"Prior to you go out as well as buy an existing small company, you require to ensure that guides as well as accounting remain in order. You require to see an annual report, and also the P & L statement, and you require to John Du Wors validate that information. What did Henry Kissinger and Ronald Reagan claim in international diplomacy and settlement? ""Trust, but confirm!"" As well as, it is my contention that you take this fantastic advice when purchasing an utilized business.

Not long ago, I was doing a little really local business consulting. As well as I clarified that before buckling down about purchasing the business the purchaser needs to get an annual report, P & L (earnings as well as loss) declaration, and also 3-years tax returns. Well, it ends up business was a corporation signified by an ""Inc."" after the name of the company on top of the P & L, so, the business depending upon the sort of corporation would need to file business tax returns.

Nonetheless, when asked to create these, they said they ran into tough times and did not file in 2007 and also 2008, and did not have the 2009 tax obligations done yet, which actually are not totally due till September of 2010 with allocated Internal Revenue Service expansions. Interesting I believed, yet after that I happen to state this inquiry relating to getting a service from a Company, which fell short to submit its taxes for 2008 as well as 2009 this evening to a Tax obligation Accounting Professional at the Club House here.

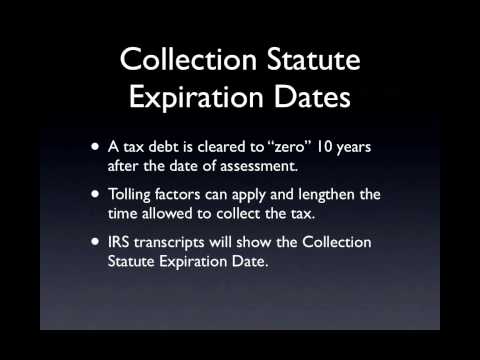

He stated this could be a massive trouble; namely, not filing at all is a lot worse than filing and also not being able to pay, as the Internal Revenue Service would establish a payment structure to find present. The 2009 taxes in theory are not due till September if he would certainly filed an extension. Yet 2007 as well as 2008 are a real trouble.

Now after that, prior to I go any additionally, I need to make a statement to the visitor right here; CYA - I am not a Tax obligation Attorney, this is not legal recommendations, as well as I recommend you verify this conversation (rumor) with an accredited and professional Tax lawyer Specialist. I am not qualified to provide you legal suggestions, would never ever exercise law without a certificate, and you can not take anything I claim as lawful advice. Okay so, CYA aside, this is my opinion and also why I believe this:

You see, I likewise talked to a person at Starbucks a couple of weeks back, and he informed me a story where a company that fell short to submit tax obligations, and ultimately went bankrupt had actually paid him as an electrical/mechanical professional for constructing remodeling. The other vendor's plumber, TI person, drywaller, etc. and the IRS never made money, as the business lacked money.

The Insolvency court followed the electric professional to repay the cash for the solutions he 'd rendered completely, as well as the BK Court said that cash would certainly be divided among the rest of the financial debts, and also in 18-months, the electric specialist would obtain a check, probably 10 cents on the buck or his share. He had to repay the cash he 'd been paid. Oops. Thus, the $80,000 was repaid to the court, had he not paid, that BK Court might compel him to pay it. Kind of like the folks that were paid back from the Bernie Madoff money before everybody searching for out it was a Ponzi Scheme, although they got their refund, it in fact was owed to all the other people too. Everybody loses.

Similarly, according to the Tax obligation Attorney I spoke to, the possessions of the Firm (in this situation Organisation Available Inc.) could be subject to a lien by the Internal Revenue Service, in fact all possessions of that company. If the head of state of that firm sold those assets to the customer, it could be illegal transportation, and also thus, despite the fact that they remained in the buyer's property and also a brand-new company, the customer could need to pay - or surrender that equipment to satisfy the lien, and presume what, they 'd have business's address as well as might put a lock on the door - bad luck.

In addition, in this situation, we had business available for sale Inc. without any way to confirm the balance sheet or P and L, besides 8-sheets of paper from a Quicken Program. And no Organisation Broker in their right mind would certainly proceed the listing keeping that gigantic warning out front. Okay so, in this instance as a very small business expert might claim - ""I have no way to figure out if this is so, all I can do is guess?""

Nonetheless, there is sufficient factor to use no more for this business than the value of the used tools, as well as still, how can the purchaser recognize if entrepreneur or his company possesses it all free-and-clear, or if they obtained against a line of credit at the count on the assets of the business, and also the back taxes owed, which the Firm's President claims are owed. He may not have ""really"" made any kind of money in those years, but assuming he did, he owes, and also without those being paid, all the possessions of that corporation are in limbo from what my friends as well as associates tell me.

Hence, this organisation case study is a wake-up call to anybody purchasing a company. And also if you find yourself in a similar circumstance, and if you want to seek such an organisation purchase even more, I would certainly recommend you talk to an expert tax obligation attorney before you continue. You see acquiring a service entails danger, as well as when such variables as well as unpredictabilities are included in the formula it makes sense to seek advise on this collection of circumstances. Tax Attorneys generally have time on their hands to take a seat to review points like this after April 15, as well as without a doubt, you 'd truly just need an hour or more to ask this inquiry, and obtain the ""correct"" response."