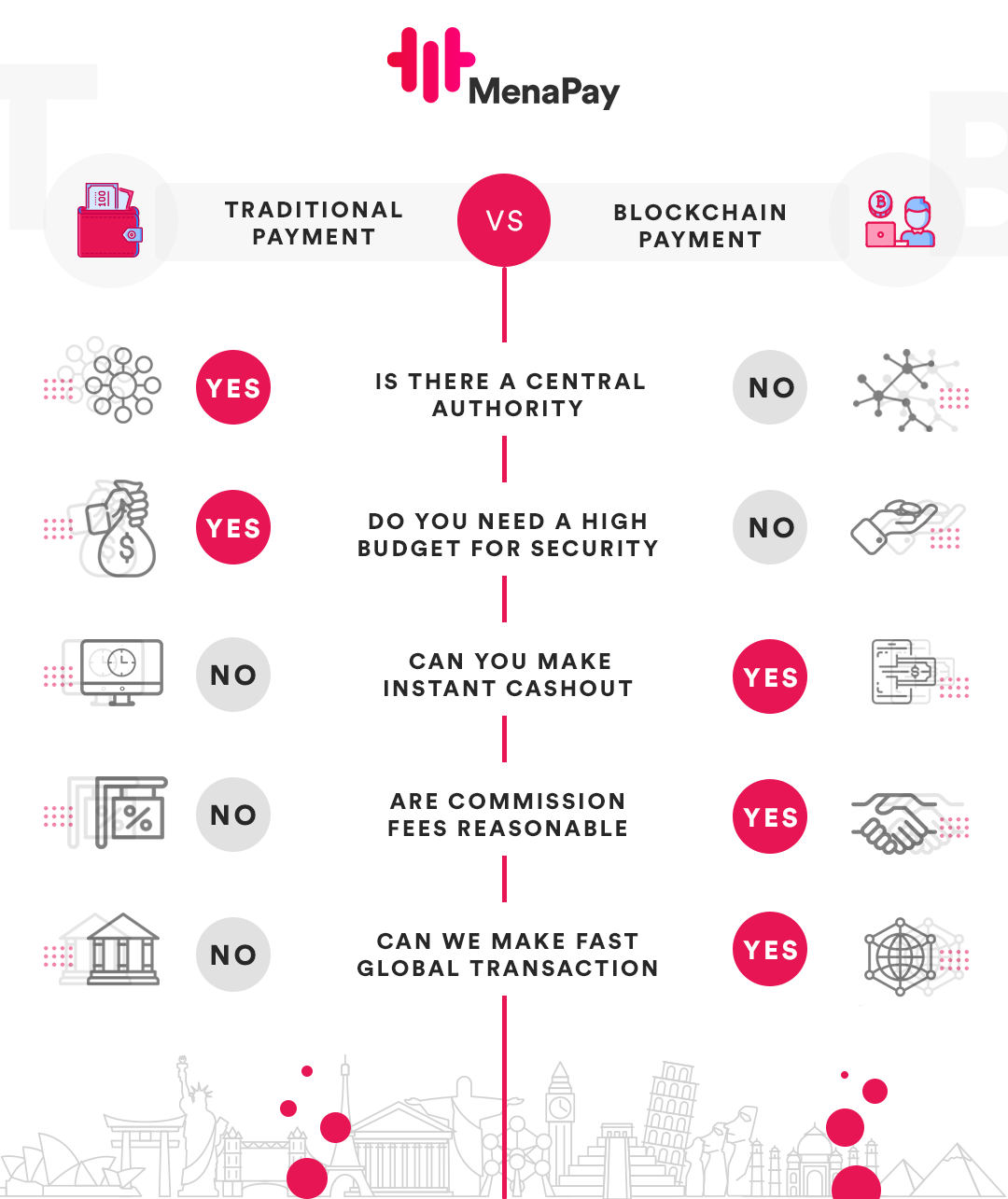

TRADITIONAL PAYMENT SYSTEMS vs BLOCKCHAIN BASED PAYMENT SYSTEMS

Since there’s a great rumor on blockchain disrupting the traditional payment systems, we wanted to clarify why is everybody talking about this possibility. How does blockchain payment systems provide a better, safer and more transparent experience for the customers?

Central Authority

In traditional payment systems, there’s an authority like a bank that is able to control all your actions through their system. They have all your information and without any warnings, they can share this information with anyone they like. This creates sincere trust issues in the customer. Unaware of their data being shared or secured well, some populations like Middle East (http://uk.businessinsider.com/the-worlds-unbanked-population-in-6-charts-2017-8/#the-vast-majority-94-of-adults-in-oecd-high-income-countries-said-they-had-a-bank-account-in-2014-while-only-54-of-those-in-developing-countries-did-the-middle-east-had-the-lowest-proportion-of-account-holders-with-only-14-on-average-1) don’t even prefer to use banks.

However, blockchain payment systems provide a more secure and transparent for the customers. Since all transactions can be seen publicly and cannot be altered once they’re coded into the system, blockchain helps customers to spend their digital moneys (cryptocurrencies) much easier. That leads to the reduction of cash usage.

Security Expenses

Traditional systems like banks have to use a high security in their organization in order to protect the customer data. For that, they build servers, security teams and control teams which have a high effect in their budget management.

Blockchain, by its’ nature, is secure once it is in the system. Therefore, there aren’t any extra protections are necessary for the system.

Instant Cash-out

Banks require a settlement time in order to cash-out your revenue. It approximately takes 30 days to turn your revenue into cash which is really long and exhausting.

Blockchain payment systems provide an easier and faster cash-out process without any settlement rate.

Commission Fees

Banks require a lot of commissions since they have such a big operation going on. Also, since they’re central authorities, the service they provide could cost a lot more than a decentralized system.

In blockchain payment systems, there aren’t any bosses. The community, all together, rules the platform. Therefore, costs are more reduced which leads to a lot lower commission fees.

Transaction Speed

Especially in cross-border transactions, traditional payment systems fail in giving a fast service. Despite of being unpredictable, they are also taking a lot longer than blockchain payment systems.

Blockchain, with its’ strong infrastructure, helps you to make a lot faster transactions between peers and international payments. Since it’s secured and transparent, transactions take a lot shorter due to the quickness of approval processes.