My Favorite Things About Investing

Welcome to my page on investment information with investment links.

Investment Weblinks

Some indicators to look for concerning the economy.

This all appeared in the November 20, 1998 Wall Street Journal on Page 1 of Section A for those of you interested in the full article.

An indicator that an economic recession is in the works.

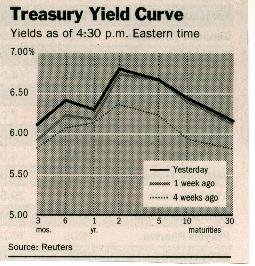

When there is an inverted yield curve in the US Treasury Securities market, it is indicative that an economic recession is on the way. With only one or two exceptions, this indicator has preceded a recession every time in the past 15 years after it has occurred. A normal yield curve reflects lower yields for short term treasuries, with those yields increasing as maturities lengthen. Inverted yield curves show higher rates for short term investments with yields DECREASING as maturities extend out. Below is an illustration from the Wall Street Journal on May 11, 2000 of an inverted yield curve:

Now that it appears that the banking system is going to produce numerous bank failures going forward because of the financial chaos in the banking system, a few words need to be shared on this issue.

First off, you need to be aware of how FDIC deposit insurance works. Rather than try to explain it, I am furnishing a link to the precise page on FDIC’s website for you to examine. If you CLICK HERE, they give you access to a 33 page .pdf file in plain English, along with a link to the actual Federal Deposit Insurance Act (12 U.S.C.1811 et seq.) and the FDIC's regulations relating to insurance coverage (12 C.F.R. Part 330). YOU NEED TO READ THIS CAREFULLY IF YOU HAVE MORE THAN $100,000 IN YOUR BANK.

Now, what happens when a bank is seized and closed by the FDIC? This will vary, however, in the lion’s share of cases, this is generally what happens:

Usually, the FDIC moves in and closes an institution on a Friday and deals with the failed institution over the weekend. (Technically, it’s the Office of Thrift Supervision of the US Treasury, the US Comptroller of the Currency, or the appropriate state regulator if it's state chartered, who closes the institution, appointing the FDIC as the receiver.) On Monday morning, the bank usually reopens normally as though nothing has happened, with certain major differences. Usually, the FDIC creates a bank with a national charter with nothing but customer deposits and branch locations that are now owned by another institution. The FDIC keeps the loan portfolio and tries to liquidate it by selling the loans to other institutions. Customers with less than $100,000 have ready access to their money while customers with in excess of $100,000 become unsecured creditors of the failed institution and eventually may or may not get much, if any, of their deposits back. Mortgage and loan customers will still have their loans under the same terms and conditions as before, however, they will be making their payments to a different lender.

An example is as follows: On March 20, 1992, the banking authorities closed Danbury Savings & Loan Association (a Connecticut chartered thrift) and seized all the assets for liquidation. On the following business day, the institution reopened as Danbury Federal Savings and Loan Association, now owned by Eagle Federal Savings Bank out of Bristol, Connecticut. The customers of the former DS&L whose deposits were covered by FDIC Insurance were able to conduct their everyday banking business transactions completely unimpeded. The new institution (DFS&L/Eagle FSB) gave the customers of the former DS&L three months to have checks clear against their accounts using the old routing/transit numbers. On June 20, 1992, DS&L checks could not be used, and on July 20, 1992, any checks written using the old DS&L routing/transit numbers would be returned unpaid. Customers were furnished with a complimentary order of 50 checks for the new institution free of charge. Other than that, the transition from DS&L to DFS&L was seamless to the typical checking account customer. Savings account and CD customers also were able to transact business unimpeded.

When Indymac Bancorp was seized by the feds, there was a run on the bank. There was absolutely no reason whatsoever for anyone to be worried about their funds availability at Indymac unless they had in excess of $100,000 in their accounts. BUT, you need to study HOW FDIC insurance works and HOW to structure your banking relationships so that you take maximum advantage of the government’s deposit insurance. This you can do by accessing FDIC’s web page, for which I have provided a link to above.

My good friend Renee was quite concerned about her accounts in her credit union and asked me yesterday (Sunday, 9/28) about the safety of her money. I explained to her that credit union deposits were also insured and safe under equivalent terms as those found in the FDIC regulations. Credit unions are insured by the National Credit Union Administration, which is also a US Government agency. Credit unions tend to be less apt to become insolvent than banks primarily because they don’t have as large a market share of deposits as banks do and they are operated as member owned financial cooperatives. However, rather than my explaining how their insurance program works, I am supplying you with a link to their website, where you will find all the details you will need. Click HERE for the NCUA Share Insurance Fund page.

FDIC & NCUA INSURANCE RE-VISITED

You will notice on the FDIC’s website that deposit insurance was raised to $250,000. However, the increase is only TEMPORARY – set to expire on December 31, 2013. The same goes for NCUA insurance for credit unions which expires December 31, 2009 – FOUR FULL YEARS BEFORE the FDIC expiration date (updated Sept. 22, 2009). See the “Emergency Economic Stabilization Act of 2008” (HR 1424), Division A, Section 136, P. 35. DO NOT LET BANKS TELL YOU THAT YOU ARE INSURED IF YOU HAVE CD’S EXPIRING AFTER 12/31/09 (CREDIT UNIONS = 12/31/08)!!! Further, make sure that if you have a CD, make sure that your CD and other accounts in the same name do not exceed the insured amount.

(Updated April 10, 2010) I understand that CDs are covered in the full amount (if < $250,000) if the CDs are opened when the old rule is in effect and they mature after the new rule dropping the insured amount back to $100,000 goes into effect. Check with FDIC or NCUA to be sure!

I know an attorney who writes for our local paper in Fort Myers, Florida, who said he would not trust the insurance level of $250,000 and would not keep any money in excess of $100,000 in any one bank. If you wish to read his article, which is most informative, it’s at The News-Press, Business and Money Section, Page D-2, October 12, 2008. (William Edy, Esq., “Pay Attention to FDIC insurance rules.”) He stated that after reviewing the interim rules, he would not issue a written opinion letter on them. That's pretty significant!

Now that we have finished digesting the largest stock market crash in the history of the United States, which followed the largest ever wholesale destruction of the wealth of Americans in the history of this country, I have some observations to make.

Remember that prior to the stock market crash, we also endured a bubble in the bond market, a complete collapse of the real estate market, a large disappearance of defined benefit pensions from the marketplace, and skyrocketing health insurance premiums (accompanied with a scarcity of insurers willing to write meaningful health coverage for healthy older Americans without charging punitively high premiums). Now, we are to endure a possible collapse of our banking system because of the mortgage crisis, which was exaggerated because of the real estate market collapse and irresponsible and/or reckless mortgage lending by many financial institutions over the past few years.

Our geniuses in Washington seem to believe that a dramatic expansion of government spending, accompanied by public works projects and higher taxes on “the rich” are going to save the day. Also, that Keynesian Economics is right on target and that THIS is the true measure of how to achieve future prosperity. Recall that Franklin Roosevelt engaged in similar activities following the defeat of President Hoover and that the economy did not improve until the beginning of World War II. Heavy government spending didn’t work then – so how do these distinguished geniuses in Washington believe that it will magically work now?

My concern is that as we “monetize” the debts we incur because of the bailouts of our banking system, the automakers in Detroit, and whoever else can convince the geniuses in the legislature that they are worthy, it will ruin the economy for years to come. Does anyone remember the 1970’s, where we had stagflation? Do we really want rising prices of everything to take hold while employment opportunities (or, rather lack thereof) suffer and wages either stagnate or decline in real purchasing power? Does this sound like something from our past that we want to repeat again?

And, what of your investments; do you really think that the real estate market will improve soon? How about the stock market? Recall that after the 1929 crash, it took the market 12 years to recover. Sure, the geniuses in Washington will tell you "it's different this time." Sure....and these were the same geniuses that told you that the economy was healthy and running well when in reality, it was in a giant recession! Now, as to how long it will take for Real Estate to recover, there is no equivalent precedent I am aware of concerning this. First, foreclosures and employment contraction need to stabilize before real estate can even begin any serious effort on recovery. How long will THAT take? Who knows?

You all better pray to God that Nancy Pelosi, Harry Reid, Barack Obama, and all the big money Democrats who supported the campaign of this new President have all the answers and can fix things in time. Your personal wealth and future ability to live comfortably in retirement depend on these people succeeding. From where I sit, that doesn’t look too likely. Boy, do I hope that I am wrong!!

My outlook on the economy has changed dramatically since the election and the attempt being made by the Congress to spend money. Mind you, it’s not a stimulus bill that is being signed into law, it is a SPENDING bill – and a BIG one at that.

First off, it most likely will take a long time before housing improves. Unfortunately, we have only seen the beginning of the foreclosure activity, with a lot more coming down the road. The pipeline today only includes those B/C/D quality loans, option arms, and no income verification mortgages with one to three year interest rate change and payment recasts. There were a lot of these things written with up to five year recasts and balloon payment calls that have not made it into foreclosure yet. Also, as the economy continues to worsen, there will be more borrowers unemployed who will not be able to keep up on their payments or resell their homes, adding to the foreclosed housing stock. Therefore, I believe real estate prices will not rebound anytime in the near future.

I am seeing the same things post 2009 crash as I see that happened in the post 1929 crash period. Virtually no financial institution is willing to lend (except some of the local small banks or to solid well capitalized borrowers) and lenders’ portfolios of loans continue to experience heavy default losses with no relief in sight. No one is optimistic about the market and those who are partially optimistic are advocating only buying stocks that are oversold and solid dividend payers with solid prospects of not cutting dividends down the road. I am expecting within the next couple of years a 5,000 Dow, with the Dow trading in a narrow market range around 5,000 to 6,000 for about eight years. This will prevent the lion’s share of “baby boomers” from retiring because their 401K’s and IRA’s will be decimated. Also, the discovery financial fraud and Ponzi Schemes will become more numerous, which will only aggravate conditions.

(Updated April 10, 2010) My prediction for what was going to happen to the stock market turned out to be too pessimistic. No way did we get even near a Dow of 5,000. In fact, the Dow closed yesterday at 10,997 – which is more than double where I thought it would be by now. So, what happened? My theory is that this occurred mainly because of a number of factors. I think the greatest one is that Bernanke & Company at the Federal Reserve managed to keep the fed funds rate targeted at 0% to 0.25% for more than a year. Consequently, we have punitively low interest rates being paid to savers on CDs and money markets. No way will the return on these accounts be anything near keeping pace with inflation after paying income taxes on the income these things generate. What it does do is create a very steep yield curve allowing banks to make money by borrowing short (at < 1% APY for a 6 month CD) and lending long at 4% for a 30 year mortgage. So long as this scheme remains in place, it’s a no brainer for banks to make money – provided they don’t get wiped out because of increased defaults. Defaults? Sure – what if the real estate market doesn’t improve and unemployment doesn’t improve? Who will be able to even afford to borrow – and if there is no market appreciation in real estate, who will want to buy an asset that depreciates?

What about the bond markets? Aren’t these yields about as low as they can get? It seems to me that it’s time to rotate out of bonds into something else until prices of bonds decline – which will occur as rates creep upward. But, where? How about good solid dividend paying stocks in companies where there is an opportunity for not only increased dividends but also increased valuation possibilities.

Defined Benefit Pension plans, where still in existence, will most likely not have the liquidity to satisfy all comers. And, as employers with these pension plans begin going bankrupt, there will be limits on pensions as they start becoming assigned to the Pension Benefit Guaranty Corporation. Social Security will not be an option, as this was only originally meant to be a “supplement” to other retirement plans. Here, Social Security (FICA) taxes will have to be substantially increased and benefits dramatically decreased just to maintain the “status quo.”

Any retiree health benefits will disappear completely in bankruptcy proceedings and where companies are able to survive without filing bankruptcy, they will begin eliminating this benefit as a cost saving measure. It is likely that the United States will move into a nationalized health care program similar in nature to the one in Canada today. This scheme employs the concept of health care rationing, as opposed to health care management. Also, the Medicare program, scheduled for insolvency in the year 2020, may actually collapse sooner.

(Updated September 22, 2009) Now, we have health care legislation that is taking center stage. We will definitely have an overhaul of the health care system. However, it will be closer to aa single payer system with absolute government control over every possible aspect of health care. Additionally, health insurance will be mandatory for ALL to have and there will be penalties imposed against employers not furnishing it and consumers not procuring it. There will be insufficient resources available to take care of all who need it so, necessarily, some will either have to wait in line for care or go without treatment. The following are off the table and beyond consideration because, according to those currently in power, they will NOT work: availability and sale of health insurance across state lines, medical malpractice reform, tax decuctions (or tax credits) for consumers buying health insurance, and tort reform, just to name a few.

(Updated April 10, 2010) Ok, now we have something we can count on. We now have that cherished health care reform that Obama promised to us. Wow! Is this GREAT or what? Before you begin celebrating, bear in mind that what I said about this previously is almost correct. Part of what will happen is a huge monetary cut from Medicare (over $550 Billion) to “improve” Medicare. Huh? They’re also promising to cut waste in the Medicare program—this I have to see. Anyway, it looks like in this new health care package, there will be only a few approved policy options available to buy when 2014 arrives – sort of like viewing health insurance as a public utility. It will be highly regulated and the government will have total say over what you will get, what you will pay for, and the treatment you will receive. And, sure, you can keep what you have but will you r employer continue to offer it and/or will you be able to continue to afford it? What’s that, you don’t like this? Well, too bad. The supervisory panel that will be appointed to handle things concerning health care will have decision making authority that cannot be appealed anywhere – it will be final. And, to make matters worse, the Internal Revenue Service will have complete and unfettered access to all your financial information and bank accounts – with the ability to withdraw money without your permission – to be sure you will pay for what you need.

Here are some things that are in the new health care reform law that you will find interesting. There are plenty of new taxes and tax increases that will affect lots of individuals and businesses, but it will be years before most of these increases take a bite out of your bank account. There are also some tax breaks in this law to help both individuals and small businesses pay for insurance.

A] All employers will be required to include the value of the health care benefits they provide to employees on W-2s, beginning with W-2s issued covering 2011. BUT, does this mean that health care benefits are no longer tax free benefits? Will you now have to pay income taxes for them as though you received the amount spent for your health insurance as a cash salary? My source wasn’t clear on this point.

B] The penalty for nonqualified distributions from health savings accounts doubles from 10% to 20%. This begins in 2011.

C] Employees will be limited to no more than $2,500 that they can contribute to health care flexible spending accounts, effective in 2013.

D] Funds from flexible spending accounts, health reimbursement arrangements or health savings accounts for the cost of over-the-counter medications will be completely prohibited, beginning in 2011.

E] The floor on itemized deductions for medical expenses increases from 7.5% to 10%, beginning in 2013. But it doesn’t apply to taxpayers age 65 and over until 2016.

F] A 0.9% Medicare surtax will apply to all wages that exceed $200,000 for single taxpayers and exceed $250,000 for married couples beginning in 2013. Additionally, a Medicare tax will apply to investment income of high earners. This brand new 3.8% tax will hit the lesser of EITHER their unearned income OR the amount by which their adjusted gross income exceeds the $200,000 or $250,000 threshold amounts respectively. This new law now defines unearned income as interest, dividends, capital gains, annuities, rental income, and royalty income. Tax-exempt interest and any income from retirement accounts will not be included in this new 3.8% Medicare tax.

G] A brand new 40% excise tax on high-cost health plans, which the politicians called “Cadillac” plans, will be levied on the portion of the premiums that exceeds $10,200 for individuals and $27,500 for families. This begins in 2018. Note that if insurance premiums continue doubling every four years, as they have been doing, this so-called excise tax will impact a very large percentage of the population!

H] A new tax on individuals who fail to obtain health insurance coverage that is acceptable to the government, by 2014 will be levied. It will be gradually phased in over a three year period. It starts off at the greater of $95, or 1% of income in 2014. It then rises to the greater of $695, or 2.5% of income, in 2016.

I] The law provides a refundable tax credit, once the individual mandate takes effect in 2014. This is designed to assist low-income people purchase health coverage. To be eligible, a person's household income must be between 100% and 400% of the federal poverty level. This is generally around $11,000 to $44,000 for singles and $22,000 to $88,000 for families.

J] You will find small firms will get tax credits as incentives to provide insurance coverage, starting this tax year. Small firm employers with 10 or fewer workers and average annual wages of less than $25,000 can receive a credit of up to 35% of their health premium costs each year through 2013. The tax credit is eventually phased out for firms with more than10 employees and the credit disappears completely if a company has more than 25 employees or average annual wages of $50,000 or more. Starting in 2014, small firms that sign up with one of the to-be-created “health exchanges” receive a credit of up to 50% of their insurance costs.

K] The deduction employers now may take for providing Medicare Part D prescription drug coverage to their retirees to the extent that the federal government subsidizes the coverage will go away. This takes effect in 2013.

L] There will be a nondeductible fee charged to businesses with 50 or more employees if these businesses fail to offer adequate health insurance coverage to their employees. The fee will be equal to $2,000 times the number of employees, however, the first 30 workers of that business will not be included in that calculation.

M] And, lastly, Indoor tanning services will cost you an additional 10% excise tax on services provided after June 30, 2010. (Now; is this last one ridiculous, or what???)

Additionally, Paul Volcker (one of Obama’s economic advisors) has recommended that we have a new Value Added Tax (called a VAT – prevalent in Europe today) enacted so that we can balance the budget. This proposal is being given serious consideration and it will be in addition to our present tax structure – not as a replacement. It is heartwarming to see that we are finally increasing taxes so that we can be on parity with Europe. Soon, we will be looking like the days of old in the 1970s with marginal rates as high as 75%, similar to what used to take place in Scandinavia. Everyone will have to pay their fair share and pay much higher taxes so that the bottom half of our economic ladder can survive. (We call that redistribution of income.) If you earn over $200,000, be prepared to pay out somewhere between 60% and 90% of your gross income to the government. “Change, we need….. Change, we got…… Change, did we really want this?”

I am looking for a national unemployment rate to settle into a narrow range of around 15% over the next ten to fifteen years. Without an improvement in housing anywhere on the horizon, it is unlikely that employment growth can take place. I expect unemployment rates to be much higher in certain areas of the country, depending on their local employment base and diversity of business activities.

(Updated April 10, 2010) Our unemployment rate is somewhat less than what I predicted and stands more near the 10% rate than what I predicted. But, what is the REAL unemployment rate. There are those who say the real rate is somewhere near 30% because we don’t count those who are underemployed in part time jobs, those who gave up looking, etc. It also counts one person with two part time jobs as one person, lessening the unemployment rate. In my local market, our unemployment rate is 13.9% - at least, that’s what they’re admitting.

I expect a return to the “good old days” of the 1970s style stagflation. This calls for a stagnation of employment opportunities coupled with no or very little increases in employment income. As we spend trillions of dollars in an effort to spend our way out of this, we are going to find foreign governments unwilling to continue funding us. There will be little money available domestically to borrow owing to the fragility of our economy and unavailability of sufficient monetary resources in the United States to borrow. Taxes will have to be dramatically increased; however, any increases will most likely yield insufficient resources. The only other solution is to “monetize” the debt by increasing the supply of dollars to pay for the borrowings. This, of course, is a prescription for inflation.

If you had asked me in November, 2008 whether we were going to have a depression on the size and magnitude of that which this country experienced in the 1930s, I’d have told you NO WAY. However, it now appears to me that such a scenario is quite likely to appear again (albeit in a slightly different form) and history may indeed repeat itself. Our solution appears to be to bail out very large banks, the “big three” auto makers, throwing complete support to organized labor, subsidizing everyone at the bottom of the economic ladder, penalizing investment and capital formation with increased taxes, and penalizing citizens who have accumulated any wealth. In this economy, there appears to be no safe place to “hide” assets to prevent large losses because of the collapse of our financial system currently taking place. This all has the potential to provide for a grim future for those younger than us and puts the United States at risk in terms of future survival as an ongoing republic in its present form.

Click HERE to return to Jim Hogg's Freemasonry and Law Homepage.