Chattooga Assessors Website

"Boat" Returns

If you received this document in the mail

it is because we have you listed as owning a boat or other marine

craft as of January 1st of the the tax year.

If you received this document in the mail

it is because we have you listed as owning a boat or other marine

craft as of January 1st of the the tax year.

In the State of Georgia marine craft (whether business or personal) are returned for taxes in the county where they are "located 184 days a year or more".

The form allows for the listing of up to 5 marine craft with motors and any extra equipment they might have. Information about the craft goes on page 3 (and 4 if necessary). The owner's estimate of what price this craft could reasonably bring on the open market goes on page 2 under "TAXPAYER RETURN VALUE AS OF JAN. 1 THIS YEAR".

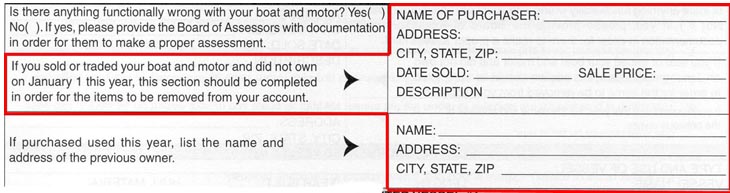

If you owned the marine craft January 1st of last year, but sold it before January 1st of this year, then we need you to fill out the small section that starts about 2/3rds of the way down page 3.

If you sold the marine craft... please

fill this section out ! This

helps to make sure that the right person gets the tax bill on the

craft, and that we don't inadvertently bill two different owners

for the same craft.

If you sold the marine craft... please

fill this section out ! This

helps to make sure that the right person gets the tax bill on the

craft, and that we don't inadvertently bill two different owners

for the same craft.

Well, what if I just chunk this thing into the garbage can?!

For several reasons we really wish you wouldn't do that:

Oh yes! The form MUST be signed! Your signature (or the signature of whoever handles these things for you) goes on the bottom of page 1. Without a signature, the Department of Revenue tells us, the return is not vaild, which means it may generate a late penalty (if we can't get a signature from you before April 1st), or the marine craft might be treated as Unreturned .... which gets us back to reasons (1) and (2) listed above.

If you need help with the form, call (706) 857 - 0737 and ask for "Cindy".