Chattooga County Assessors Website

TAX BILLS

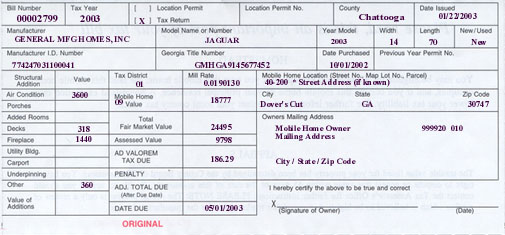

If the item gracing your mailbox looked like the

facsimile to our left, then we are of the impression that you

were the owner of a Mobile / Modular / Manufactured Home as of

January 1st of this year.

If the item gracing your mailbox looked like the

facsimile to our left, then we are of the impression that you

were the owner of a Mobile / Modular / Manufactured Home as of

January 1st of this year.

Yes, as much as it surprises some people, Mobile Homes (or Modular or Manufactured Homes) are taxable in the State of Georgia; and they are taxable at the same tax rate as land and buildings. However, while land and buildings are billed at the end of the year, manufactured housing (Mobile or Modular Homes) is billed at the beginning of the year. That means if you allow someone to put a Mobile Home (for brevity, I am going to refer to all these types of Manufactured Housing as "Mobile Homes") on your property, it does not effect your property value or your property taxes. In most cases a Mobile Home is billed separately from all other property. The bill contains a summary of such information as we have on the Home, the amount of taxes due, and the date payment is due. By State Law, the due date for payment of taxes is May 1st of the tax year.

By the way, a Mobile Home bill (or a PT-40, to use DOR nomenclature) serves a dual purpose. Not only is it a tax bill, indicating the amount of taxes due on this Home for the tax year ... it is also a return form ... that is a statement of ownership and condition. That's what the part that says "I hereby certify the above to be true and correct" located right above the signature line is all about. To pay the bill your signature is required ... your signature is to certify that the information we are billing the Home on (owner, age, size, make, model, etc,) is all correct to the best of your knowledge. It also serves as your statement of value on this Home. So PLEASE read this thing before you pay it or sign it. Contact us if there is any error in the information, or if you disagree with the valuation. Go back to our HOME PAGE for the office address and phone numbers (or contact me directly at taxchatt@lmjc.net) However you contact us ... ask for Roger.

Some of you receive a PT-40 where the field "AD VALOREM TAX DUE" is blank ... that is, there are no taxes due on this Home. This can be for one of three reasons:

- Again, it serves as Property Tax Return form. You need to verify the information on

it to make sure we are valuing and billing accurately (note: I didn't say "correctly") your

Mobile Home

- You are still required to have a location permit (decal) posted on the Home. The

PT-40 serves as a reminder to come in and get your decal (There is no charge for the

decal ... it is covered in your property taxes).

By the way, if you want a closer look at what this bill might look like ... click here.