Cash Ratio

The cash ratio or money coverage ratio is a liquidity ratio that steps a firm's capacity to repay its recent liabilities with only cash and funds equivalents. The cash ratio is way far more restrictive as opposed to current ratio or quick ratio simply because no other present assets can be utilized to pay off present-day debt--only cash.

This is why a lot of lenders look on the cash ratio. They want to find out if a corporation maintains ample cash balances to pay off all in their latest debts since they occur because of. Lenders also like the simple fact that stock and accounts receivable are ignored of your equation due to the fact both equally of these accounts usually are not guaranteed to be obtainable for credit card debt servicing. Inventory could consider months or a long time to provide and receivables could choose months to collect. Money is sure to be out there for creditors.

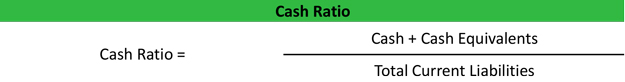

Formula

The funds protection ratio is calculated by incorporating cash and dollars equivalents and dividing by the complete recent liabilities of a enterprise.

Most companies checklist dollars and income equivalents with each other on their own balance sheet, but some organizations list them independently. Income equivalents are investments and also other assets which might be transformed into income in just 90 days. These property are so close to money that GAAP considers them an equivalent.

Current liabilities are often revealed separately from long-term liabilities within the experience of your balance sheet.

Analysis

The cash ratio shows how properly a company pays off its current liabilities with only dollars and dollars equivalents. This ratio displays dollars and equivalents like a percentage of latest liabilities.

A ratio of one means which the company has precisely the same number of cash and equivalents as it has present debt. Basically, as a way to pay back its present-day personal debt, the company must use all of its income and equivalents. A ratio above 1 signifies that each one the existing liabilities might be compensated with funds and equivalents. A ratio under one means which the organization desires additional than just its money reserves to pay off its current credit card debt.

As with most liquidity ratios, the next income protection ratio implies which the enterprise is much more liquid and can much more simply fund its debt. Collectors are specifically interested in this ratio since they want to be sure their loans might be repaid. Any ratio previously mentioned 1 is taken into account to be a very good liquidity measure.

Example

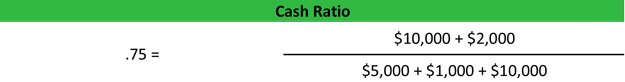

Sophie's Palace can be a cafe that is wanting to rework its eating area. Sophie is asking her lender for the financial loan of $100,000. Sophie's harmony sheet lists these items:

- Cash: $10,000

- Cash Equivalents: $2,000

- Accounts Payable: $5,000

- Current Taxes Payable: $1,000

- Current Long-term Liabilities: $10,000

Sophie's cash ratio is calculated similar to this:

As you could see, Sophie's ratio is .75. Consequently Sophie only has sufficient hard cash and equivalents to pay for off 75 % of her present liabilities. This can be a reasonably significant ratio which implies Sophie maintains a comparatively large funds stability through the calendar year.

Obviously, Sophie's bank would look at other ratios before accepting her mortgage application, but based upon this coverage ratio, Sophie would more than likely be acknowledged.

Visit to get more detailed You Can Learn More About The Cash Debt Ratio Here