THE ADRIAN REPORT on Fannie Mae & Goldman Sachs & Their Circles of Friends, 1999 to 2009, the Deadly Decade! ... with updates from 2017

THE FEDERAL RESERVE IS OUT TO MONETIZE YOUR SOUL INTO NON-NEGOTIABLE TOILET PAPER

Recently the editors of this report added a few updates from 2017

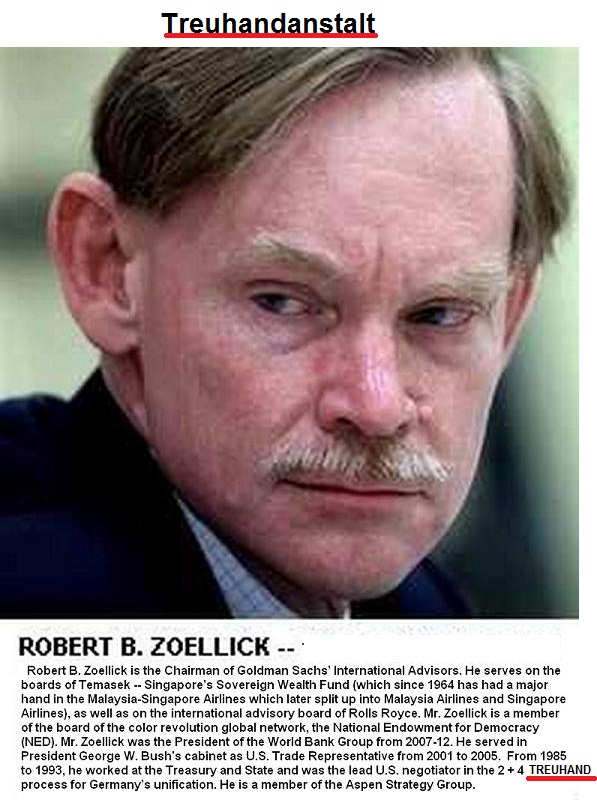

Democratic and Republican officials in successive

administrations have for many years repeatedly denied that the trillions of

dollars of debt Fannie and Freddie issued is

guaranteed. Some people and blogs and

reports seem to indicate FANNIE MAE is only a Democrat created financial

disaster and scandal. No

way Ray. Despite that democrats Sen. Chuck Schumer and Sen. Barney Frank have

their fingerprints all over the scene of the Fannie Mae & Freddy Mac

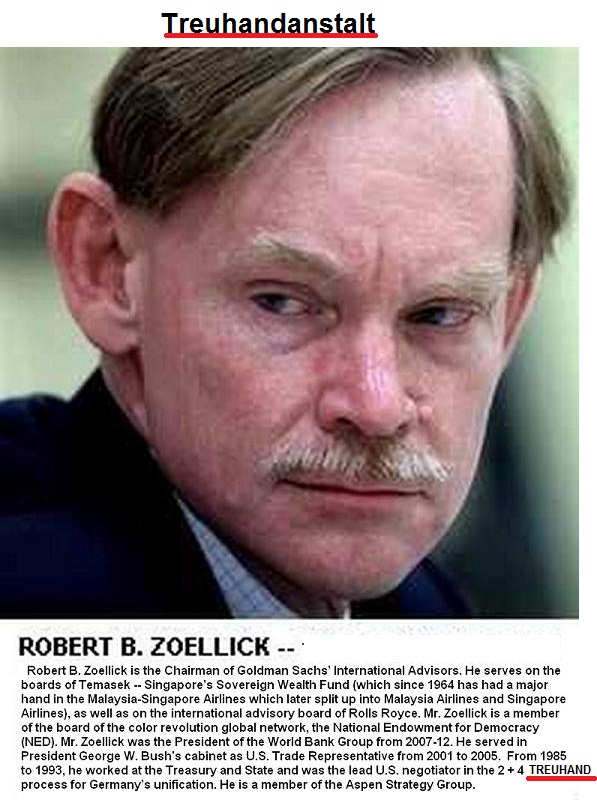

felonies against the US people, both Republicans Newt Gingrich and Robert Zoellick

took up key positions with Fannie Mae during its heyday. Let’s not forget the COUNTRYWIDE role in this

with their “Fast & Easy” pre-2008 federal home loans, paid out by

commercial CountryWide but in the end, after “feces funds” hit the fan, the

federal government, i.e. the U.S. taxpayers, had to pick up the tab of the

non-payments on the loans, in the trillions, with the now infamous federal

bailouts. Not one record has been

released documenting this long running scam, via the FOIA rules and procedures

which were written to protect democracy and the citizens of the nation. Does that surprise anyone?

China has never disclosed the size of its holdings of

Fannie and Freddie securities, but according to the U.S Treasury’s report on

foreign holdings of U.S. securities, China held $454 billion of long-term U.S.

agency debt as of June 30, 2009. China has been using Belgian holdings, an offshore center used extensively

by China to mask its selling off and dumping of U.S. Treasury bills, bonds, and

notes, which in theory were created to back up and protect the dollar.

Now in 2017, Japan is holding more of the T-Bills than

China, and suddenly they are printing money without any backing just like the

U.S. Federal Reserve! China's huge holdings of U.S. debt fell to $1.12 trillion

at the end of October 2016, their lowest level in more than six years,

according to U.S. Treasury Department data. Japan holds $1.13 trillion of U.S.

colossal debt. This bubble is gonna burst real soon and it

won’t be pretty. How would the U.S.

afford its global military empire after the bursting? They won’t be able. Unless they precipitate World War 3, which

would in all likelihood involve nuclear bombs exchanges. Now might be a good time to enlist the

peacekeeping skills of soft power diplomat Benjamin the Bomb Netanyahu? Wrong!

short interview with the director

John Titus of the film ALL THE PLENARY’S MEN (very stimulating and easy to

grasp)

https://www.youtube.com/watch?v=0JoRlZV6fdU

EDITOR’S

NOTE June 2017

Observers suggest that foreign investors have the U.S. over a barrel because they own at

a minimum 43 percent of Treasuries outstanding.

U.S. private investors have stepped in when China and Japan are unloading U.S. T-bills and Treasuries which shows that pension funds are not always putting the money of their employees into U.S. “agency funds” they are also at times purchasing Treasuries when foreign central banks are dumping them.

China had been selling off U.S. mortgage bonds at a rapid clip and China is no longer the largest owner of securities, often mixed in complicated financial packages with Fannie Mae and Freddie Mac, as of January 2017.

China has been vastly shedding U.S. Treasury bonds since the Crash of 2008 in which US taxpayers bailed out the fiscally foolish commercial home mortgage players Fannie and Freddie, as if they were real federal agencies. Previously buying and selling dollar-denominated securities like U.S. Treasury or mortgage bonds had been a preferred method for foreign governments to weaken or strengthen their currencies.

Buying mortgage bonds marked China’s first major foray into the U.S. real estate market in the early 2000s. More recently, Chinese institutions have been investing heavily in commercial real estate properties, particularly in New York.

Washington's

relationship with Fannie and Freddie is a bit complicated. The government actually

doesn't own any of the common shares that trade on Wall Street.

The Treasury Department has warrants that give it the right to a 79.9% ownership stake in

Fannie Mae & Freddy Mac. But the government has not exercised those

warrants.

So who owns the shares of Fannie and Freddie that trade on Wall Street?

Mutual fund giant Fidelity has big stakes in the stocks of both companies.

Bill Ackman's

Pershing Square is the largest investor in Fannie and also has a stake in

Freddie. Fairholme Funds, managed by Bruce Berkowitz, owns preferred stakes in

both.

Fannie's capital reserves were $600 million at the end of 2016 but are expected to be nil in 2018. U.S. Treasury debt is at a minimum estimated to be $20 trillion dollars.

On September 22, 2004, the OFHEO released “Special Examination of Fannie Mae”. Between 1994 and 2004, according to the report, Fannie Mae improperly reported $10.6 billion in earnings. Franklin Raines resigned as Fannie CEO in a cloud of malfeasance. In the 109th Congress of 2005, there were 55 Republican Senators which means that five Democrats would have to support the GSE regulatory bill being designed to hog tie Fannie & Freddie. Chris Dodd (D-CT), ranking Democrat on the Senate Committee for Banking, Housing and Urban Affairs recommended opposition to the regulatory bill restraining Fannie & Freddie. For years, EZ huge home loans had been paid out to illegal Mexican immigrants and other near broke high risk recipients, home loans on an average of $600,000 at super low interest and no money down. Every one of Mr. Dodd’s Democrats had opposed the reform bill in committee, and not one Democrat from the larger Senate offered support to bring this arresting legislation to the floor. Barack Obama (D-IL) joined the Senate in January 2005 and was among the people supporting the “filibuster” against checks and balances on Fannie and Freddie.

Despite all this grandstanding of Republicans in the Fannie and Freddie debacle, as if they are fiscally responsible and had no role also in this fiasco on a global scale ( https://tjhancock.wordpress.com/housing-bubble-financial-crisis-detailed-comprehensive-assessment/ ), lobbyists have long been making it certain that both Republican and Democrat allied businesses and bankers and investors benefited from this raw deal for the US taxpayers, so any grand theater of reform of the Republicans is just that, stage acting.

This is a good example and a perfect trope for how almost all of Washington Congressional activity is a play by play distraction of the American public’s attention span, while the lobbies spend all their tax money for their clients and their sinfully obese profits at the expense of the national Treasury. Mixing up United States T-bills and Treasury bonds and Treasury notes with bad debt and “agency” trillion dollar losses, has put China in the driver’s seat as the leader of the world, for at least a decade in a half already. If there had not been collusion between the two Congressional parties, regarding Fannie and Freddie (and Sallie Mae), the Pentagon would be broke also, without all the loans made to the US Treasury from China and other foreign nations, via buying up Treasuries and agency debt hand over fist right up to the cusp of the Crash of 2008, and still afterwards!

It will be interesting to watch how Congress finds money under Trump when the Republicans put on a show that they are trying to uncouple Fannie and Freddie from taxpayer bailouts another time. Additionally, it will be interesting to see if U.S. gold is ever audited and accounted for, it seems to have gravitated to other shores and U.S. taxpayers and investors and government have been left holding paper receipts, like gold colored IOUs in a $10 board game.

Owing to its control of the mortgage markets, the U.S.

government mandated that Fannie Mae and Freddie Mac have no capital at all by

December 31, 2017. To make this happen, the Treasury Department has taken all

of the two companies’ earnings every quarter, resulting in both companies being

now insolvent.

Neither of the two

big debt agencies have any

common equity. Likewise, the junior preferreds in

both Fannie and Freddy have no value because the government has eliminated all

prospects of their receiving dividends. The adjusted equity in Fannie and

Freddy are negatives, as a percent of assets. This means the future of USA is

negative also. Meanwhile, the Federal

Reserve Bank Agency, also not a federal body but a private commercial network

agency, just keeps printing billions and billions of fresh U.S. dollars, for

the benefit, of …. Who??

CHRIS HEDGES writes in "Truth Dig", Jan. 1, 2017

"The Trump transition team is busy anointing its coterie of kleptocrats. The appointment of Betsy DeVos (from a family with a net worth in excess of $5 billion) to become secretary of education means she will oversee the more than $70 billion spent annually on the Department of Education. DeVos—the sister of Eric Prince, who founded the notorious private security firm Blackwater Worldwide—has no direct experience as an educator. She promoted a series of for-profit charter schools in Michigan that make money but have had dismal academic results. She sees vouchers as an effective tool to funnel government money into schools run by the Christian right. Her goal is to indoctrinate, not educate. She calls education reform a way to “advance God’s kingdom.” Trump has already proposed using $20 billion of the department’s budget for vouchers. The American system of public education, already crippled by funding cuts, will be destroyed if Trump and DeVos succeed. The Veterans Administration spends $152.7 billion a year on veterans’ benefits that include general health care and treatment in VA hospitals. Last week Trump publicly weighed allowing veterans to use the for-profit health care system. Cleveland Clinic CEO Toby Cosgrove (annual salary $2.3 million) is one of the front-runners to head the VA.

“We think we have to have kind of a public-private option, because some vets love the VA,” he added. “Definitely an option on the table to have a system where potentially vets can choose either/or or all private.”

Rep. Tom Price, a Georgia Republican (net worth $13 million), has been selected by Trump to be secretary of health and human services. He plans to abolish Obamacare. He said he expects the House to push for Medicare privatization “within the first six to eight months” of the Trump administration.

Steve Mnuchin (net worth $40 million), a former partner at Goldman Sachs and the president-elect’s choice to lead the Department of the Treasury, told Fox Business that “getting Fannie and Freddie out of government ownership” is one of the Trump administration’s top 10 priorities. This is also the stated goal of Trump’s choice for budget director, Rep. Mick Mulvaney (net worth $3 million), a Republican from South Carolina. The privatization of the government-backed mortgages would see financial institutions authorized to issue mortgage-backed securities that carry a government guarantee. If the mortgages failed under the privatization scheme, the taxpayer would foot the bill. If the mortgages succeeded, the banks would get the profit. The privatization plan amounts to the institutionalization of the 2008 government bailout for big banks. It could cost the taxpayer billions.

The biggest pot of gold is the $2.79 trillion contained in or owed to the Social Security fund. The kleptocrats will work hard under Trump to divert this money into the hands of hucksters and crooks on Wall Street. Tom Leppert (net worth $12 million), the former mayor of Dallas, whom Trump is expected to name to head the Social Security Administration, not surprisingly advocates the privatization of Social Security and Medicare. The infusion of this kind of liquidity into an overheated stock market would probably bring on a crash that would evaporate perhaps as much as 40 percent of the Social Security fund, rendering it insolvent.

Israel Infinity Venture

Infinity is a leading Israeli-Chinese equity fund managing many BILLIONS since 1993. The Fund leverages its strong network and experience in both Israel and China to bring added value to Israeli and Chinese companies. The Fund's core strategy is to invest in late-stage Israeli technology related companies with parallel investments in Hakka Chinese operational businesses that license Israeli technologies, adjust them to the needs of the Chinese market and market them in China. The Fund's partners include leading financial institutions in Israel, China, Europe and the US.

In partnership with the IDB Group and CSVC/SIP, Infinity received the first license ever awarded by the Chinese government to foreign investors to operate an on-shore fund (00001 registration number). The Fund has since been able to assist Israeli technology companies expand operations in the Chinese market by utilizing strategic relationships in China with governmental agencies, large corporations and private firms.

Historically, the Fund's performance has ranked in the top-tier of all global firms with successful exits in companies such as Galileo, ESC Medical, Saifun, Shopping.com, Scitex Vision, Sightline, Identify Software, AGT International, Beidahuang Group, Beijing Capital Group Co., Ltd, BOE Technology Group Co., Ltd., China Aerospace Science and Industry Corporation, CASIC, COFCO, Ichilov hospital (Tel Aviv Sourasky Medical Center- TASMC), Zhejiang University’s Insigma Technology Company Ltd, is a leader in the China-based IT services and outsourcing industry, LR Group - Agriculture Partner, Miya - Water Partners, Sanpower Group, Sheba Medical Center - Medical Partner, Sichuan Development Holding, Wahaha, WEGO, ZONGSHEN Industrial Group.

THE BIG FOOT REPORT on Fannie Mae & Goldman Sachs & Their Circles of Friends, 1999 to 2009, the Deadly Decade!

THE FEDERAL RESERVE IS OUT TO MONETIZE YOUR SOUL INTO NON-NEGOTIABLE TOILET PAPER

... this website is just one human's small effort to make a layperson's composite and historical "string" of many of the news events of the decade, which forced the Western World democracies to collapse and fold themselves like rolly pollies into the mere semblance of their former selves, whimpering in the corner, trembling at each new ...

... this website is just one human's small effort to make a layperson's composite and historical "string" of many of the news events of the decade, which forced the Western World democracies to collapse and fold themselves like rolly pollies into the mere semblance of their former selves, whimpering in the corner, trembling at each new ... KAGANS Neocon assault on your freedom, your health, your economic survival, your happiness and freedom of artistic expression ...

... are all of us headed to the same fate as the Palestinians and Gazans??....this website endeavors to instill a 'remembrance of things past', in the links and excerpts below, which may give some of us yet, a prayer of a chance to survive what has befallen many of us already, before there is only One World Order, and not a good one.

... are all of us headed to the same fate as the Palestinians and Gazans??....this website endeavors to instill a 'remembrance of things past', in the links and excerpts below, which may give some of us yet, a prayer of a chance to survive what has befallen many of us already, before there is only One World Order, and not a good one.

Count each and every democratic freedom you still have and cherish it as a gift, for you may soon have to fight for each one of them, without the protection of our Constitution.

$44 TRILLION USD "VAPORIZED" [late 2008]

Who is Yanis Varoufakis?

He has long described himself as a 'Libertarian '. He was born with a large silver serving spoon in his mouth and in a royal 24 carat gilded

bed. His family has owned and run one of

the biggest and wealthiest shipping

and steel industries in Greece. He has lived outside of Greece almost

as much as he has inside. He had been

teaching game theory, the mathematical study of decision-making and of conflict

and strategy in social situations, and classical economics for many years in Australia as an

Australian citizen. His PhD dissertation

was in economics using game theory analysis of industrial strikes in UK/USA and models of wage inflation. Varoufakis is a darling of the free market

enthusiasts at The Adam Smith Institute, and also publicly admired by Bloomberg

media as "brilliant". Why would a man like this give up a seemingly conservative

successful past lifestyle, i.e. everything, to win a Syriza revolt on behalf of

normal Greek people he has not even lived with for long? The American actor

James Dean rode a motorcycle also in a black leather jacket, but was quite

short sighted and needed very strong eyeglasses to read the handwriting on the

wall. By stepping up to the plate for

all Greek people and imbued with their most unrestrained trust, with bases

loaded and two men out, and then trotting with tail between his legs away from

the Troika with LESS than the Greek workers had before his historic sell-out

meeting, it seems the day has come for Yanis Varoufakis to trade in his

motorcycle for a pink, fluffy, flamingo befeathered seat, deluxe lady's silver-rimmed

moped, and continue with his blogging online.

Would anyone disagree?

***********************

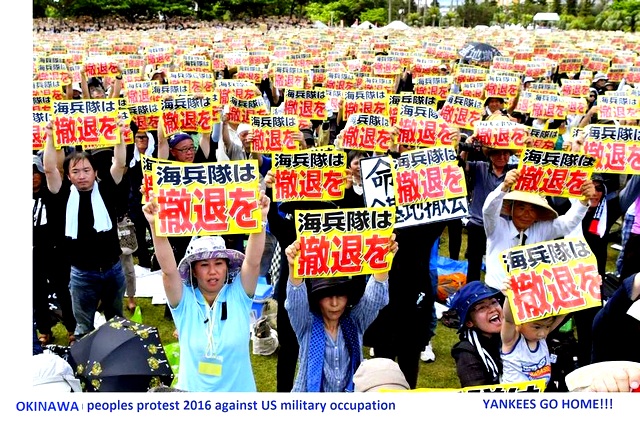

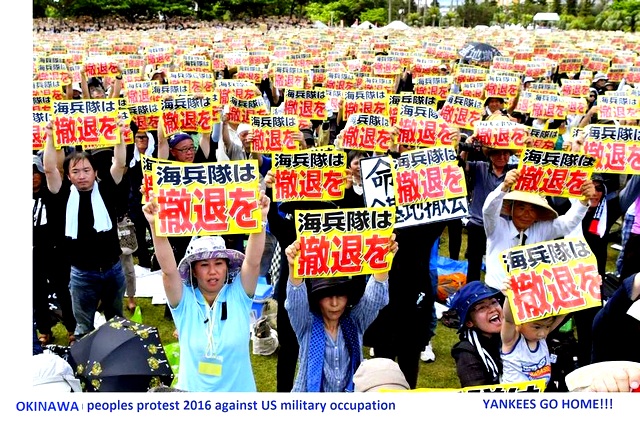

The US has some 5,000 military war bases—4,000 in the US itself and almost a thousand on all the other continents. The current U.S. Defense Secretary Ash Carter recently announced that missiles and men would be based in the Philippines, facing China. This is happening while NATO continues its strange military buildup in Europe, right on Russia’s borders. In the US, where media in all its forms is ubiquitous and the press is constitutionally the freest in the world, there is no national conversation, let alone debate, about any of these developments. Okinawa has 32 US military installations. Nearly a quarter of the land is occupied by US bases. Is this REALLY what JFK called democracy when he founded the Peace Corps? read http://www.informationclearinghouse.info/article45245.htm

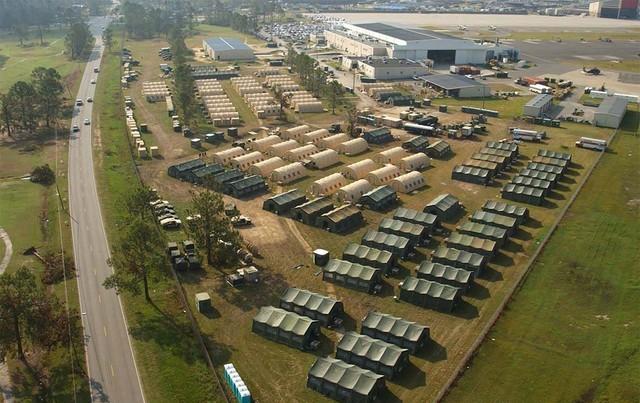

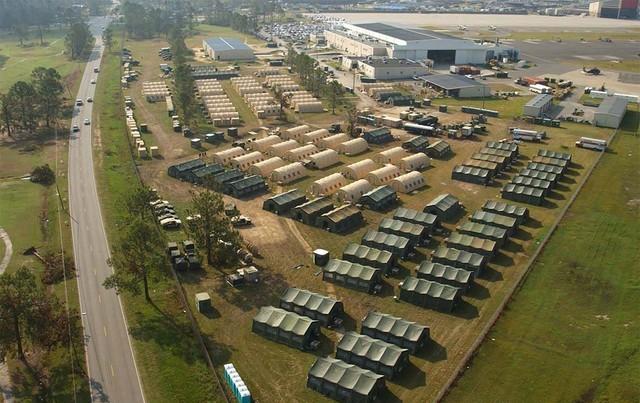

TENT CITIES, aka "NeoCon-villes" ... just two pictured above ...

MAY 2015: There will be legions of tent cities in U.S. sooner than you think! Even the FHFAO Government Agency stated in no uncertain terms just before April 2015, that Fannie Mae and Freddie Mac will EXPLODE again, this time worse than late 2008, and the Fed Reserve will not be able to simply print xerox copy U.S. Treasury dollars again, not to cover $500 trillion (that's trillion, with a "t") worth of shakey U.S. dollar based abra cadabra financial instruments worldwide.

Federal

Housing Finance Agency Office of Inspector General

FHGA

OIG March 18

2015 major White Paper REPORT to Americans, titled,

"The Continued

Profitability of Fannie Mae and Freddie Mac Is Not Assured"

http://fhfaoig.gov/Content/Files/WPR-2015-001.pdf

In this March 2015 report, Fannie Mae and Freddie Mac are referred

to collectively as, "the

Enterprises"

CONCLUSION

" Imprudent

business practices and unfavorable market conditions led to the Enterprises’ financial

collapse and conservatorship in 2008. After years of

huge losses, the Enterprises have reported net income since 2012. Non-recurring

events have been a significant driver of earnings in 2013 and 2014 and are

unlikely to drive future earnings. While OIG cannot predict whether additional

Treasury investments to either Enterprise is a reasonable possibility in the

near future, we recognize that significant uncertainties concerning the level

of guarantee fees the Enterprises will be able to charge, when combined with

the winding down of their investment portfolios and loss of interest income,

and possible losses on the derivatives portfolios, mean that the Enterprises’ future profitability is far from assured. The

reduction and eventual elimination of the Enterprises’ capital reserves

increases the likelihood of additional Treasury investment. Changes in market

conditions and the uncertainty of the current mortgage securities market can

further affect future profitability, as shown by recent Dodd-Frank Act stress

tests. For all of these reasons,

stakeholders should not presume continued profitability of the Enterprises."

2008 Financial Crash Senate Hearing: Lloyd Blankfein of Goldman Sachs vs. Senator Carl Levin

2008 Financial Crash: Sen. Carl Levin questioning Daniel Sparks - Former Goldman Sachs Mortgages Department Head, asking him "How much of that shitty deal did you sell to your clients?" during Goldman Sachs Hearing on Fraud and Contempt of clients

During the Financial Services Subcommittee on Oversight and Investigations hearing of May 5 2009, Ms. Coleman was unable to answer several questions regarding trillions of dollars of increases to the balance sheet of the Federal Reserve. Elizabeth A. Coleman, Inspector General for the entire Federal Reserve System of USA, has NO IDEA what happened to $9 TRILLION in the national reserve bank, nor its relation to Lehman Brothers!

William Black, professor of law and professor of economics and former Fed regulator at the highest levels, nearly lets some tears of indignation fall from his eyes, in Congressional testimony, explaining how the highest SEC regulators and the most senior executives of finance in the Senate, knew what happened with the improprieties of the Federal Reserve, leading up to the Crash of 2008. Prof. Black is an expert on "bond vigilantes" and the American trend of "U.S. financial regulators race to the bottom", and he warns that "bad ethics drive good ethics out of the marketplace". He is very depressed that our own FDIC has only $130 on deposit for every $10,800 of risk that it insures.

3-1/2 hours C-Span on Goldman Sachs FRAUD hearings regarding 2008 GLOBAL FINANCIAL COLLAPSE

Here are some highly recommended sites:

The REAL HISTORY of TED and TED-x conferences and videos .... click here to open your eyes and stop sleeping.....

click here for DUCKS UNLIMITED part 1

*****************end**********************

... this website is just one human's small effort to make a layperson's composite and historical "string" of many of the news events of the decade, which forced the Western World democracies to collapse and fold themselves like rolly pollies into the mere semblance of their former selves, whimpering in the corner, trembling at each new ...

... this website is just one human's small effort to make a layperson's composite and historical "string" of many of the news events of the decade, which forced the Western World democracies to collapse and fold themselves like rolly pollies into the mere semblance of their former selves, whimpering in the corner, trembling at each new ...  ... are all of us headed to the same fate as the Palestinians and Gazans??....this website endeavors to instill a 'remembrance of things past', in the links and excerpts below, which may give some of us yet, a prayer of a chance to survive what has befallen many of us already, before there is only One World Order, and not a good one.

... are all of us headed to the same fate as the Palestinians and Gazans??....this website endeavors to instill a 'remembrance of things past', in the links and excerpts below, which may give some of us yet, a prayer of a chance to survive what has befallen many of us already, before there is only One World Order, and not a good one.