The Clockwork Statement

By Eric Blair

WAR IS PEACE

IGNORANCE IS STRENGTH

FREEDOM IS SLAVERY

Access andt update 1st February 2002.

George W Bush Greaseball Links to Osama Bin Ladin

Guerrilla of the Week

Editor's Pick, November 19, 2001

Once again, a major bombshell about the true origins of this conflict has broken

overseas. And once again, the information is nowhere to be seen in the American

media. Last week, French journalists Jean-Charles Brisard and Guillaume Dasquié,

editors of Online Intelligence, released their book "Bin Laden, La Verite

Interdite (Bin Laden: The Forbidden Truth)." "La Verite Interdite"

outlines a very different picture than the American news has been reporting,

but one that supports many controversial claims made here on GuerrillaNews.

Brisard and Dasquié, who have been tracking bin Laden for years, detail

how: the war was in the works prior to 9-11; Bush blocked the FBI's investigation

into bin Laden to protect the Saudis and the Bush family's ties to their corrupt

regime; and the real motivating force behind the war is oil. The following article

from the Irish Times outlines the book's findings. Prepare for a paradigm shift:

The Irish Times (19/11/2001)

By Michael Jansen, in Beirut

The fate of John O'Neill, the Irish-American FBI agent who for years led U.S. investigations into Osama bin Laden's al-Qaeda network, is the most chilling revelation in the book Bin Laden: The Hidden Truth, published in Paris this week.

O'Neill investigated the bombings of the World Trade Centre in 1993, a US base in Saudi Arabia in 1996, the U.S. embassies in Nairobi and Dar-Es-Salaam in 1998, and the USS Cole last year.

Jean-Charles Brisard, who wrote a report on bin Laden's finances for the French intelligence agency DST and is co-author of Hidden Truth, met O'Neill several times last summer. He complained bitterly that the U.S. State Department - and behind it the oil lobby who make up President Bush's entourage - blocked attempts to prove bin Laden's guilt.

The U.S. ambassador to Yemen, Ms Barbara Bodine, forbade O'Neill and his team of so- called Rambos (as the Yemeni authorities called them) from entering Yemen. In August 2001, O'Neill resigned in frustration and took up a new job as head of security at the World Trade Centre. He died in the September 11th attack.

Brisard and his co-author Guillaume Dasquié, the editor of Intelligence Online, say their book is a tribute to O'Neill. The FBI agent had told Brisard: "All the answers, everything needed to dismantle Osama bin Laden's organisation, can be found in Saudi Arabia."

But U.S. diplomats shrank from offending the Saudi royal family. O'Neill went to Saudi Arabia after 19 U.S. servicemen died in the bombing of a military installation in Dhahran in June 1996. Saudi officials interrogated the suspects, declared them guilty and executed them - without letting the FBI talk to them. "They were reduced to the role of forensic scientists, collecting material evidence on the bomb site," Brisard says.

O'Neill said there was clear evidence in Yemen of bin Laden's guilt in the bombing of the USS Cole [in which 17 U.S. servicemen died] but that the State Department prevented him from getting it."

Brisard and Dasquié discovered that the first country to issue an international arrest warrant against bin Laden was not the U.S., but Moamar Gadafy's Libya, in March 1998. The confidential notice, published for the first time in their book, was sent by the Libyan interior ministry to Interpol on March 16th, 1998, and accuses bin Laden of murdering two German intelligence agents, Silvan Becker and his wife, in Libya in 1994.

Bin Laden supported a fundamentalist group called al-Muqatila, made up of Libyans who had fought with him against the Soviets in Afghanistan. Al-Muqatila wanted to assassinate Gadafy, whom it considered an infidel. According to the former MI5 agent David Shayler, British intelligence - also in league with al-Muqatila - tried to assassinate Gadafy in November 1996.

It was because of British collaboration with al-Muqatila that the Interpol warrant was ignored, Brisard says. Since September 11th, al-Muqatila has been placed on President Bush's list of "terrorist groups".

The central thesis of Brisard and Dasquié's book is sure to join the annals of 21st century conspiracy theories. The writers document negotiations between the Bush administration and the Taliban between February and August of this year.

Less convincingly, they conjecture that the September 11th suicide attacks were the result of the failure of those negotiations.

The chief motivation behind U.S. attempts to make peace with the Taliban can be summed up in one word: oil. The former Soviet republics of Central Asia - Turkmenistan, Uzbekistan and especially "the new Kuwait", Kazakhstan - have vast oil and gas reserves. But Russia has refused to allow the U.S. to extract it through Russian pipelines and Iran is considered a dangerous route. That left Afghanistan.

The U.S. oil company Chevron - where Mr. Bush's National Security Advisor Condoleeza Rice was a director throughout the 1990s - is deeply involved in Kazakhstan. In 1995, another U.S. company, Unocal (formerly Union Oil Company of California) signed a contract to export $8 billion worth of natural gas through a $3 billion pipeline which would go from Turkmenistan through Afghanistan to Pakistan.

The authors recall how the State Department applauded the Taliban takeover in September 1996, five months after a U.S. assistant secretary of state warned "economic opportunities will be missed" if political stability was not restored in Afghanistan.

Laila Helms, the part Afghan niece of the former CIA director and former U.S. ambassador to Tehran Richard Helms, is described as the Mata-Hari of U.S.-Taliban negotiations.

Ms. Helms brought Sayed Rahmatullah Hashimi, an adviser to Mullah Omar, to Washington for five days in March 2001 - after the Taliban had destroyed the ancient Buddhas of Bamiyan. Hashimi met the directorate of Central Intelligence at the CIA and the Bureau of Intelligence and Research at the State Department.

In negotiations which continued until July, the U.S. then took a more discreet position, letting the UN envoy Francesc Vendrell do most of the work and appointing a former U.S. ambassador to Pakistan, Thomas Simons, to represent the U.S. at informal meetings in Berlin.

The last direct U.S. contact with the Taliban was on August 2nd, 2001, when Christina Rocca, the director of Asian affairs at the State Department, met the Taliban ambassador in Islamabad. Ms. Rocca was previously in charge of contacts with Islamist guerrilla groups at the CIA, where in the 1980s, she oversaw the delivery of Stinger missiles to Afghan mujaheddin.

Last February, the Taliban had indicated it might be willing to hand over bin Laden, but by June, according to Brisard and Dasquié, the U.S. began considering military action. "The U.S. thought they could 'decouple' Osama bin Laden from the Taliban," Brisard says. "What they did not understand was that without bin Laden, the Taliban regime wouldn't have existed."

By dispatching Francesc Vendrell to see the exiled King Zaher Shah in Rome and raising the threat of military action, Washington "backed the Taliban into a corner", the authors say. For the Taliban - assuming its leadership had advance knowledge of the suicide attacks - September 11th was a sort of pre-emptive strike.

Brisard and Dasquié claim a significant part of the Saudi royal family supports bin Laden. "Saudi Arabia has always protected bin Laden - or protected itself from him," says Brisard. He points out that attacks inside the kingdom targeted US interests, never the Saudis.

Khalid bin Mahfouz is the former chairman of the kingdom's biggest bank, the National Commercial Bank, who, with 10 family members received Irish citizenship in December 1990. Brisard and Dasquié call him "the banker of terror".

The 73-year-old Mahfouz is now under house arrest

in the Saudi resort of Taif, accused by the FBI and CIA of having diverted $2

billion to Islamic charities that helped bin Laden

compiled sources as at 8th December 2001, this update below 1st January 2002

Access Date 8th December 2001

http://members.localnet.com/~jeflan/jfafghanpipe.htm"

http://members.localnet.com/~jeflan/jfafghanpipe.htm"

The Grand Chessboard Dr. Zbigniew : Millions will suffer.....as a result .....

http://www.chevrontexaco.com/news/spotlight/caspian.asp

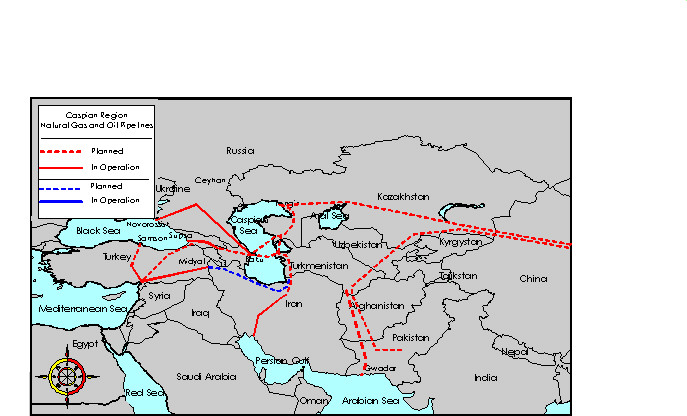

THE CENTRAL ASIAN PIPELINE MAP:Caspian Region

WHOSE VESTED INTEREST?

CHEVRONTEXACO'S

SPOTLIGHT: Kazakhstan & the Caspian Sea Region

The Tengiz

Field

ChevronTexaco and the Republic of Kazakhstan are developing the

giant Tengiz and nearby Korolev oil fields. This historic

partnership, called Tengizchevroil (TCO), was formed in 1993 as a

40-year, $20 billion joint venture. Tengiz, one of the world's

largest oil fields, contains some 6 to 9 billion barrels of

recoverable oil.

SEE PRIMA FACIE EVIDENCE FROM THE TOPWIG EXECUTIVE -HEARING ON U.S. INTERESTS IN THE CENTRAL ASIAN REPUBLICS THURSDAY, FEBRUARY 12, 1998 House of Representatives, Subcommittee on Asia and the Pacific, Committee on International Relations, http://commdocs.house.gov/committees/intlrel/hfa48119.000/hfa48119_0.HTM

ChevronTexaco is building on success in Kazakhstan - with two additional projects brought to the merged company by Texaco - and expanding its presence in the petroleum-rich Caspian region, one of the hottest growth areas for the petroleum industry.

...............

http://www.unocal.com/uclnews/97news/102797a.htm Consortium formed to build Central Asia gas pipeline ASHGABAT, Turkmenistan, Oct. 27, 1997 -- Six international companies and the Government of Turkmenistan formed Central Asia Gas Pipeline, Ltd. (CentGas) in formal signing ceremonies here Saturday. The group is developing a project to build a 790-mile (1,271-kilometer) pipeline to link Turkmenistan's abundant proven natural gas reserves with growing markets in Pakistan. The group is also considering an extension of the line to the New Delhi area in India. The Route The 48-inch diameter pipeline will extend 790 miles (1,271 kilometers) from the Afghanistan-Turkmenistan border, generally follow the Herat-to-Kandahar Road through Afghanistan, cross the Pakistan border in the vicinity of Quetta, and terminate in Multan, Pakistan, where it will tie into an existing pipeline system. Turkmenistan will construct a pipeline that will link with the CentGas line at the border and stretch approximately 105 miles (169 kilometers) to the Dauletabad Field. A potential 400-mile (644-kilometer) extension from Multan to New Delhi also is under consideration. Estimated cost of the project is US$1.9 billion for the segment to Pakistan, and an additional US$600 million for the extension to India. [09] TURKMEN-PAKISTANI PIPELINE IDEA REVIVED? Despite renewed fighting between groups in Afghanistan, a Turkmen official said he has secured agreements from warring factions there to allow construction of the Turkmen-Afghan-Pakistan gas pipeline, ITAR-TASS reported on 6 June. Former Turkmen Oil and Gas Minister Gochmurad Nazjanov, who is now the Turkmen government's coordinator for the proposed pipeline, met with leaders from Afghanistan's Taliban Movement and the Northern Alliance at the end of May and received security guarantees for "the pipeline and its builders." The project has been discussed for several years, but fighting within Afghanistan has prevented work from starting. The Turkmen government, the U.S. company Unocal, Saudi Arabia's Delta Corp. and companies from Japan, South Korea, and Pakistan are all involved in the project. BP http://www.hri.org/news/balkans/rferl/1998/98-06-08.rferl.html#09

Below are the many

links throughout our Web site about the Caspian Region.

http://www.feminist.org/research/report/102_one.html

Afghanistan Pipeline

In response to continued news reports that California-based UNOCAL has been negotiating with the Taliban militia to build a gas pipeline through Afghanistan, the Feminist Majority Foundation joined a coalition of human rights, women's rights, and environmental groups to demand that the California attorney general revoke UNOCAL's charter to do business, because of their crimes against humanity and the environment.

"If UNOCAL thinks it can do business with the Taliban, a regime that, in effect, denies women their right to exist as human beings, then we think UNOCAL's privilege to exist as a corporation must also be denied," said Kathy Spillar, National Coordinator for the Feminist Majority Foundation.

The coalition presented a petition to California Attorney General Dan Lungren at a press conference, documenting UNOCAL's abuses, including: initiating business dealings with the Taliban militia in Afghanistan, which has virtually imprisoned Afghan women and girls in their homes; profiting from forced labor in Burma, where UNOCAL is constructing a pipeline; and oil spills and hazardous waste spills in California.

Law professor Robert Benson, who co-wrote the petition, commented: "People mistakenly assume that we have to try to control these giant corporate repeat offenders one toxic spill at a time, one human rights violation at a time. But the law has always allowed the attorney general to go to court to simply dissolve a corporation for wrongdoing." Attorney General Lungren rejected the 127-page petition just five days after it was presented to him, with no explanation or legal analysis of the rejection. The coalition may seek a court order to compel the Attorney General to act.

UNOCAL is the leader of the CENTGAS consortium formed to build the pipeline through Afghanistan. Other members of the consortium include Saudi Arabia's Delta, and companies in Japan, Indonesia, Korea, and Pakistan. In May, for the first time, the full CENTGAS consortium met with the Taliban in Afghanistan. The cost of the pipeline has been estimated at two billion dollars. The Taliban regime stands to earn up to $150 million annually from the proposed pipeline.

Earlier this summer, the Feminist Majority led protests outside UNOCAL's headquarters in Los Angeles and Washington, DC, including a protest at UNOCAL's annual shareholder's meeting in early June. The National Organization for Women, the Women's Alliance for Peace and Freedom, and other women's rights organizations also joined the protest to demand that UNOCAL end all business dealings with the Taliban.

While the protest was going on outside, Feminist Majority board member Mavis Leno attended the UNOCAL shareholder's meeting and asked UNOCAL chairman Roger Beach questions about the company's involvement with the Taliban. Five days after the shareholder's meeting, UNOCAL ended its $1 million contract with the University of Nebraska to train Afghan men to build the pipeline. In August the company circulated a press release acknowledging, for the first time, the concern about the treatment of women in Afghanistan.

Other corporations are also getting on the Taliban bandwagon. A New Jersey company has signed a $240 million contract to do business with the Taliban. Telephone Systems International will build a cellular phone network for the Taliban, including access to the Internet. However, the Taliban has demanded that special software must block citizens' access to all Web sites except Taliban sites. One of the company's owners is from Afghanistan.

The Taliban, which controls 85% of Afghanistan and recently took over the northern city of Mazar-I Sharif, continues to press for U.N.recognition as the official government of Afghanistan. The U.N. accreditation committee meets in October, and U.N. recognition would pave the way for international funding for the pipeline.

The Taliban has ordered over one hundred home schools for girls to close. Many of the schools are supported by foreign relief agencies and teach vocational skills to girls and women. According to the Taliban, girls may receive education only up to age eight, and schools for girls must teach only lessons on the Koran. UN spokesperson Sarah Russell said that these restrictions violate an agreement formed between the UN and the Taliban last May in which the Taliban promised to create a joint consultative committee to discuss issues such as female education. The Taliban refuses to honor the agreement, despite numerous UN requests. In a related development, European Union officials announced a freeze on new funding for humanitarian aid projects in Kabul to protest the Taliban's treatment of women.

Doctors and humanitarian workers in Afghanistan report that more and more women in Afghanistan are committing suicide in response to the Taliban's laws banning women from working, going to school, or leaving their homes without a close male relative. A recent report by Physicians for Human Rights, which surveyed 160 women in Afghanistan, found that 21% of the women had frequent suicidal thoughts. Most women commit suicide by taking caustic soda, causing a slow, painful death. Many other women suffer from depression and other mental illnesses. Most of the women treated at Kabul's mental hospital are former government workers who are no longer allowed to work.

The Physicians for Human Rights report also found that 69% of the survey respondents said that they or a family member had been detained by the Taliban, mostly for not adhering to the dress code, which requires women in public to be completely covered by a "burqa," with only a mesh opening to see through. Seventy-one percent of the women said their physical health had declined in the past two years, because women are not allowed to see male doctors unless chaperoned, and few female doctors are permitted to work.

To take action against gender apartheid in Afghanistan, go to the Feminist Majority Foundation Online: .

Feminist Majority Report, Fall 1998; Arlington, VA

http://www.oilandgasinternational.com/departments/from_editor/10_29_01.html

Access Date 8th December 2001

Oil and Gas News International

Unocal

& Afghanistan

(10/29/01) There can be no doubt that the tragic terrorist attack

on New York City and Washington requires apprehension and

bringing to justice those responsible. They and their

organization were in all likelihood led by the terrorist linchpin

Osama bin Laden, who is harbored in Afghanistan, from which he is

believed to have directed, trained, and financed this and other

terrorist acts. And there can be no question that the Taliban

rulers of Afghanistan are aiding and abetting him and his al-Qaida

organization. But, despite how much this terrorist and his

henchmen and the Taliban themselves are despised by most of the

civilized world and the majority of Afghans themselves, can that

be a justification for the present bombing of the country and

soaring number of innocent casualties? Or, as is being said

throughout the Middle East, is there an ulterior motive? Is it to

put another regime in power that may be more favorable to the

West?

Author Ahmed Rashid has revealed that since 1995, Unocal has

sought to build US$1.9 billion, 790-mile oil and gas pipelines

from the 25 Tcf Dauletabad Field in Turkmenistan across

Afghanistan to Pakistani ports on the Arabian Sea as an alternate

route for transporting Caspian region oil and gas to the enormous

Indian subcontinent markets and perhaps beyond to Southeast Asia.

But, Rashid points out, this requires an agreeable administration

in Afghanistan, which the Taliban no longer is.

Unocal tried courting Taliban leaders after they took Kabul in

1996, taking them to Houston, where they were treated royally.

They were offered US$.15 per 1000 cf of gas that passed through

Afghanistan, and they agreed after US Assistant Secretary of

State Robin Raphael lobbied them for the Unocal pipeline. During

their first year running the country.

The Taliban were unopposed by the US government. Rashid says in

1997, he was told by an American diplomat, "The Taliban will

probably develop like the Saudis did. There will be Aramco,

pipelines, an emir, no parliament, and lots of Sharia law. We can

live with that." But when the Taliban began to enforce

strict sharia edicts, particularly against women, policies began

to change. Nevertheless, Rashid says, Unocal told a 1998 US

congressional hearing that Asian energy demands and the sanctions

against Iran made Afghanistan "the only other possible route"

for its proposed million b/d pipeline, but when the Taliban

demanded more than the $100 million a year in rent for the

pipeline route in the form of the construction of roads, water

supplies, telephone lines, and electricity power lines, as well

as a tap in the pipeline to provide oil and gas for Afghanistan,

Unocal balked, and finally dropped its plans after the East

Africa embassy bombings.

The US Energy Information Agency says, "Afghanistan's

significance from an energy standpoint stems from its

geographical position as a potential transit route for oil and

natural gas exports from Central Asia to the Arabian Sea. This

potential includes the possible construction of oil and natural

gas export pipelines through Afghanistan."

If the Taliban is overthrown, terrorism may take a major blow,

but in doing so, the primary stumbling block to the Caspian-Pakistan

pipeline will also be removed. In the Middle East, where oil has

always dominated political decisions, this is the rationale for

the US-led strike against Afghanistan. The question is asked, if

bin Laden were still in Saudi Arabia, would the same punishment

be given that country?

Access Date 8th December 2001

http://www.lewrockwell.com/orig/sardi7.html

The Leo Rockwell site

by Bill Sardi

Testimony before the US Congress is circulating on the internet. It pertains to a proposed oil pipeline through Central Asia that is applicable to the current war in Afghanistan.

On February 12, 1998, John J. Maresca, vice president, international relations for UNOCAL oil company, testified before the US House of Representatives, Committee on International Relations. Maresca provided information to Congress on Central Asia oil and gas reserves and how they might shape US foreign policy. UNOCAL's problem? As Maresca said: "How to get the region's vast energy resources to the markets." The oil reserves are in areas north of Afghanistan, Turkmenistan, Uzbekistan, Kazakhstan and Russia. Routes for a pipeline were proposed that would transport oil on a 42-inch pipe southward thru Afghanistan for 1040 miles to the Pakistan coast. Such a pipeline would cost about $2.5 billion and carry about 1 million barrels of oil per day.

Maresca told Congress then that: "It's not going to be built until there is a single Afghan government. That's the simple answer."

Dana Rohrbacher, California congressman, then identified the Taliban as the ruling controllers among various factions in Afghanistan and characterized them as "opium producers."

Then Rohrbacher asked Maresca: "There is a Saudi terrorist who is infamous for financing terrorism around the world. Is he in the Taliban area or is he up there with the northern people?"

Maresca answered: "If it is the person I am thinking of, he is there in the Taliban area." This testimony obviously alluded to Osama bin Laden.

Then Rorhbacher asked: "... in the northern area as compared to the place where the Taliban are in control, would you say that one has a better human rights record toward women than the other?"

Maresca responded by saying: "With respect to women, yes. But I don't think either faction here has a very clean human rights record, to tell you the truth."

So women's rights were introduced into Congressional testimony by Congressman Rohrbacher as the wedge for UNOCAL to build its pipeline through Afghanistan. Three years later CNN would be airing its acclaimed TV documentary "Under The Veil," which displayed the oppressive conditions that women endure in Afghanistan under the rule of the Taliban (a propaganda film for the oil pipeline?).

Rohrbacher then went on to say that a democratic election should take place in Afghanistan and "if the Taliban are not willing to make that kind of commitment, I would be very hesitant to move foreward on a $2.5 billion investment because without that commitment, I don't think there is going to be any tranquility in that land."

Beginning in 1998 UNOCAL was chastized, particularly by women's rights groups, for discussions with the Taliban, and headed in retreat as a worldwide effort mounted to come to the defense of the Afghani women. This forced UNOCAL to withdraw from its talks with the Taliban and dissolve its multinational partnership in that region. In 1999 Alexander's Gas & Oil Connections newsletter said: "UNOCAL company officials said late last year (1998) they were abandoning the project because of the need to cut costs in the Caspian region and because of the repeated failure of efforts to resolve the long civil conflict in Afghanistan." [Volume 4, issue #20 - Monday, November 22, 1999]

Three days following the attack on the World Trade Centers in New York City, UNOCAL issued a statement reconfirming it had withdrawn from its project in Afghanistan, long before recent events. [www.unocal.com September 14, 2001 statement]

UNOCAL was not the only party positioning themselves to tap into oil and gas reserves in central Asia. UNOCAL was primary member of a multinational consortium called CentGas (Central Asia Gas) along with Delta Oil Company Limited (Saudi Arabia), the Government of Turkmenistan, Indonesia Petroleum, LTD. (INPEX) (Japan), ITOCHU Oil Exploration Co., Ltd. (Japan), Hyundai Engineering & Construction Co., Ltd. (Korea), the Crescent Group (Pakistan) and RAO Gazprom (Russia).

Just because CentGas had dissolved does not mean that the involved parties have totally abandoned their interest in building an oil pipeline out of Central Asia. There is also talk of another pipeline thru Iran. India and Pakistan are bidding to be the pipeline terminal ocean port since they would obtain hundreds of millions of dollars in fees.

So, in 1998 Osama bin Laden was identified as the villain behind the Taliban, Afghanistani women the victims of an oppressive Taliban regime, and the stage was set for a future stabilization effort (i.e. a war). Was all this a cover story for a future oil pipeline?

In November 2000, Bruce Hoffman, director of the Rand Institute office in Washington DC, indicated that the next US President would have to face up to the growing threat is Islamic terrorism. Hoffman: "The next administration must turn its immediate attention to knitting together the full range of US counterterrorist capabilities into a cohesive plan." [Los Angeles Times, November 12, 2000]

All that was needed was a triggering event.

October 15, 2001

Bill Sardi [send him mail] is a health journalist at www.askbillsardi.com.

Copyright ? 2001 by the Bill Sardi Word of Knowledge Agency, San Dimas, California

Access Date 8th December 2001

ChevronTexaco Annual Profit and Loss Report.

Source: http://www03.activate.net/metrovision/essex/001016/

ANALYST PRESENTATION WEBCAST

&

NEWS CONFERENCE CALL WEBCAST

Archived from October 16, 2000

http://www03.activate.net/metrovision/essex/001016/slides/sld012.htm

Following the merger of Chevron and Texaco in October 9th 2000,, this company posted record profits and dividends for the Year 2000 financial year, concurrent to the oil price hike in mid 2000. Obviously someone benefited from the high oil prices.

Caltex bought off by ChevronTexaco!

http://www.caltex.com/caltex.com/default.asp

What did Unocal Say?

Denial, Denial,Denial ad lib...

Conflicting Claims by the same People....

access date 8th December 2001

http://www.unocal.com/uclnews/98news/centgas.htm

Updated 1st January 2002 : Unocal reiterates prior statements

The company is not supporting the Taliban in Afghanistan in any way whatsoever. Nor do we have any project or involvement in Afghanistan.

Beginning in late 1997, Unocal was a member of a multinational consortium that was evaluating construction of a Central Asia Gas (CentGas) pipeline between Turkmenistan and Pakistan. Part of this pipeline would have crossed western Afghanistan. However, Unocal suspended its participation in the CentGas consortium in August 1998 and formally withdrew from that consortium in December 1998. Our company has had no further role in developing or funding that project or any other project that might involve the Taliban. The pipeline was never constructed.

During this time, Afghanistan was in the midst of a civil war. We met with many factions, including the Taliban, to educate them about the benefits such a pipeline could bring to this desperately poor and war-torn country, as well as to the Central Asian region. At no time did we make any deal with the Taliban, and, in fact, consistently emphasized that the project could not and would not proceed until there was an internationally recognized government in place in Afghanistan that fairly represented all its people. Our hope was that the project could help bring peace, stability and economic development to the Afghans, as well as develop important energy resources for the region.

Unocal suspended its participation in the CentGas consortium (see statement). The company officially withdrew from the project in December 1998 (see statement below). After several incorrect reports appeared, including one published in Pakistan in February 1999, Unocal reconfirmed its position regarding this matter in another statement dated Feb. 16, 1999.

UNOCAL CORPORATION SITE:

what "they say..."

Consortium formed to build Central Asia gas pipeline

http://www.unocal.com/uclnews/97news/102797a.htm

"The

proposed natural gas pipeline would stretch from the Turkmenistan/Afghanistan

border in southeastern Turkmenistan to Multan, Pakistan (790

miles, 1,271 kilometers), with a 400-mile (640-kilometer)

extension to India under consideration. Estimated cost of the

project is US$1.9 billion for the segment to Pakistan and an

additional US$600 million for the extension to India.

This news release contains forward-looking information, including

projections of future business plans and potential capital

expenditures. Actual results could differ materially from these

projections."

Consortium formed to build Central Asia gas pipeline

ASHGABAT, Turkmenistan, Oct. 27, 1997 -- Six international companies and the Government of Turkmenistan formed Central Asia Gas Pipeline, Ltd. (CentGas) in formal signing ceremonies here Saturday. The group is developing a project to build a 790-mile (1,271-kilometer) pipeline to link Turkmenistan's abundant proven natural gas reserves with growing markets in Pakistan. The group is also considering an extension of the line to the New Delhi area in India.

"This is a truly significant step in the development of this project," said John F. Imle, Jr., president of Unocal Corporation . Unocal was appointed by the Government of Turkmenistan to lead the project development activities and form the gas pipeline consortium. A Unocal subsidiary will serve as development manager for CentGas. "The interest shown by major international companies underscores both the attractiveness of the proposed pipeline and the significant economic benefits it can bring to the region. This project could be the foundation for a new commerce corridor for the region -- often referred to as the Silk Road for the 21st century.

The CentGas consortium will initially include the following companies, either directly or through affiliates: Unocal Corporation, 46.5 percent; Delta Oil Company Limited (Saudi Arabia), 15 percent; the Government of Turkmenistan, 7 percent; Indonesia Petroleum, LTD. (INPEX) (Japan), 6.5 percent; ITOCHU Oil Exploration Co., Ltd. (CIECO) (Japan), 6.5 percent; Hyundai Engineering & Construction Co., Ltd. (Korea), 5 percent; and the Crescent Group (Pakistan), 3.5 percent. RAO Gazprom (Russia) has indicated an interest in signing the consortium agreements formalizing a 10 percent share in the project in the near future.

The proposed pipeline will carry natural gas from the Dauletabad Field, in southeastern Turkmenistan at a rate of up to 2 billion cubic feet per day (20 billion cubic meters per year). The Dauletabad Field has independently certified reserves of more then 25 trillion cubic feet (708 billion cubic meters). The Government of Turkmenistan has guaranteed deliverability of 25 trillion cubic feet (708 billion cubic meters) of natural gas exclusively for the Central Asia Gas Pipeline. Much or all of this gas is expected to come from the Dauletabad Field.

The inaugural memorandum of understanding between the governments of Turkmenistan and Pakistan for the CentGas project was signed in March 1995.

"The formation of the consortium is another major milestone achieved in accordance with the requirements of protocols and agreements previously signed with the Governments of Turkmenistan and Pakistan," said Marty Miller, Unocal Corporation vice president responsible for new ventures in Central Asia and Pakistan.

Miller pointed out that the project still faces significant economic, political and commercial challenges, such as finalizing mutually acceptable commercial agreements and agreements with transit countries. "This project has exceptionally sound economic fundamentals, given the presence of proven gas reserves in Turkmenistan and the market needs of Pakistan and India. The Dauletabad Field has produced well over 2 billion cubic feet per day in the past and is capable of producing that volume today. With the right development program, the Field will continue to be able to produce natural gas at this rate long into the future. No other import project can provide such volumes of natural gas to these markets at a lower price."

The proposed natural gas pipeline would stretch from the Turkmenistan/Afghanistan border in southeastern Turkmenistan to Multan, Pakistan (790 miles, 1,271 kilometers), with a 400-mile (640-kilometer) extension to India under consideration. Estimated cost of the project is US$1.9 billion for the segment to Pakistan and an additional US$600 million for the extension to India.

This news release contains forward-looking information, including projections of future business plans and potential capital expenditures. Actual results could differ materially from these projections.CentGas Consortium Members:

Unocal Corporation (U.S.), 46.5 percent

Founded over 100 years ago, Unocal is one of the world's leading energy resource and project development companies providing regional integrated energy solutions. Unocal has reserves of more than 9.8 trillion cubic feet of natural gas equivalent (1.6 billion barrels of oil equivalent) and major oil and gas production activities in Asia and the U.S. Gulf of Mexico.Delta Oil Company Limited (Saudi Arabia), 15 percent

Delta Oil Company Limited, a private Saudi-owned company, was founded by its Chairman and Chief Executive Officer, Mr. Badr M. Al-Aiban. Mr. Al-Aiban established the original Delta entity in Saudi Arabia in 1978, and its activities have expanded significantly since its inception. Today, Delta and its affiliates comprise a diversified group of companies involved in the energy industry, real estate development, food processing and packaging, soft drink bottling and distribution, agriculture and manufacturing. The company's operations extend to Central Asia, South East Asia and other countries in the Middle East. Delta has developed a number of strategic alliances in the oil and gas industry. As a member of the Azerbaijan International Operating Company (AIOC) and the North Absheron Operating Company Limited (NAOC), Delta and its affiliates are involved in exploring and developing oil fields in Azerbaijan, as well as other Central Asian countries.The Government of Turkmenistan, 7 percent

Since declaring its independence from the USSR on October 27, 1991, Turkmenistan has looked forward to increasing the economic strength of the new state. The country has strived to build on its traditions, values and history to form a political and economic system capable of increasing the well-being of its people, and strengthening the sovereignty of Turkmenistan. The leadership of Turkmenistan has met the challenge of reform head on, and has established many channels for swift economic development. As an independent state, Turkmenistan has much to offer to the Central Asian region and the international community. By effectively using its natural resources, continuing on a path of economic reform as can be seen in the agricultural industry, and promoting its economic potential to attract foreign investment, Turkmenistan can be assured of decades of successful economic growth. The government believes that by seeking international investment, technological and management support for its country, Turkmenistan can play a major role as the economic catalyst for the Central Asian region, and join the world leaders in the distribution of oil and gas.Indonesia Petroleum, LTD. (INPEX) (Japan), 6.5 percent

Indonesia Petroleum, LTD. (INPEX), a Tokyo-based company, has been engaged in the exploration and development of petroleum resources, mainly in Indonesia, since 1966 in order to ensure a continued stable supply of energy resources to Japan. With its core activity area in Indonesia, INPEX is expanding its activities in East Asia, Oceania, CIS, the Middle East and Africa. INPEX and its subsidiaries are currently producing 280,000 BOEPD equity oil and gas in Indonesia, Australia and UAE.ITOCHU Oil Exploration Co., Ltd. (CIECO) (Japan), 6.5 percent

ITOCHU Oil Exploration Co., Ltd. (CIECO) was formed in 1972 and is now involved in the exploration, development and production of hydrocarbons in Indonesia, U.K. North Sea, Australia, Pakistan, CIS Countries, Yemen, Oman and Gabon. CIECO is the core company responsible for all Hydrocarbon Exploration and Production activities within the subsidiaries and associates of ITOCHU Corporation, the largest trading company in Japan. With maximum utilization to ITOCHU's worldwide network, CIECO is well placed to continue to expand its foreign activities in the future.Hyundai Engineering & Construction Co., Ltd. (Korea), 5 percent

Hyundai Engineering & Construction Co., Ltd. was established in 1947, and its major role was rebuilding Korea's infrastructure. Growing rapidly during the early 1960s, Hyundai built dams, bridges, buildings and tunnels, as well as industrial plants that were desperately needed. Since it launched into the international market in 1968, Hyundai has taken a place among top global general contractors, with approximately US$32 billion construction orders through 1996. As the core company of Hyundai Business Group, Hyundai has set the pace for the Hyundai Business Group which is now a US$87 billion multi-national conglomerate specializing in engineering and construction, automobiles, shipbuilding, robotics, electronics, petrochemicals, aerospace and trading.The Crescent Group (Pakistan), 3.5 percent

The Crescent Group, in business for more than 50 years, is the premier industrial and financial conglomerate in Pakistan. More than 35 independent companies operating across Pakistan form the nucleus of the group and are leaders in textiles, jute, sugar, engineering, steel, investment banking, insurance, leasing and software development. The Crescent Group employs over 15,000 people and contributes to one percent of GNP of the country and over two percent of market capitalization of Pakistan.

Strategic alliances have helped position the Crescent Group as a leader in its core businesses, such as textile and textile made-ups. Crescent is in partnership with some of the most well-known corporations from the United States and Europe.

The Group puts heavy emphasis on keeping its projects environment-friendly, promotes education, and spends considerably on the development of human talent in safe working conditions.Project Overview

International Pipeline Consortium

Six international companies and the Government of Turkmenistan are forming an international pipeline consortium, Central Asia Gas Pipeline, Ltd. (CentGas) to develop a natural gas pipeline that will link Turkmenistan's vast natural gas reserves with the growing markets of Pakistan and possibly India. This major new source of fuel will supplement indigenous natural gas supply.

An efficient, clean-burning fuel, natural gas can be economically and safely transported by pipeline over long distances, and priced competitively with alternate fuels.The Resource

Dauletabad Field is one of the largest gas fields in the world. DeGolyer & MacNaughton, an internationally recognized petroleum engineering firm, has thoroughly evaluated the field's reserves. These evaluations clearly show that the field's resources are adequate for project needs, assuming production rates of roughly 1.5 billion cubic feet of gas per day (15 billion cubic meters of gas per year) for 30 years or more. The Government of Turkmenistan has guaranteed deliverability of 25 trillion cubic feet (709 billion cubic meters) of natural gas exclusively for this project. Much or all of this gas is expected to come from the Dauletabad Field.The Market

Forecasts based on reasonable gas purchase, sales price and other assumptions show sufficient demand for the imported gas at prices that support the project's economic viability. Market analyses indicate that Pakistan's electric power generation market will be the main consumer of the imported gas.The Route

The 48-inch diameter pipeline will extend 790 miles (1,271 kilometers) from the Afghanistan-Turkmenistan border, generally follow the Herat-to-Kandahar Road through Afghanistan, cross the Pakistan border in the vicinity of Quetta, and terminate in Multan, Pakistan, where it will tie into an existing pipeline system. Turkmenistan will construct a pipeline that will link with the CentGas line at the border and stretch approximately 105 miles (169 kilometers) to the Dauletabad Field. A potential 400-mile (644-kilometer) extension from Multan to New Delhi also is under consideration. Estimated cost of the project is US$1.9 billion for the segment to Pakistan, and an additional US$600 million for the extension to India.Inter-Government Support

The project enjoys strong support from the governments and leadership of the three countries directly involved and has also attracted the interest of other countries. Turkmenistan and Pakistan have demonstrated inter-government support through various memorandums of understanding.Regional Benefits

The project offers numerous long- and short-term benefits to the region. It will link plentiful supplies of clean-burning natural gas with growing regional markets, employ thousands of local people, foster regional cooperation, and enhance trade, transportation and communication. The development of pipeline-related infrastructure also will create opportunities for economic growth in other industries.

In addition to regional advantages, the pipeline offers specific benefits to the countries involved. Turkmenistan will reach new markets with its plentiful gas reserves, while Pakistan gains a reliable source of clean-burning fuel to drive its economic growth. Afghanistan will earn extensive economic benefits from the pipeline, both during construction and over the life of the project.SOURCE: Central Asia Gas Pipeline, Ltd.

Access date 8th December 2001

http://www.pipe-line.com/archive/archive_97-12/97-12_construction.html

Total deal helps Iran-Pakistan proposal

"...Pakistan is considering three pipeline projects to meet its gas demand

during the next century. This includes the line from Iran, one from Qatar

and another from Turkmenistan through Afghanistan. "

....

Unocal has taken a 36.5% interest in an international consortium that plans to build a pipeline to deliver natural gas from Turkmenistan to Pakistan.

Central Asia Gas Pipeline Ltd., which was set up late October, proposes building a $2-billion, 915-mi pipeline from the Turkmen Dauletabad gas field to Multan in Pakistan. Observers say construction on the line, which will cross the war-torn Afghanistan, will have to start early next year in order to meet a 2000 in-service date.

Besides Unocal, stakeholders include the Turkmen government with 17%, Saudi Arabia's Delta, 15% and Russia's Gazprom, 10%. The remaining 21.5 % is split among other participants that include Japan's Itochu Corp. and Inpex, Pakistan's Crescent Group and South Korea's Hyundai.

As planned, some 477 mi will run across northern Afghanistan, where the purist Islamic Taleban militia is battling an opposition alliance. Unocal says it plans to open teaching centers to train Afghans in pipeline construction.

Application for the proposed $1.2-billion Viking Voyageur natural gas pipeline has been sent to FERC.

As proposed, the 773-mi line will reach from Emerson, Manitoba, to Joliet, Illinois. According to Viking partners, Northern States Power Co., TransCanada PipeLines Ltd and Nicor Inc., the line will serve Minnesota, Wisconsin and northern Illinois.

In the FERC application, the operation describes a 42-in. line that will move an estimated 1.4 Bcfd. However, the line's backers say the ultimate size will depend on market interest. Plans call for construction to start early 1999 with an in-service date of November 1999.

Unocal has taken a 36.5% interest in an international consortium that plans to build a pipeline to deliver natural gas from Turkmenistan to Pakistan.

Central Asia Gas Pipeline Ltd., which was set up late October, proposes building a $2-billion, 915-mi pipeline from the Turkmen Dauletabad gas field to Multan in Pakistan. Observers say construction on the line, which will cross the war-torn Afghanistan, will have to start early next year in order to meet a 2000 in-service date.

Besides Unocal, stakeholders include the Turkmen government with 17%, Saudi Arabia's Delta, 15% and Russia's Gazprom, 10%. The remaining 21.5 % is split among other participants that include Japan's Itochu Corp. and Inpex, Pakistan's Crescent Group and South Korea's Hyundai.

As planned, some 477 mi will run across northern Afghanistan, where the purist Islamic Taleban militia is battling an opposition alliance. Unocal says it plans to open teaching centers to train Afghans in pipeline construction.

China National Petroleum Corp. (CNPC) reports it is currently studying a pipeline to move crude oil from Kazakstan fields to eastern China.

Earlier this year CNPC, agreed to build a pipeline after acquiring production units in Kazakstan. CNPC says the line will move its crude production from Kazakstan's Aktyubinsk and Uzen fields through the proposed line to China's western Zinjiang border.

From the border, the crude will be moved by rail to China's eastern region where the country's energy demand exists. China's petroleum company says rail will be used because initial production volume will not be sufficient enough to build a pipeline. Once production increases enough to make the project economical, a line is expected to be built.

Chevron is keeping a watchful eye on the proposed system as a possible outlet for Tengiz oil.

Pakistani gas observers believe Total's proposed gas deal with Iran will boost the prospects of building a pipeline to move Iranian natural gas to Pakistan.

The French company's announced $2-billion agreement to develop Iran's South Pars gas field is seen as positive news for the pipeline project. The Iran-Pakistan proposal has been under consideration for some time, but western companies have shown little interest in building the line due to U.S. sanctions against doing business with Iran.

Pakistan is considering three pipeline projects to meet its gas demand during the next century. This includes the line from Iran, one from Qatar and another from Turkmenistan through Afghanistan.

The line from Iran would reach 1,250 mi from the Gulf port of Bandar Abbas to Multan in Pakistan's central Punjab province. Estimated cost is between $1.7 and $2.8 billion.

The Thailand Cabinet has given its approval for the Petroleum Authority of Thailand to build a 2.67-mi section of the Yadana pipeline in the Sai Yok National Park.

Construction had been stopped after environmental groups and village chiefs protested against building the line in the forested area. PTT agreed to start work in the forest after the rainy season passed in late November and agreed to a $5-million environment mitigation program.

Construction on the 174-mi Yadana line reportedly is 60% complete and is on schedule for a summer 1998 completion.

Although agreement has been reached for completion of the Yadana line, PTT says it has postponed plans on other projects. Due to the weakness in the baht, spending for 1998 pipeline projects has been cut by $769-million.

A gas line to link the Offshore Joint-Development Area with Ratchaburi province has been delayed from a 2002 start to 2008. Also, a 95-mi line between Ratchaburi province and Ayutthaya province has been delayed to late 1999 and the diameter has been reduced from 36 in. to the 24 to 30 in. range.

Commercial Resins-SAW, Baytown, Texas, has been awarded a contract to coat 17 mi of 42-in. steel pipe.

On completion, the pipe will be internally lined with fusion bonded epoxy and externally coated with three-layer polyethylene. The pipe is part of a water supply line to the world's largest copper mine in Northern Chile.

Commercial Resins-SAW is a partnership of Tulsa-based Commercial Resins and SAW Pipes, USA, Baytown.

Ashland Petroleum plans to build a petroleum products pipeline from Catlettsburg, Kentucky, to central Ohio.

Preliminary engineering and feasibility studies have begun on the project. A 16-in. line will transport refined products to the central Ohio marketplace. Construction is expected to begin in 1998.

Ashland barges over 90% of Catlettsburg's refined products making it one of the largest inland marine fleets. The new line is not expected to have any impact on Ashland's Canton, Ohio, refinery operations.

Chevron Nigeria Ltd. has awarded Global Industries a contract to install platforms and pipelines in the Ewan Field, Offshore West Africa.

Global will transport and install two tripod platforms which are being fabricated in Nigeria. The company also will be installing some 29 mi of interfield lines ranging from 4 in. to 14 in.

Work is scheduled to run from December, 1997, to March, 1998, and will be carried out from Global's combination pipelay/derrick barge Cheyenne in water depths ranging from 15 ft to 40 ft.

FERC will prepare an environmental assessment (EA) on Florida Gas Transmission Company's (FGT) proposed Calcasieu Pipeline Replacement Project.

FGT wants to reroute one section and replace, within the same right- of-way, two sections of its 24-in. mainline in Calcasieu Parish, Louisiana. The sections to be replaced are between mileposts 425.99 and 426.92, section 1; 430.53 and 432.09, section 2; and 432.17 and 432.40, section 3.

The company wants to:

Section 1—abandon 5,070 ft of existing 24-in. mainline, install 8,883 ft of new 24-in.

Section 2—abandon 8,236 ft of existing 24-in. mainline, install 7,586 ft of new 24-in. located 10 ft south of the existing line, remaining 650 ft of new 24-in. located north of existing line

Section 3—abandon 1,239 ft of existing 24-in. mainline, install 1,239 ft of new 24-in. located 10 ft south of existing mainline.

Gulf Interstate Engineering Co. (GIE) has been awarded a contract by Transcontinental Gas Pipe Line Corp. to provide project management, engineering, design, and procurement services on the Mobile Bay Lateral Extension and Expansion Project.

The project facilities include the installation of two 15,000 hp natural gas turbine driven centrifugal compressors. One is located at their existing Compressor Station 82 and one at a new grass roots Compressor Station 83. Both stations are located in Mobile County, Alabama, and are scheduled to be completed in 1998.

Affiliates of Shell Oil Co., Texaco Trading and Transportation Inc., and Marathon Oil Co. have formed Odyssey Pipeline L.L.C., a network of crude oil pipelines to transport production from existing and future development projects in the eastern Gulf of Mexico.

Odyssey will combine Shell's existing 40-mi, 12-in. Cobia Pipeline with 80 mi of new 16 in. and 20 in. The system will have a 300,000 bpd capacity.

The project will begin with construction of a 40-mi, 20-in. line from Main Pass Block 289 to Shell's Delta Pipeline at Main Pass Block 72, near the mouth of the Mississippi River. This new segment loops the Cobia Pipeline and establishes Main Pass 289 as a hub for future connections. Construction is scheduled for completion in late 1997. The existing Cobia Pipeline connection to Delta at Main Pass Block 69 will also become part of the Odyssey system.

In addition, a 40-mi, 16-in. line will be constructed to extend from Main Pass 289 to Texaco and Marathon's Petronius project at Viosca Knoll Block 786. This segment also will transport crude from Shell's development project at Viosca Knoll Block 780. Construction is scheduled to begin in early 1998 and be completed in mid 1998.

Other development projects, such as Shell, Exxon and Amoco's Ram- Powell at Viosca Knoll Block 956 connect to the Odyssey system at Main Pass Block 289C. Additionally, Shell's Bud pipeline will connect in this area.

Coastal Corp.'s Australian subsidiary, Coastal Gas Pipelines Victoria Pty., reportedly has received the okay from the Victoria government to build, own and operate a 104-mi natural gas pipeline in Western Victoria.

The line will run from an existing gas transmission network at Carisbrook to the towns of Stawell and Horsham with a spur extending 9 mi to Ararat. Gas will be moved under a firm, long-term transportation service to Kinetik Energy, a natural gas company that supplies Western Victoria.

With permits and the necessary license in hand, construction will start immediately with completion set for mid-1998.

MCN Energy Group Inc. has announced its participation in the Vector Pipeline project, a high-pressure pipeline that will transport 1 Bcfgd from the Chicago area, through Michigan and into the TransCanada PipeLines Ltd system in Ontario.

MCN's stake in the $540 million project is expected to be 17.5%. Other partners include IPL Energy Inc. and TCPL, each with 35%, and Columbia Gas Transmission Corp.

Access Date 8th December 2001

http://www.chevrontexaco.com/news/press/2001/images/Caspian-map.jpg

Application for the proposed $1.2-billion Viking Voyageur natural gas pipeline has been sent to FERC.

As proposed, the 773-mi line will reach from Emerson, Manitoba, to Joliet, Illinois. According to Viking partners, Northern States Power Co., TransCanada PipeLines Ltd and Nicor Inc., the line will serve Minnesota, Wisconsin and northern Illinois.

In the FERC application, the operation describes a 42-in. line that will move an estimated 1.4 Bcfd. However, the line's backers say the ultimate size will depend on market interest. Plans call for construction to start early 1999 with an in-service date of November 1999.

Unocal has taken a 36.5% interest in an international consortium that plans to build a pipeline to deliver natural gas from Turkmenistan to Pakistan.

Central Asia Gas Pipeline Ltd., which was set up late October, proposes building a $2-billion, 915-mi pipeline from the Turkmen Dauletabad gas field to Multan in Pakistan. Observers say construction on the line, which will cross the war-torn Afghanistan, will have to start early next year in order to meet a 2000 in-service date.

Besides Unocal, stakeholders include the Turkmen government with 17%, Saudi Arabia's Delta, 15% and Russia's Gazprom, 10%. The remaining 21.5 % is split among other participants that include Japan's Itochu Corp. and Inpex, Pakistan's Crescent Group and South Korea's Hyundai.

As planned, some 477 mi will run across northern Afghanistan, where the purist Islamic Taleban militia is battling an opposition alliance. Unocal says it plans to open teaching centers to train Afghans in pipeline construction.

China National Petroleum Corp. (CNPC) reports it is currently studying a pipeline to move crude oil from Kazakstan fields to eastern China.

Earlier this year CNPC, agreed to build a pipeline after acquiring production units in Kazakstan. CNPC says the line will move its crude production from Kazakstan's Aktyubinsk and Uzen fields through the proposed line to China's western Zinjiang border.

From the border, the crude will be moved by rail to China's eastern region where the country's energy demand exists. China's petroleum company says rail will be used because initial production volume will not be sufficient enough to build a pipeline. Once production increases enough to make the project economical, a line is expected to be built.

Chevron is keeping a watchful eye on the proposed system as a possible outlet for Tengiz oil.

Pakistani gas observers believe Total's proposed gas deal with Iran will boost the prospects of building a pipeline to move Iranian natural gas to Pakistan.

The French company's announced $2-billion agreement to develop Iran's South Pars gas field is seen as positive news for the pipeline project. The Iran-Pakistan proposal has been under consideration for some time, but western companies have shown little interest in building the line due to U.S. sanctions against doing business with Iran.

Pakistan is considering three pipeline projects to meet its gas demand during the next century. This includes the line from Iran, one from Qatar and another from Turkmenistan through Afghanistan.

The line from Iran would reach 1,250 mi from the Gulf port of Bandar Abbas to Multan in Pakistan's central Punjab province. Estimated cost is between $1.7 and $2.8 billion.

The Thailand Cabinet has given its approval for the Petroleum Authority of Thailand to build a 2.67-mi section of the Yadana pipeline in the Sai Yok National Park.

Construction had been stopped after environmental groups and village chiefs protested against building the line in the forested area. PTT agreed to start work in the forest after the rainy season passed in late November and agreed to a $5-million environment mitigation program.

Construction on the 174-mi Yadana line reportedly is 60% complete and is on schedule for a summer 1998 completion.

Although agreement has been reached for completion of the Yadana line, PTT says it has postponed plans on other projects. Due to the weakness in the baht, spending for 1998 pipeline projects has been cut by $769-million.

A gas line to link the Offshore Joint-Development Area with Ratchaburi province has been delayed from a 2002 start to 2008. Also, a 95-mi line between Ratchaburi province and Ayutthaya province has been delayed to late 1999 and the diameter has been reduced from 36 in. to the 24 to 30 in. range.

Commercial Resins-SAW, Baytown, Texas, has been awarded a contract to coat 17 mi of 42-in. steel pipe.

On completion, the pipe will be internally lined with fusion bonded epoxy and externally coated with three-layer polyethylene. The pipe is part of a water supply line to the world's largest copper mine in Northern Chile.

Commercial Resins-SAW is a partnership of Tulsa-based Commercial Resins and SAW Pipes, USA, Baytown.

Ashland Petroleum plans to build a petroleum products pipeline from Catlettsburg, Kentucky, to central Ohio.

Preliminary engineering and feasibility studies have begun on the project. A 16-in. line will transport refined products to the central Ohio marketplace. Construction is expected to begin in 1998.

Ashland barges over 90% of Catlettsburg's refined products making it one of the largest inland marine fleets. The new line is not expected to have any impact on Ashland's Canton, Ohio, refinery operations.

Chevron Nigeria Ltd. has awarded Global Industries a contract to install platforms and pipelines in the Ewan Field, Offshore West Africa.

Global will transport and install two tripod platforms which are being fabricated in Nigeria. The company also will be installing some 29 mi of interfield lines ranging from 4 in. to 14 in.

Work is scheduled to run from December, 1997, to March, 1998, and will be carried out from Global's combination pipelay/derrick barge Cheyenne in water depths ranging from 15 ft to 40 ft.

FERC will prepare an environmental assessment (EA) on Florida Gas Transmission Company's (FGT) proposed Calcasieu Pipeline Replacement Project.

FGT wants to reroute one section and replace, within the same right- of-way, two sections of its 24-in. mainline in Calcasieu Parish, Louisiana. The sections to be replaced are between mileposts 425.99 and 426.92, section 1; 430.53 and 432.09, section 2; and 432.17 and 432.40, section 3.

The company wants to:

Section 1—abandon 5,070 ft of existing 24-in. mainline, install 8,883 ft of new 24-in.

Section 2—abandon 8,236 ft of existing 24-in. mainline, install 7,586 ft of new 24-in. located 10 ft south of the existing line, remaining 650 ft of new 24-in. located north of existing line

Section 3—abandon 1,239 ft of existing 24-in. mainline, install 1,239 ft of new 24-in. located 10 ft south of existing mainline.

Gulf Interstate Engineering Co. (GIE) has been awarded a contract by Transcontinental Gas Pipe Line Corp. to provide project management, engineering, design, and procurement services on the Mobile Bay Lateral Extension and Expansion Project.

The project facilities include the installation of two 15,000 hp natural gas turbine driven centrifugal compressors. One is located at their existing Compressor Station 82 and one at a new grass roots Compressor Station 83. Both stations are located in Mobile County, Alabama, and are scheduled to be completed in 1998.

Affiliates of Shell Oil Co., Texaco Trading and Transportation Inc., and Marathon Oil Co. have formed Odyssey Pipeline L.L.C., a network of crude oil pipelines to transport production from existing and future development projects in the eastern Gulf of Mexico.

Odyssey will combine Shell's existing 40-mi, 12-in. Cobia Pipeline with 80 mi of new 16 in. and 20 in. The system will have a 300,000 bpd capacity.

The project will begin with construction of a 40-mi, 20-in. line from Main Pass Block 289 to Shell's Delta Pipeline at Main Pass Block 72, near the mouth of the Mississippi River. This new segment loops the Cobia Pipeline and establishes Main Pass 289 as a hub for future connections. Construction is scheduled for completion in late 1997. The existing Cobia Pipeline connection to Delta at Main Pass Block 69 will also become part of the Odyssey system.

In addition, a 40-mi, 16-in. line will be constructed to extend from Main Pass 289 to Texaco and Marathon's Petronius project at Viosca Knoll Block 786. This segment also will transport crude from Shell's development project at Viosca Knoll Block 780. Construction is scheduled to begin in early 1998 and be completed in mid 1998.

Other development projects, such as Shell, Exxon and Amoco's Ram- Powell at Viosca Knoll Block 956 connect to the Odyssey system at Main Pass Block 289C. Additionally, Shell's Bud pipeline will connect in this area.

Coastal Corp.'s Australian subsidiary, Coastal Gas Pipelines Victoria Pty., reportedly has received the okay from the Victoria government to build, own and operate a 104-mi natural gas pipeline in Western Victoria.

The line will run from an existing gas transmission network at Carisbrook to the towns of Stawell and Horsham with a spur extending 9 mi to Ararat. Gas will be moved under a firm, long-term transportation service to Kinetik Energy, a natural gas company that supplies Western Victoria.

With permits and the necessary license in hand, construction will start immediately with completion set for mid-1998.

MCN Energy Group Inc. has announced its participation in the Vector Pipeline project, a high-pressure pipeline that will transport 1 Bcfgd from the Chicago area, through Michigan and into the TransCanada PipeLines Ltd system in Ontario.

MCN's stake in the $540 million project is expected to be 17.5%. Other partners include IPL Energy Inc. and TCPL, each with 35%, and Columbia Gas Transmission Corp.

Access Date 8th December 2001

The information contained in this report is the best available as of September 2001 and can change. General Background Afghanistan's significance from an energy standpoint stems from its geographical position as a potential transit route for oil and natural gas exports from Central Asia to the Arabian Sea. This potential includes the possible construction of oil and natural gas export pipelines through Afghanistan, which was under serious consideration in the mid-1990s. The idea has since been undermined by Afghanistan's instability. Since 1996, most of Afghanistan has been controlled by the Taliban movement, which the United States does not recognize as the government of Afghanistan. On December 19, 2000, the UN Security Council imposed additional sanctions against Afghanistan's ruling Taliban movement (which controls around 95% of the country), including an arms embargo and a ban on the sale of chemicals used in making heroin. These sanctions (Resolution 1333) are aimed at pressuring Afghanistan to turn over Osama bin Laden, suspected in various terrorist attacks, including the August 1998 US Embassy bombings in Kenya and Tanzania. These latest sanctions are in addition to sanctions (Resolution 1267) imposed on Afghanistan in November 1999, which included a freeze on Taliban assets and a ban on international flights by Afghanistan's national airline, Ariana. The Taliban reacted sharply to the new sanctions, ordering a boycott of US and Russian goods, and pulling out of UN-mediated peace talks aimed at ending the country's civil war. On November 29, 1999, UN Secretary General Kofi Annan issued a report on Afghanistan which listed the country's major problems as follows: civil war (which has caused many casualties and refugees, and which has devastated the country's economy), record opium production, wide-scale human rights violations, and food shortages caused in part by drought. According to the 2001 CIA World Factbook, Afghanistan is an extremely poor, landlocked country, highly dependent on farming and livestock raising. Afghanistan has experienced over two decades of war, including the nearly 10-year Soviet military occupation (which ended in 1989). During that conflict one-third of the population fled the country, with Pakistan and Iran sheltering a combined peak of more than 6 million refugees. Large Afghan refugee populations remain in Pakistan and Iran. Gross domestic product has fallen substantially over the past 20 years because of the loss of labor and capital and the disruption of trade and transport. The severe drought of 1998-2000 added to these problems. The majority of the population continues to suffer from insufficient food, clothing, housing, and medical care. Inflation remains a serious problem throughout the country. International aid can deal with only a fraction of the humanitarian problem, let alone promote economic development. The economic situation did not improve in 1999-2000, as internal civil strife has continued, hampering both domestic economic policies and international aid efforts. Numerical data are likely to be either unavailable or unreliable. Afghanistan was by far the largest world producer of opium poppies in 2000, and narcotics trafficking is a major source of revenues. Energy Overview The Soviets had estimated Afghanistan's proven and probable natural gas reserves at up to 5 trillion cubic feet (Tcf) in the 1970s. Afghan natural gas production reached 275 million cubic feet per day (Mmcf/d) in the mid-1970s. However, due to declining reserves from producing fields, output gradually fell to about 220 Mmcf/d by 1980. At that time, the Jorquduq field was brought online and was expected to boost Afghan natural gas output to 385 Mmcf/d by the early 1980s. However, sabotage of infrastructure by the anti-Soviet mujaheddin fighters limited the country's total production to 290 Mmcf/d, an output level that was held fairly steady until the Soviet withdrawal in 1989. After the Soviet pullout and subsequent Afghan civil war, roughly 31 producing wells at Sheberghan area fields were shut in pending the restart of natural gas sales to the former Soviet Union. At its peak in the late 1970s, Afghanistan supplied 70%-90% of its natural gas output to the Soviet Union's natural gas grid via a link through Uzbekistan. In 1992, Afghan President Najibullah indicated that a new natural gas sales agreement with Russia was in progress. However, several former Soviet republics raised price and distribution issues and negotiations stalled. In the early 1990s, Afghanistan also discussed possible natural gas supply arrangements with Hungary, Czechoslovakia, and several Western European countries, but these talks never progressed further. Afghan natural gas fields include Jorqaduq, Khowaja Gogerdak, and Yatimtaq, all of which are located within 20 miles of the northern town of Sheberghan in Jowzjan province. Natural gas production and distribution is the responsibility of the Taliban-controlled Afghan Gas Enterprise. In 1999, work resumed on the repair of a distribution pipeline to Mazar-i-Sharif. Spur pipelines to a small power plant and fertilizer plant also were repaired and completed. Mazar-i-Sharif is now receiving natural gas from the pipeline, as well as some other surrounding areas. Rehabilitation of damaged natural gas wells has been undertaken at the Khowaja Gogerak field, which has increased natural gas production. In February 1998, the Taliban announced plans to revive the Afghan National Oil Company, which was abolished by the Soviet Union after it invaded Afghanistan in 1979. Soviet estimates from the late 1970s placed Afghanistan's proven and probable oil and condensate reserves at 95 million barrels. Oil exploration and development work as well as plans to build a 10,000-bbl/d refinery were halted after the 1979 Soviet invasion. A very small amount of crude oil is produced at the Angot field in the northern Sar-i-Pol province. It is processed at a primitive topping plant in Sheberghan, and burned in central heating boilers in Sheberghan, Mazar-i-Sharif, and Kabul. Another small oilfield at Zomrad Sai near Sheberghan was reportedly undergoing repairs in mid-2001. Petroleum products such as diesel, gasoline, and jet fuel are imported, mainly from Pakistan and Turkmenistan. A small storage and distribution facility exists in Jalalabad on the highway between Kabul and Peshawar, Pakistan. Turkmenistan also has a petroleum product storage and distribution facility at Tagtabazar near the Afghan border, which supplies northwestern Afghanistan. Besides oil and natural gas, Afghanistan also is estimated to have 73 million tons of coal reserves, most of which is located in the region between Herat and Badashkan in the northern part of the country. Although Afghanistan produced over 100,000 short tons of coal annually as late as the early 1990s, as of 1999, the country was producing only around 1,000 short tons. Afghanistan's power grid has been severely damaged by years of war. Currently, the ruling Taliban are concentrating on rebuilding damaged hydroelectric plants, power distribution lines, and high-voltage cables. Production of power by Afghanistan's hydroelectric dams was negatively affected by the drought of 1998-2000, resulting in blackouts in Kabul and other cities. Increased rainfall in 2001 has improved power production. The Kajaki Dam in Helmand province near Kandahar is undergoing the addition of another generating turbine with assistance from the Chinese Dongfeng Agricultural Machinery Company. This will add 16.5 megawatts (MW) to its generating capacity when completed. Transmission lines from the Kajaki Dam to Kandahar were repaired in early 2001, along with a substation in the city, restoring supplies of electricity. The Dahla Dam in Kandahar province also has been restored to operation, along with the Breshna-Kot Dam in Nangarhar province, which has a generating capacity of 11.5 MW. The 66-MW Mahipar hydro plant also is now operational. Turkmenistan supplies electricity to much of northwestern Afghanistan. In October 1999, Afghanistan announced that it had reached agreement with Turkmenistan for electricity imports into northwestern Afghanistan, including power to the city of Herat and the Herat cement plant. Another transmission line has been built from Turkmenistan to the city of Andkhoy, and one was under construction in 2001 to Sheberghan. Electricity has previously been imported from Uzbekistan for Mazar-i-Sharif, but supplies were cut off during the winter of 1999 due to payment arrears. Regional Pipeline Plans In January 1998, an agreement was signed between Pakistan, Turkmenistan, and the Taliban to arrange funding on a proposed 890-mile, $2-billion, 1.9-billion-cubic-feet-per-day natural gas pipeline project. The proposed pipeline would have transported natural gas from Turkmenistan's 45-Tcf Dauletabad natural gas field to Pakistan, and most likely would have run from Dauletabad south to the Afghan border and through Herat and Qandahar in Afghanistan, to Quetta, Pakistan. The line would then have linked with Pakistan's natural gas grid at Sui. Natural gas shipments had been projected to start at 700 Mmcf/d in 1999 and to rise to 1.4 Bcf/d or higher by 2002. In March 1998, however, Unocal announced a delay in finalizing project details due to Afghanistan's continuing civil war. In June 1998, Gazprom announced that it was relinquishing its 10% stake in the gas pipeline project consortium (known as the Central Asian Gas Pipeline Ltd., or Centgas), which was formed in August 1996. As of June 1998, Unocal and Saudi Arabia's Delta Oil held a combined 85% stake in Centgas, while Turkmenrusgas owned 5%. Other participants in the proposed project besides Delta Oil included the Crescent Group of Pakistan, Gazprom of Russia, Hyundai Engineering & Construction Company of South Korea, Inpex and Itochu of Japan On December 8, 1998, Unocal announced that it was withdrawing from the Centgas consortium, citing low oil prices and turmoil in Afghanistan as making the pipeline project uneconomical and too risky. Unocal's announcement followed an earlier statement -- in August 1998 -- that the company was suspending its role in the Afghanistan gas pipeline project in light of U.S. government military action in Afghanistan, and also due to intensified fighting between the Taliban and opposition groups. Unocal had previously stressed that the Centgas pipeline project would not proceed until an internationally recognized government was in place in Afghanistan. To date, however, only three countries -- Saudi Arabia, Pakistan and the United Arab Emirates -- have recognized the Taliban government (note: in late September 2001, Saudi Arabia and the United Arab Emirates both cut ties with the Taliban). Besides the gas pipeline, Unocal also had considered building a 1,000-mile, 1-million barrel-per-day (bbl/d) capacity oil pipeline that would link Chardzou, Turkmenistan to Pakistan's Arabian Sea Coast via Afghanistan. Since the Chardzou refinery is already linked to Russia's Western Siberian oil fields, this line could provide a possible alternative export route for regional oil production from the Caspian Sea. The $2.5-billion pipeline is known as the Central Asian Oil Pipeline Project. For a variety of reasons (i.e. war and political instability), however, this project remains highly doubtful for the time being. In April 1999, Pakistan, Turkmenistan and the Taliban authorities in Afghanistan agreed to reactivate the Turkmenistan-Pakistan gas pipeline project, and to ask the Centgas consortium, now led by Saudi Arabia's Delta Oil (following Unocal's withdrawal from the project), to proceed. Periodic meetings to discuss the project have continued. It remains unlikely, however, that this pipeline will be built.

Access Date 8th December 2001

Source http://www.washtimes.com/world/20011203-90947944.htm"

Caspian

pipeline opens

By Christopher Pala

THE WASHINGTON TIMES

ALMATY, Kazakhstan — The first pipeline built to bring Kazakhstan's oil to world markets was dedicated in Russia last week, four months late and minus the presidents of the two countries through which it passed.

Speeches delivered near the Russian

port of Novorossiisk called the 940-mile steel tube a symbol of

international cooperation, and that it is indeed: The Russian

Federation and American and Russian oil companies have provided

most of the $2.6 billion cost, and Russia stands to earn $20

billion over the 40-year life of the pipeline.

But the pipeline is also:

•The first step to Kazakhstan's

ambitious plan to deliver 3 million barrels a day in 15 years to

world markets and become one of the top three oil exporters in

the world.

•A multibillion-dollar bet by

Chevron Corp. in 1993 that is now set to pay off handsomely.

•An example of the difficulty

of doing business in Russia.

•Proof that with perseverance,

it can be done.

The pipeline, built by the 11-member

Caspian Pipeline Consortium, known as CPC, starts on the desert

shores of the northeast Caspian Sea at Tengiz, Kazakhstan, the

world's sixth-largest oil field.

The longest 40-inch pipe in the

world then curls around the Caspian before striking west across

the broad plains north of the Caucasus range and ends at a tanker

terminal 10 miles west of Novorossiisk.

When completed, at a final cost of

$4 billion, it will be able to carry up to 1.3 million barrels

per day (bpd), more than double its initial capacity.