Chattooga County Property Assessors Website

If what you got in the mail

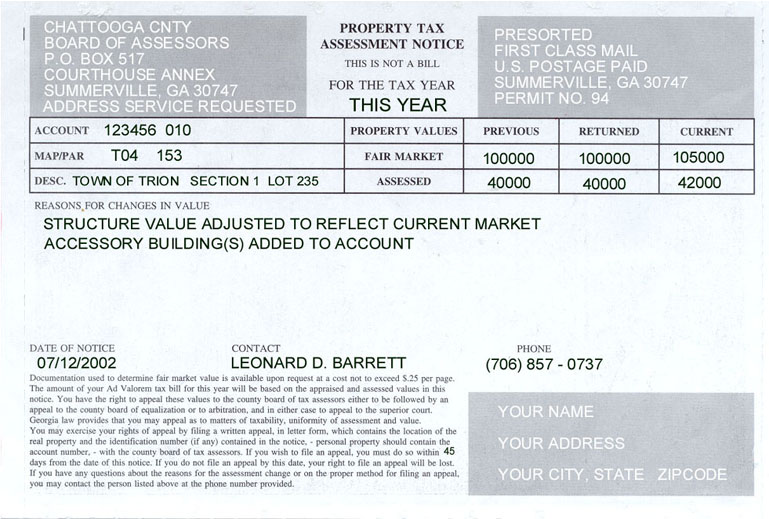

looked anything like this, (click here to see a larger version) then you are the proud recipient of  a Property Tax

Assessment

Notice.

An assessment notice is a statement sent to you by the Assessors Office to

inform you of the intent to change your property value, or (if you are a new property owner) to let you know what the value of your newly

acquired property is before any taxes are levied. Assessment

Notices are typically mailed in the summer (July or August) so

questions of value can be settled prior to the setting of tax

rates (which happens in the

fall).

a Property Tax

Assessment

Notice.

An assessment notice is a statement sent to you by the Assessors Office to

inform you of the intent to change your property value, or (if you are a new property owner) to let you know what the value of your newly

acquired property is before any taxes are levied. Assessment

Notices are typically mailed in the summer (July or August) so

questions of value can be settled prior to the setting of tax

rates (which happens in the

fall).

Property values can change for any number of reasons -- for explanations for the primary reasons (no -- it is not to raise your taxes) click here.

The lines below the gray boxes (the boxes at the top) are the ones that seem to cause the most confusion. They are broken into boxes and columns that contain the information the notice is designed to give you. Some of these should be self-explanatory, but just in case, the following links connect to explanations and/or definitions of them: (1) Account (2) Map/Par (3) Desc. and (4) Property Value. Property Value then breaks down into three sub-headings: (a) Previous, (b) Returned, and (c) Current.

The middle third of the form (between the "Account", "Map/Par", and "Desc." boxes at the top and the fine print at the bottom) provides "Why", "Who", "When", and "Where" information. "Why" is covered in "Reasons for Changes in Value"; "Who" is "Contact"; "When" is "Date of Notice"; and "Where" is "Phone".

Last, if the fine print on your notice is as hard to read for you and it is for us, this link will take you to a page that has this in full-size print.