There are numerous forms of life insurance policy plan today yet both key classifications are term as well as entire life. In reality, in recent times, elderly life insurance has come to be an exceptionally common insurance policy item in America. Flexible life insurance policy is more than likely not needed by the majority of individuals. It is a sort of http://www.thefreedictionary.com/life insurance quotes life insurance policy plan that you can adapt to fit your Additional resources transforming demands. When you discover how much you can assign toward life insurance policy monthly, explore the numerous sort of coverage options available. Life insurance for the majority of individuals is quite costly.

The insurance firm you place in your application for life insurance with makes a fantastic distinction in your odds of getting covered. You may not think that life insurance policy is an essential facet of protection, yet it is. Life insurance is an essential part of an individual's fiscal safety net. It is a sort of insurance policy that supplies defense to individuals and also their households, in case of the unforeseen death of the income earner. Permanent life insurance, additionally called entire life, can last your entire life. No matter your age, you should certainly be in a placement to safeguard inexpensive and also superior life insurance to provide your family members with the security which they require. Therefore, you might usually discover more inexpensive life insurance when you acquire it at an early stage in life.

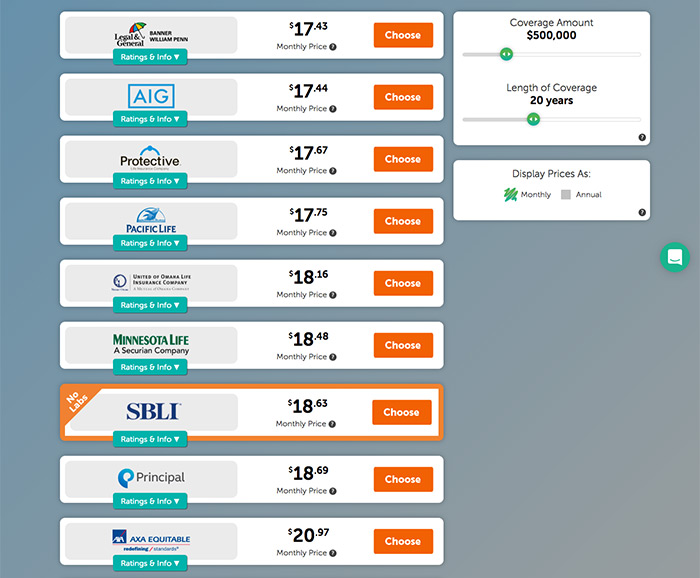

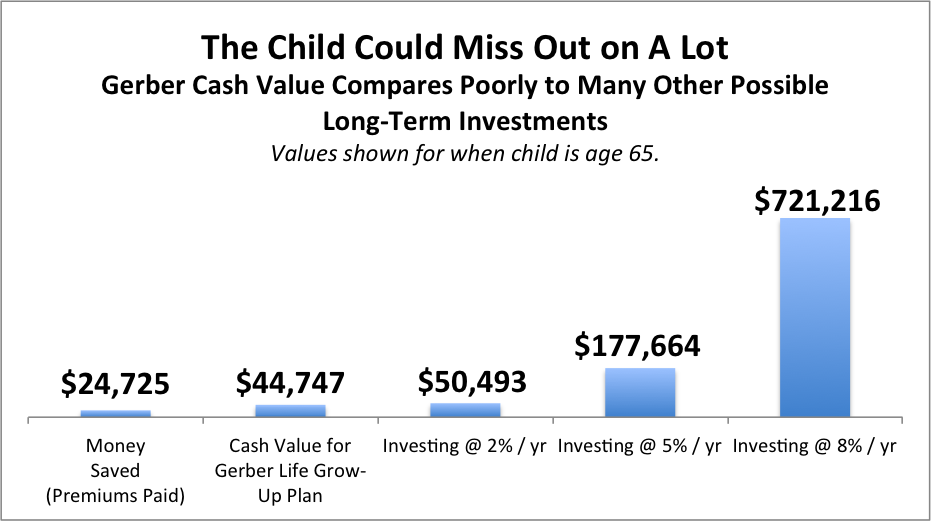

There are several points you can do in order to reduce your rates by a substantial margin. Life insurance prices are expected to increase, as you end up being older. The speed at which your mental health and wellness issues impact your life insurance policy is based on the problem you're experiencing, extra specifically the degree of threat it places you at. The optimal method to locating the very best prices is to contrast definitely cost-free quotes online. Given up such sporting activities if you'll such as to obtain affordable life insurance rates. It's vital if you're browsing to obtain the most affordable life insurance plan coverage prices feasible that you identify what sort of elements the insurance companies have a look at whenever determining your premiums.

You shouldn't really feel embarrassed or cautious in receiving genuine insurance policy. There are several budget-friendly insurance plans provided by clinical insurance businesses.

There are a variety of reasons to check out acquiring life insurance to guard your family, even when you need to make a little budget plan sacrifice now for future defense. Stopped cigarette smoking if you would like much more budget friendly life insurance. Inexpensive life insurance policy might have to become part of your monetary planning. If you don't have life insurance and also want to figure out which describe policy is the suitable choice for you, a quick phone call to prepare a meeting is all that is required to begin the procedure. When it has to do with obtaining life insurance policy with clinical depression, there isn't any type of best guide. It's not feasible to claim which sort of life insurance policy is much better because the sort of insurance coverage that's ideal for you depends on your details conditions and also monetary goals.

Since you can see, right here are 3 methods to affix the insurance policy you require. To start with, term insurance policy (or temporary insurance policy) is a great option. Term life insurance policy, however, will certainly be restricted to a specific quantity of years. Out of every one of the different types of life insurance, it is generally one of the most affordable and also typically can be low-priced life insurance policy. It is an easy way of protecting your dependents when you pass away. It is normally one of one of the most budget friendly or inexpensive life insurance policy options. With some study, you can ascertain just how much term life insurance policy you need, or maybe come down on a full life plan to satisfy your requirements at a cost-effective pace.

You would like to choose an insurance carrier that wouldn't surprise you as soon as currently is the moment to generate a claim. Clinical insurance services assign health and wellness scores to http://www.bbc.co.uk/search?q=life insurance quotes every consumer. To guarantee the standard of healthcare, one ought to ask the health insurance plan business the way that it guarantees good healthcare. Picking the perfect life insurance carrier can be an overwhelming task. With a general idea of the absolute most normal type of depression, allow's review which life insurance companies supply the most helpful protection for clients with mental health and wellness troubles. It is extremely crucial that you locate a few premier life insurance policy services.