The longer the body, the more significant the reversal pattern. Pattern Psychology

After a strong trend has been in effect, the trend is further promoted by a gap open, usually a large gap. The opening price becomes the point where the price immediately moves back in the direction of the previous close. This makes the opening price the high or the low for the trend. This causes concern. Investors start to cover shorts or selling outright. This starts to accentuate the move, thus reversing the existing trend.

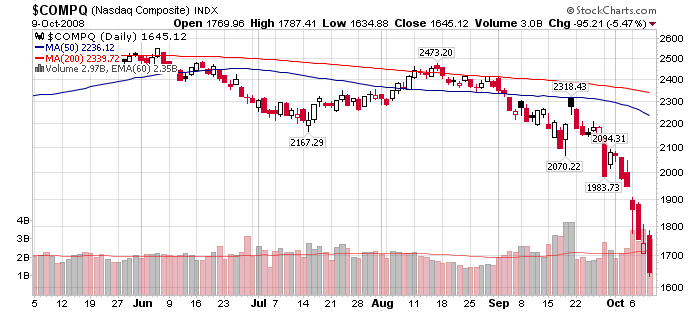

Nasdaq drops 600 points after we get Belt Hold formation

==========================================================

THREE WHITE SOLDIERS This Secondary Signal,is one of many strong reversal patterns.

Description

The Three White Soldiers (also known as The Advancing Three White Soldiers) is a healthy market reversal pattern. It consists of three white candles, the second and third candles opening lower than the previous close but closing at a new high.

Criteria

Each consecutive long candle closes with a higher open. The second and third candlesticks open in the previous day's body. Each day should close very near its high for the day The opens should be within the top half of the previous day's body.

Pattern Psychology

After a downtrend or a flat period, the presence of this formation suggests a healthy rally will occur. The strength of this formation consists of the fact that each day, the lower open suggests that sellers are present. By the end of each day, the buying has overcome the early sellers. This represents that a healthy continued rally has selling occurring as it is happening. As in any rally, too much buying with little selling can be dangerous. This Bullish reversal pattern needs no confirmation.

==========================================================

THREE BLACK CROWS

Recognition: Three long black candles occur, after a strong uptrend, all of close to equal length.

Pattern Psychology: The uptrend has now reached levels where the sellers have started to step in. This persistant pressure by the Bears provides the potential for a strong downtrend.

==========================================================

TWO CROWS

Recognition: It is a top reversal pattern only after an obvious uptrend.

Pattern Psychology: After a strong uptrend has been in effect, the price gaps open but cannot hold its gains. The further the third day closes into the last white Bullish candle, the more bearish it is.

==========================================================

Spinning Tops are depicted with small bodies relative to the shadows. This demonstrates some indecision on the part of the bulls and the bears. They are considered neutral when trading in a sideways market. However, in a trending or oscillating market, a relatively good rule of thumb is that the next days trading will probably move in the direction of the opening price. The size of the shadow is not as important as the size of the body for forming a Spinning Top.

==========================================================

UNIQUE THREE RIVER BOTTOM

Recognition: Three-Day reversal pattern at the end of a strong downtrend.

Pattern Psychology: After a strong downtrend the Bears would appear to be in control, but this rare pattern provides an early indication of a successful reversal ahead.